There are a lot of benefits to owning real estate. Steady cash flow might be number one on the list, although the ability to counter inflation by raising the rent could be moving up fast on many a real estate investor's list. Because real estate often moves independently of the stock market, that huge sector can also add diversity to a portfolio.

Anyone who buys stocks can buy real estate investment trusts (REITs), which are portfolios of income-producing properties that I find ideal for where I am in my life right now: Transitioning from investing primarily for growth to investing primarily for income.

That rite of passage doesn't mean giving up stocks completely but it does make the relative stability of REITs more appealing to me than putting new money into tech stocks in today's market.

Image source: Getty Images.

Not as hot but not as cold, and income along the way

There are about 225 publicly traded REITs across multiple industry sectors, and the best ones all have growing records -- some going back decades -- of dividend and share price growth.

The stolid nature of real estate investing makes a sharp contrast to investing in tech stocks. REITs aren't typically going to see the soaring heights or plunging lows that can characterize the tech sector from its smallest players to its most massive.

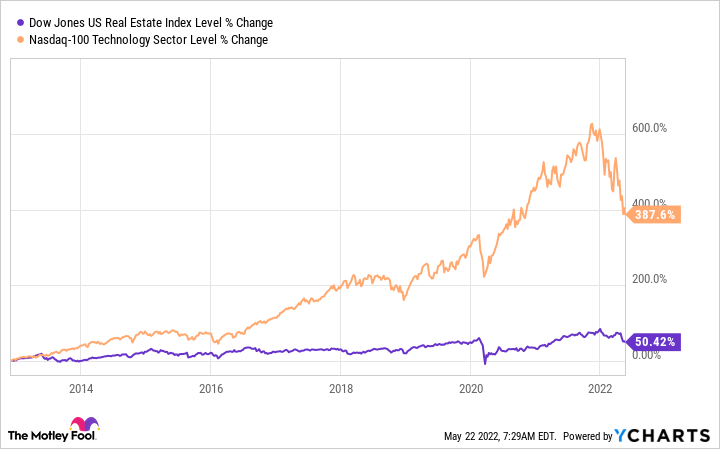

Let's use a couple of indexes for comparison here: the Dow Jones U.S. Real Estate Index and the NASDAQ-100 Technology Sector Index.

A couple of charts here tell an interesting story. First, here's a look at the year-to-date performance of each of these indexes.

Now, let's look back a decade. I chose this time frame just to show the folly of ignoring the tech sector completely, especially if you're still more in your own growth years than your income years. I didn't in my own investing, that's for sure, because I figured I had the time to ride out the volatility and worry less about preserving capital.

For this retiree, REITs are just right.

The NASDAQ-100 Technology Index is yielding about 0.98% right now, and frankly, I was mildly surprised when I saw that. Most of the tech stocks I've owned paid no dividends at all. That's not the point of owning such equities. Meanwhile, the Dow Jones U.S. Real Estate Index is yielding about 3% and most of the REITs I own are yielding more than that, especially since their respective share prices are currently beaten down.

Right now, my portfolio includes 13 REITs and the Vanguard Real Estate Index Fund ETF (VNQ -0.07%). That's a weighted collection of about 160 REITs. I'm confident in seeing an average yield of about 4%, and some quick ciphering would show that someone doing the same with a $100,000 pot of REITs could expect a monthly income of about $330 from that particular baker's dozen.

To repeat, I'm not saying tech is a bad place to invest, even for me as a newly minted retiree. My single largest holding is Alphabet, and I'm certainly not advocating putting everything in REITs.

But a substantial amount of my portfolio is, and I plan to keep it that way during my ongoing transition into drawing Social Security. They combine the benefits of owning real estate and dividend-paying equities in a way that I find sustainable and even reassuring as we plow through these bearish times.

Everyone's situation is different, of course, but for even the most go-go growth tech stock buyer or -- at the other end of the spectrum, the completely risk-averse income investor -- now might be a good time to consider some boring old real estate stocks instead of exiting the market completely and giving up the income that well-picked REITs just keep on providing.