BYD (BYDD.F -0.95%) is a pioneer and industry leader in clean energy vehicles. The Chinese company manufactures electric vehicles (EVs) and plug-in hybrid vehicles, as well as electric buses, trucks, other commercial vehicles, rechargeable batteries, and solar panels. In addition to developing sustainable solutions, BYD makes mobile handset components and has developed a monorail system.

BYD's early leadership in EVs caught the eye of Warren Buffett. His company, Berkshire Hathaway (BRK.A 1.57%)(BRK.B 1.42%), initially bought a 10% stake in the Chinese EV maker in 2008. While Buffett's company has trimmed its position over the years, he still likes BYD.

Many people are interested in BYD stock because of Warren Buffett's presence as an investor and the company's focus on sustainable solutions. This guide will teach you everything you need to know about BYD and how to invest in the Chinese electric car company.

Stock

How to buy

How to buy BYD stock

BYD first went public on the Hong Kong Stock Exchange in 2002. It completed a second initial public offering (IPO) on the Shenzhen Stock Exchange in 2011. However, even though the Chinese EV company hasn't listed its stock on a major U.S. stock exchange yet, such as the New York Stock Exchange (NYSE), you can still buy shares.

It trades on the OTC Market Exchange under the stock ticker BYDD.F. That exchange and stock ticker are important to note to avoid any potential confusion with Boyd Gaming (BYD 4.0%), an American gaming and hospitality company that trades on the NYSE under the stock ticker BYD.

People interested in buying shares of BYD will need to take a few steps to become shareholders. This four-step guide will show you how to invest in stocks and how to add the electric car stock to your portfolio.

Step 1: Open a brokerage account

You'll want to open and fund a brokerage account before buying shares of any company. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one for you. It's important to find one that allows you to buy and sell shares of companies listed on the OTC Markets Exchange so that you can invest in BYD stock.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest and figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

You don't need to buy a bunch of stocks at once. You should take your time and get comfortable with investing by starting small. For example, if you have $1,000 to invest, you should aim to slowly build a portfolio of around 10 stocks, investing roughly $100 in each company. You can grow from there as you add money to your account and become more comfortable investing.

Step 3: Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about its competitors, its balance sheet, how it makes money, and other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term.

You also need to ensure you understand the added risks of investing internationally, especially in companies headquartered in China. Continue reading to learn more about some crucial factors to consider before investing in BYD stock.

Step 4: Place an order

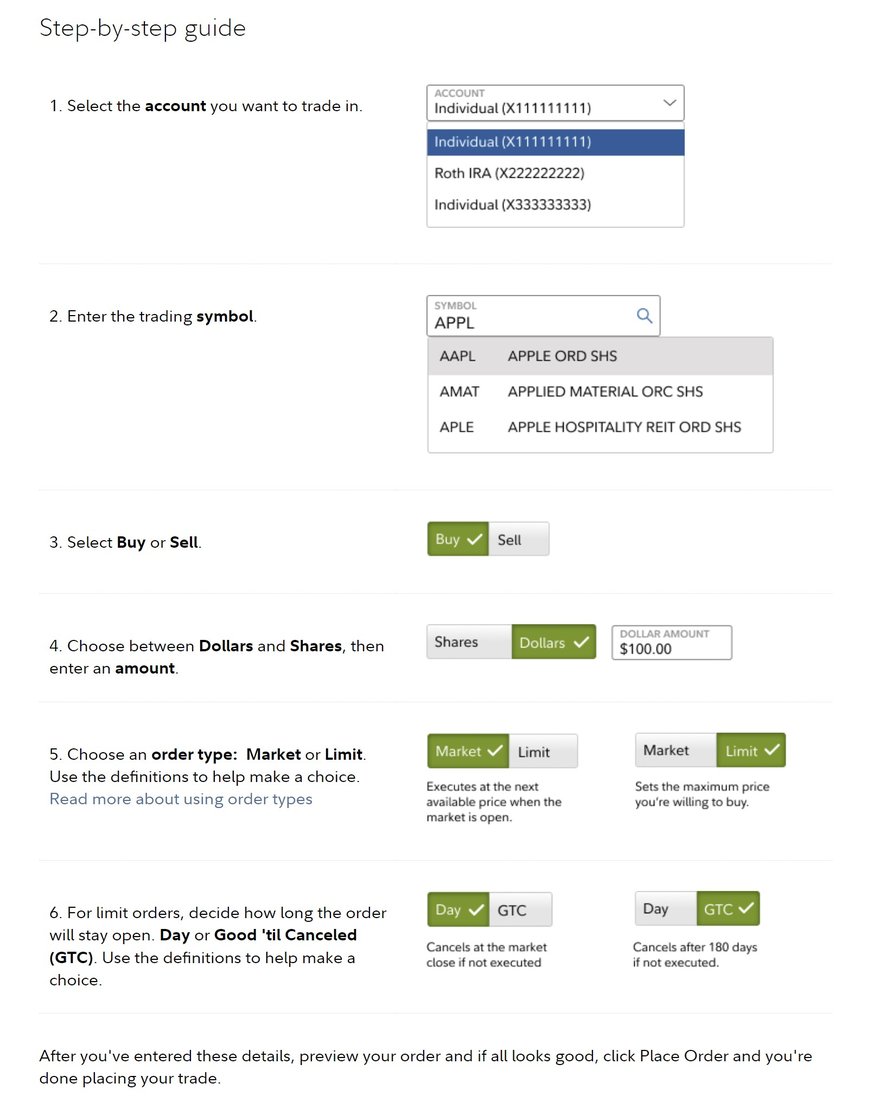

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (BYDD.F for BYD).

- Whether you want to place a limit order or a market order. (The Motley Fool recommends using a market order because it guarantees you buy shares immediately at market price.)

Here's a screenshot of how to buy a stock with the five-star-rated platform Fidelity (which offers a video tutorial and a step-by-step guide):

Make sure you double-check your order page, especially that you have the correct stock ticker for the Chinese automaker. Once you complete the order page, click to submit your trade and become a BYD shareholder.

Should I invest?

Should I invest in BYD?

Not every stock will be right for you. You need to make sure the stocks you buy will help you achieve your financial goals while aligning with your values and risk tolerance. With that in mind, here are some reasons you might want to invest in BYD:

- You want to invest in a company building a more sustainable future.

- You want to invest in stocks owned by Warren Buffett.

- Adding BYD would help diversify your portfolio by adding an international stock.

- You believe BYD can fend off the growing competition in the EV industry.

- You want to invest in a profitable EV company (a rarity in the sector).

- You're comfortable with the risks of investing in China.

On the other hand, here are some reasons BYD stock might not be right for you:

- You're concerned about the Chinese government's influence over companies operating in the country.

- You don't want to invest in foreign-listed stocks due to governance concerns and foreign exchange risk.

- You're worried about the growing competition in the EV industry.

- You think the U.S. tariffs on EVs produced in China will shut off a potentially lucrative growth market for BYD.

- Warren Buffett's sales of BYD stock have raised a red flag for you.

- You already own several EV and transportation stocks.

- You need more dividend income than BYD can supply.

Profitability

Is BYD profitable?

Profits power businesses. Companies must make money to fund their operations and expansion. Investors need to look under the hood to see whether a company is making money or is at least on the road to profitability.

BYD is a profitable company. In 2023, the Chinese automaker reported a net profit margin of 5%. Its profit almost doubled on rising revenue and a higher net profit margin (3.9% in 2022). The company's revenue has steadily increased over the last five years while its profit has surged.

The company's solid profitability enables it to continue investing in developing new EVs. It also allows BYD to return cash to investors via dividends and share repurchases.

Dividends

Does BYD pay a dividend?

BYD pays a dividend. The Chinese EV company makes an annual dividend payment based on its profit from the previous year.

For 2023, the company made a dividend payment of 3.096 Chinese yuan per share (about $0.43 per share at the exchange rate in mid-2024). That was more than double its dividend in 2022 (RMB$1.142 per share). The company pays its dividend in RMB, which is converted into U.S. dollars for holders in the U.S.

ETF options

ETFs with exposure to BYD

Active stock picking isn't for everyone. Many people would rather passively invest in a company through a fund. Exchange-traded funds (ETFs) make that easy. Many ETFs enable you to invest in a theme (e.g., transportation ETFs or electric vehicle ETFs) or a broad market index (e.g., the S&P 500 or Nasdaq-100).

Exchange-Traded Fund (ETF)

Several ETFs hold shares of BYD. Some notable options are:

- ARK Autonomous Tech & Robotics ETF (ARKQ 0.52%): The fund managed by Cathie Wood focuses on companies in the autonomous technology and robotics fields. It aims to have between 30 and 50 holdings. BYD is one of its holdings in mid-2024, with a 1.4% allocation, and the fund has a 0.75% ETF expense ratio.

- iShares MSC China ETF (NYSEMKT:MCHI): This fund focuses on large and mid-sized Chinese companies. In mid-2024, the ETF had 660 holdings, including BYD (1.4% of its assets), and a 0.59% expense ratio.

Stock splits

Will BYD stock split?

As of mid-2024, BYD has no upcoming stock split, and the company likely won't split its stock anytime soon. It trades at a very accessible price (in the mid-$50s in mid-2024), so it doesn't need to split its stock to lower the investment threshold for more investors.

Related investing topics

The bottom line on BYD

BYD is a leader in EVs. It's profitable and growing fast, which could enable the company to continue producing strong returns for investors, including Warren Buffett. However, even though Buffett owns the stock, it might not be right for everyone. Before adding it to your portfolio, you must ensure you're comfortable with the risks of investing in the Chinese EV maker.

FAQ

Investing in BYD FAQ

Where can I invest in BYD?

You can invest in BYD in most brokerage accounts. It's a public company that trades on the OTC Market Exchange, so you need a broker that allows you to buy shares listed on that exchange. If you don't have a brokerage account (or need one that can trade shares on the OTC Markets Exchange), check out this list of top online brokers and trading platforms.

Once you have opened and funded an account capable of buying OTC-listed stocks, you'd open up the order page and fill out all the required fields, including:

- The number of shares you want to buy or the amount you want to invest in purchasing fractional shares (if your broker allows trading fractional shares of OTC listed stocks)

- The stock ticker (BYDD.F)

- The order type (limit order or market order)

Make sure everything is correct (especially the stock ticker), and then submit your trade to become a shareholder.

Is BYD stock a good investment?

BYD has been a good investment over the years. As of mid-2024, the Chinese EV maker had produced a 19.3% annualized total return over the last 10 years, outperforming the S&P 500's 12.7% annualized total return.

While that past performance is no guarantee of future success, the company is in a strong position to continue growing shareholder value. It was increasingly profitable, which is a rarity in the EV sector. That's giving it the funds to invest in growing its business, including expanding into new areas.

Its growing profitability also allows the company to return cash to shareholders through dividends and share repurchases. Although the company isn't without risk, it could have the power to continue producing market-beating total returns in the future.

Is BYD on the NYSE?

BYD does not trade on the New York Stock Exchange. It went public on the Hong Kong Stock Exchange in 2002 and completed an IPO on the Shenzhen Stock Exchange in 2011.

Although the company hasn't listed its stock on a major U.S. exchange, it does trade on the OTC Markets Exchange under the stock ticker BYDD.F. Investors should be careful not to confuse BYD with Boyd Gaming, the American gaming and hospitality company that trades on the NYSE under the stock ticker BYD.

What is the ticker for BYD stock?

BYD stock trades on the OTC Markets Exchange under the stock ticker BYDD.F. Investors should be careful not to confuse BYD's stock ticker with that of Boyd Gaming, which trades on the NYSE under the stock ticker BYD.