Enterprise Product Partners (EPD -1.21%) is one of the largest midstream companies in North America, with an integrated system that transports natural gas, natural gas liquids (NGLs), crude oil, and refined products. The stock has several qualities that make it attractive.

Let's look at three reasons investors should consider piling into the pipeline giant.

1. A safe and growing distribution

With a yield of about 7%, Enterprise gives investors a very attractive income stream from its distribution payouts. Even better, the company has increased its distribution every year for the past 25 years. It has done this through various economic and energy price environments, showing the consistency of its business model.

I consider Enterprise's distribution extremely safe. The two biggest areas to look at when it comes to dividend safety are its distribution coverage ratio and leverage ratio. The former measures how much cash in distributions the company is paying out, compared to how much distributable cash flow (operating cash flow minus maintenance capital expenditures) it's generating. On that front, Enterprise had a robust 1.7x coverage ratio for 2023, demonstrating that its distribution is well covered.

Meanwhile, the company ended last year with leverage of 3x, which is near the low end of companies in the midstream space. When the leverage at companies gets too high, there's a risk they may cut their dividend. This is not the case with Enterprise.

As such, the company has an attractive and safe yield, and its distribution looks poised to continue growing.

2. A stable and growing business

Enterprise has grown its distribution during the past 25 years thanks to its steady, reliable business model. Despite being in the energy space, the company has little direct exposure to commodity prices.

About 77% of its gross operating profits in 2023 came from fee-based activities, while 17% was from differentials. The latter is where the company can take advantage of geographic arbitrage opportunities, as well as through upgrading commodities to higher-valued products.

Enterprise also has a solid backlog of growth opportunities, with $6.8 billion of projects currently under construction. The company currently plans to spend between $3.25 billion to $3.75 billion in growth capital expenditures (capex) this year, and another $3 billion in 2025. It has averaged a return on invested capital (ROIC) of about 12% over the past decade.

ROIC is the gross operating profit of a project dividend by the cost to build it. If the company spends $3 billion to build a new project, it would earn $360 million a year in gross operating profit on that spending, which should also be similar to the cash flow the asset generates.

Given its current backlog of projects and solid ROIC track record, Enterprise has a nice runway to grow over the next couple of years.

Image source: Getty Images

3. An attractive valuation

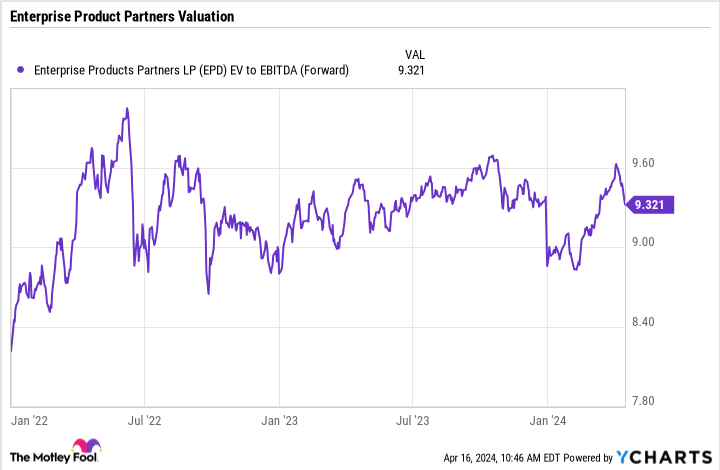

Given the non-cash depreciation costs associated with long-term assets like pipelines and the debt companies carry, midstream companies are generally valued based on an enterprise value (EV) to earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio. Enterprise value takes into consideration a stock's net debt, while EBITDA removes non-cash expenses.

On that basis, Enterprise is trading at just over a 9x multiple.

EPD EV to EBITDA (Forward) data by YCharts.

This is similar to where the stock has traded since the pandemic ended. However, before the pandemic, Enterprise stock typically traded at an EV/EBITDA multiple of over 11x, and sometimes higher than 15x.

At the same time, the company's balance sheet has improved since the pandemic ended, and it started carrying a much higher distribution coverage ratio starting in 2018.

A great time to buy

Given Enterprise's steady, reliable business model combined with an attractive and growing distribution yield, now looks like a great time to scoop up this stock, which is trading toward the low end of its historical levels. Enterprise has one of the best track records of any midstream stock. With geopolitical tensions rising, it looks like a company that has both the defensive and growth qualities that should help it perform well over the coming years.