Breakfast News: Palantir Sales Surge

November 4, 2025

| Monday's Markets |

|---|

| S&P 500 6,852 (+0.17%) |

| Nasdaq 23,835 (+0.46%) |

| Dow 47,337 (-0.48%) |

| Bitcoin $106,837 (-2.94%) |

1. PLTR and Nintendo Report Revenue Spike

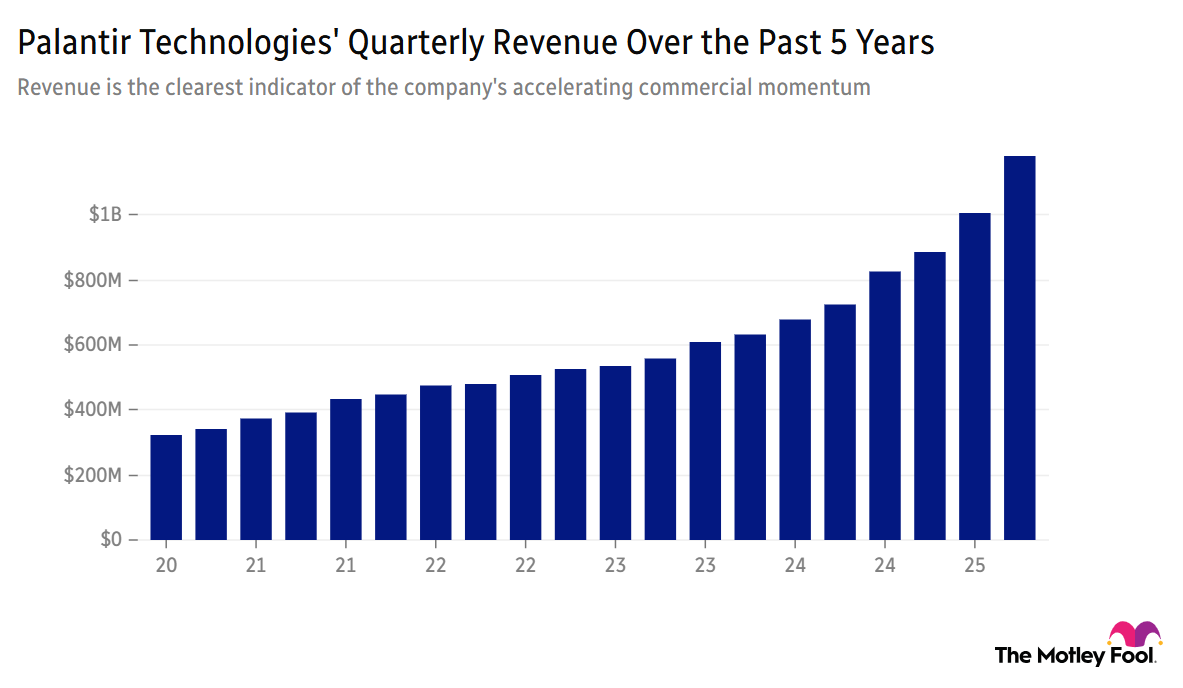

Palantir Technologies (PLTR 5.53%) jumped 7% before giving back all gains and falling over 6% in pre-market trading as investors digested quarterly results, after valuation concerns outweighed a boosted revenue outlook.

- "These are arguably the best results that any software company has ever delivered": CEO Alex Karp lauded the 63% jump in revenue from the same period last year, marking the 21st consecutive quarter Palantir has exceeded revenue estimates.

- Revenue surges over 90% year over year: Stock Advisor recommendation Nintendo (NTDOY +2.64%) also saw strong sales growth after posting earnings this morning, with the Switch 2 console flying off the shelves, selling 10.36 million units since launch in June.

2. Wall St Warns of Healthy Stock Correction

S&P 500 and Nasdaq futures fell over 1% this morning, with Wall Street banks calling for caution after the record-breaking stock market rally so far this year.

- "It's likely there'll be a 10 to 20% drawdown in equity markets sometime in the next 12 to 24 months": Goldman Sachs (GS 0.24%) CEO David Solomon expects to see a pullback, but stressed this is a normal feature of positive market cycles and shouldn't change an investor's fundamental view.

- "It's hard not to be excited about Hong Kong, China, Japan and India": Morgan Stanley (MS 0.47%) CEO Ted Pick said healthy drawdowns should be welcomed, and outlined Asia as an area he expects to continue to shine despite any global market retracement.

3. Monday's Dividend Investor Rec Results

Simon Property Group (SPG +0.25%) rose almost 1% following the closing bell after beating analyst estimates on results that showed a high 96.4% occupancy rate at U.S. malls and premium outlets, leading to a 4.8% increase in the dividend declared.

- Dividend yield of 5.18% versus the S&P 500's 1.15%: Ryman Hospitality Properties (RHP 0.64%) CEO Mark Fioravanti said U.S. tariffs impacted Q3 results released overnight, but noted estimated group room revenue for 2026 is pacing up nearly 8% versus last year.

- One of the few S&P 500 monthly dividend payers: Realty Income (O +0.54%) put out results after the market closed, detailing a push into Europe with $1 billion invested internationally versus $380 million domestically during the quarter.

4. SHOP and AMD Lead Tuesday Earnings

Shopify (SHOP 3.71%) beat expectations with strong growth in merchant solutions revenue as part of the earnings report released before the market opened, with Advanced Micro Devices (AMD 5.73%), Arista Networks (ANET 2.34%) and Upstart (UPST 8.24%) posting results after it closes, as detailed in yesterday's Breakfast News.

- "Think about just the subscriptions that you have. What is one of the last ones you would cancel? Spotify has got to be up there": Hidden Gems rec Spotify (SPOT +0.20%) released earnings this morning, with monthly active users increasing 11%, ahead of analyst expectations, with Fool contributing analyst Travis Hoium flagging the sticky subscriber base earlier in the year.

- Outperforming the S&P 500 by 278% since July 2022 Rule Breakers rec: Uber (NYSE: UBER) reported a 21% spike in total gross bookings this morning, down to factors including strong summer travel activity, building on the impressive performance from last quarter.

5. Your Take

Which of the following Hidden Gems picks, all down 15-20% since being recommended in the past 3 years, has the best chance of recovering and beating the market over the next 3-5 years, and why: Accenture (ACN 2.05%), HubSpot (HUBS 15.66%), Synopsis (SNPS 2.61%), or Zoetis (ZTS 0.85%)? Debate with friends and family, or become a member to hear what your fellow Fools are saying.