Apple (AAPL 0.31%) may be incredibly successful, but the company's fortunes could shift dramatically if anything disrupts the iPhone business.

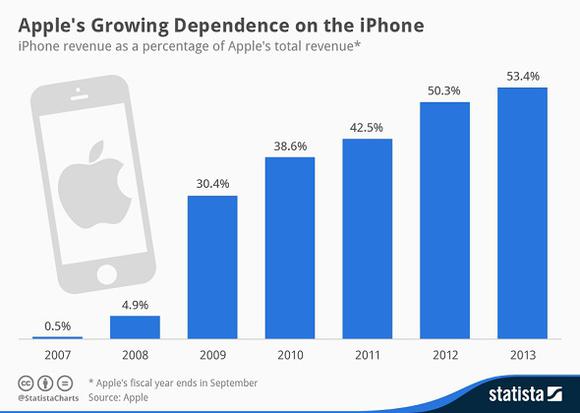

The company has grown increasingly reliant on its phone, which has brought in a steadily increasing percentage of the company's profit since it launched in 2007. Though iPhone has been a growth business for the company, it accounted for more than half of Apple's profits in 2013 and that number is expected to climb in 2014.

Though there is no reason to believe the market for iPhone will disappear any time soon, the music industry likely believed at one point that people would always want a physical copy of the albums and songs they own. Sony (SNE +0.51%) probably also once felt the same way about the Walkman/Discman, and Blockbuster Video was once a growth business that looked unstoppable.

How much does Apple rely on iPhone?

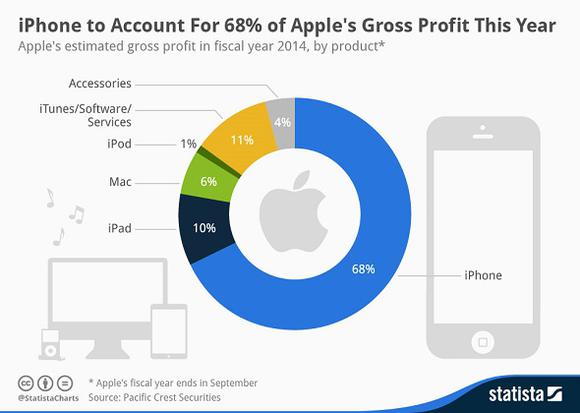

If counting on one product line for 53.4% of your profit is a cause for alarm, then predicting that the number will grow to 68% is downright disturbing. Of course Apple made nearly $40 billion in 2013, so even its sectors that make a tiny profit are still throwing off dollars that other companies would be pleased to claim for their entire business.

Still if something majorly affected the iPhone business, Apple would be in a vastly different financial situation.

A reason for short-term optimism

The expected launch of the iPhone 6 explains why Apple expects to grow its profits from iPhone in 2014.

Andy Hargreaves, an analyst for Pacific Crest, told Statista he believes Apple is about to release a 4.7-inch iPhone 6 that could come with an even higher price tag than the iPhone 5S. Hargreaves expects Apple to sell its first larger-screen iPhone for $299 with a two-year contract, which is $100 above what Apple charges for the 5S. This, he said, "will boost sales and most importantly profit margins."

That's excellent news for Apple's business, but it's not necessarily sustainable long-term (though Apple has done a remarkable job since 2007 in doing both sustaining and growing its iPhone business).

Can iPhone business go away?

No product is forever but Apple has proven especially resilient in the face of competitors. Yes, iPhone has lost market share to Android phones, but it has continually grown sales as it keeps a smaller piece of a growing market. I wrote about the idea that Apple is one failed iPhone away from being Blackberry BBRY +2.10% in an earlier Fool article, and the reality is Apple is unlikely to stumble that badly.

So Apple's greatest competitive threat is not that somehow a phone competitor will create a smartphone that devastates its customer base, but that the concept of smartphones goes away. Just like it was great to be the aforementioned Blockbuster Video until the concept of video rental largely moved from physical to digital rental, it's great to have the top smartphone while people buy smartphones.

Phones are vulnerable on a lot of fronts but wearables seem to be the next contender for the throne.

"It may seem laughable to suggest that people will soon neglect their iPhones in favor of amped-up watches, eyeglasses, rings, and bracelets," Bill Wasik wrote for Wired. "But then again, 10 years ago it seemed laughable to think that people would use their smartphones to email, surf the web, play games, watch videos, keep calendars, and take notes—all once core tasks of desktop PCs."

Apple should move cautiously

There is absolutely no guarantee that wearables -- which consumers have seemed a little tepid toward -- will replace phones in the near future. What can be guaranteed however is that something -- be it brain implants, watches that project holograms, or some other sci-fi magic -- will ultimately supplant the smartphone.

Apple derives huge profits from the iPhone and that will likely continue for years to come, but it won't continue forever. Deriving 68% of your profits from a single product line that will ultimately go the way of the record player is not a viable long-term strategy.

There is every reason to believe that Apple knows this. The company's ability to continue to thrive once whatever will replace the smartphone replaces the smartphone depends upon how it diversifies now. It's not a bad thing to make billions from the iPhone now.

But if Apple is not prepared for whatever is next, than the company -- no matter how great a 2014 it will have -- is built on a shaky foundation.