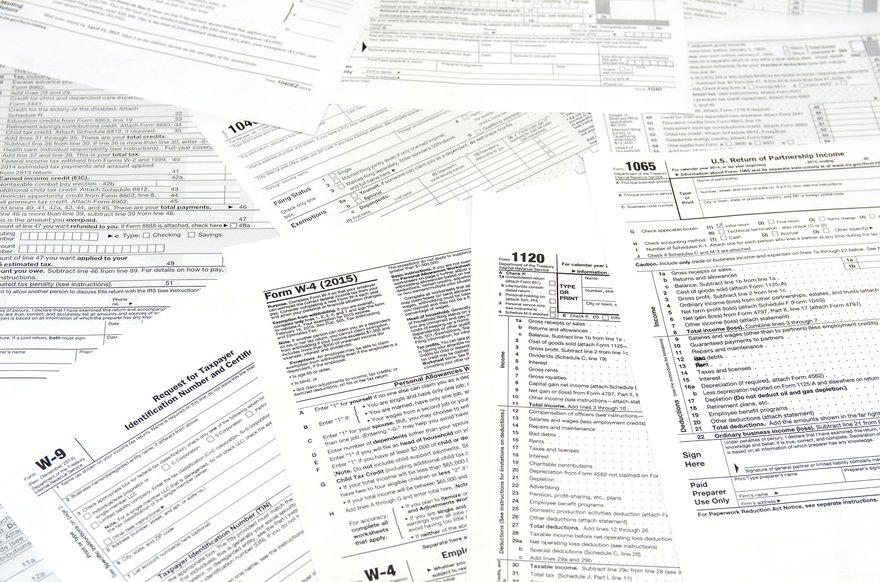

Whether you hire contractors or you're simply an investor who receives regular income from your investments, you're likely to have encountered a 1099 form. There's a lot this little form can do. We'll talk more about it in this article.

Definition

What is a 1099 form?

A 1099 form is a form that reports non-wage income, which includes most income you make outside of a regular 9-to-5 job (income that's generally reported on a W-2). These forms are issued for much the same reason as W-2s. They document your income sources, so whoever is paying you is able to write off the portion of income they're paying you and not need to pay taxes on it.

Other similar forms you may encounter include Form 5498, which reports transactions for IRAs; Form 5498-ESA, which reports transactions for education savings accounts (ESAs); and Form 1042-S, which reports investment income and distribution for nonresident aliens.

Who gets one?

Who gets 1099 forms?

In general, if you've received more than $600 from any source, including as a freelancer or gig worker, you'll get a 1099. You can also get 1099s as documentation of income from dividends or distributions, sales of stocks, bonds, derivatives, and other securities, or if you've negotiated to have some or all of a debt canceled.

Most of the different types of 1099s are due to the recipient by January 15, but the 1099-B may be allowed to show up as late as March 15, depending on your circumstances. Regardless of the source and when the income was received, you have to report this income on your income tax return each year.

Types of 1099s

What types of 1099 forms are there?

There are many different types of 1099 forms, but the ones that matter the most to investors are:

- 1099-MISC. This form will report payments from rent or leases, as well as other income like royalties, cash prizes, health care payments, and other miscellaneous items.

- 1099-B. If you sold stocks in your brokerage account, you may receive a 1099-B.

- 1099-DIV. Got dividend income? You're bound to also get a 1099-DIV. Make sure to report your dividend income, even if it seems very small.

- 1099-INT. Because of inflation, many savings accounts are now actually paying enough for interest to be reported. Depending on how much you have in savings, this might be the first time you've seen this form. Even if you don't ultimately end up having to pay tax on your savings income, you have to report it.

- 1099-OID. Did you buy bonds or certificates of deposit (CDs) through a brokerage at less than face value? This is the form for you. You'll likely pay tax on some percentage of that discount as long as you hold that bond up to maturity.

- 1099-R. If you've gotten any kind of distribution from a retirement pension or annuity worth at least $10, you'll get a 1099-R that documents it.

- 1099-S. If you sold real estate during the year, you have to report that transaction. This is the form that will show your gross proceeds.

Related investing topics

Why they matter

Why do 1099 forms matter to investors?

If you're an investor who is living off your investments or who is active in the real estate market, the chances are good that you'll be receiving 1099 forms each year. It's important to understand what each form represents so you can properly report your income, pay your applicable taxes, and strategize for the future.

A 1099 form can also be used as a tool to help you measure the success of your investment portfolio. Although you have plenty of metrics to judge the performance of your portfolio, the amount of income and tax you have to deal with each year is certainly one measure.