Sometimes, people who work in the business world don't always have their clients' best interests in mind. You might hear about them on the news or through word of mouth, taking advantage of their positions. If you're wondering, "What is a kickback?" we've got some answers for you.

What is a kickback?

A kickback is an illegal payment to someone for preferential treatment. That payment can come in the form of cash, but it can also be valuable gifts or even financial favors, such as paying someone's mortgage. It can be considered a kickback if anything of value is exchanged for special treatment.

There is always some sort of collusion at the root of a kickback, which can involve outright fraud or simply steering customers toward a particular company, investment, or fund. Kickbacks are highly illegal, so everything that flows from them can be considered to have corrupt intentions.

Examples of kickbacks

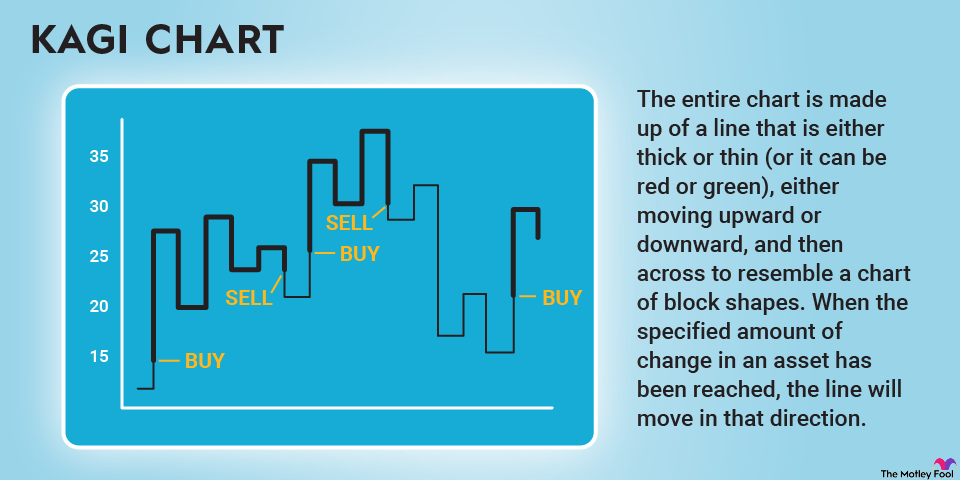

A common kickback in the investment world is when a broker always uses a particular exchange for orders, even if it's not the most competitively priced. The broker would do this, of course, because they get some kind of payment from the exchange or from someone at the exchange (you can have a corrupt player within a sound organization, too).

Another example of a kickback would be when a company acts as a vendor for a large company or government agency and provides kickbacks to employees to ensure their products are consistently chosen over the competition.

So, for example, if the vendor operates a dump truck fleet, it might give the accountant at the highway department a kickback to ensure it always wins supply contracts for repaving projects, even if it isn't the best company for the job or its fees are much higher than other bids.

How do kickbacks affect financial customers?

Kickbacks can affect financial customers in various ways. The most direct way is to limit the options available to customers when it comes to choosing financial products. If their financial advisor is taking kickbacks from a particular fund or exchange, the advisor may steer clients toward that entity rather than place their money in the places best suited to their financial goals.

Kickbacks can also affect financial customers by falsely altering the balance sheets and affecting the long-term health of companies that may interest investors. If company XYZ is paying a lot of kickbacks to become a vendor for large government projects, for example, that's less money that can go back to investors.

More importantly, that's an unsustainable growth model that will eventually hurt those investors unaware of the shenanigans going on behind the scenes.

Can kickbacks be controlled?

Kickbacks should be controlled from within the organizations offering them, but they can be very hard to detect. After all, no accountant is going to tell their boss that they're taking kickbacks from a vendor.

That's why it's important to have independent people at every level of the organization checking pricing structures and cash flow to ensure that money is being handled properly.

Related investing topics

Contracting with friends or family of someone with the power to make those decisions within an organization is always a very suspect situation, one that can be prime for kickbacks. However, there are many other situations in which someone behaves badly on one end or the other of a transaction.

If a kickback is detected, it may result in professional ethics violations, criminal prosecution, and even tax penalties since kickbacks are technically taxable income that is rarely reported.