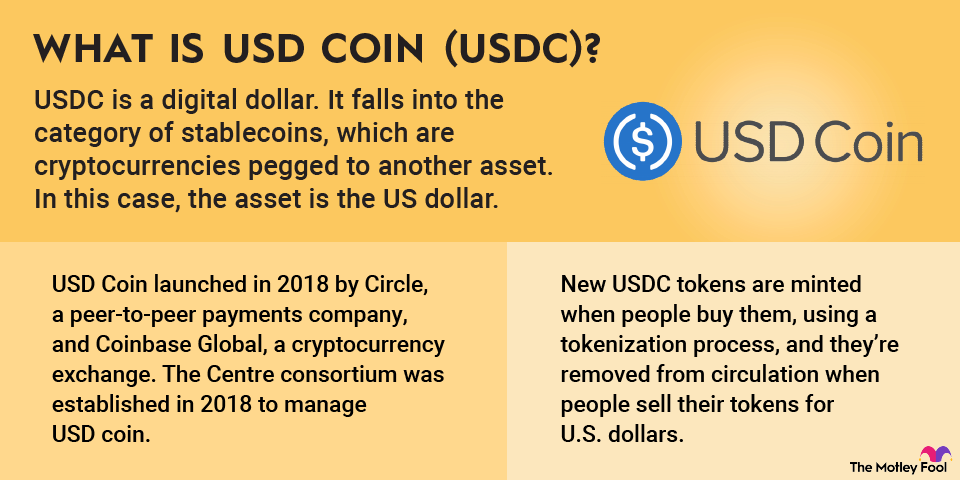

USD Coin (USDC -0.01%) is a digital dollar. It falls into the category of stablecoins, which are cryptocurrencies pegged to another asset. In USD Coin's case, the asset is the U.S. dollar, and one USDC is designed to maintain a value of $1.

Although stablecoins aren't investments, they have a variety of other uses, and you can often earn generous interest rates on them. Since its launch, USD Coin even became one of the largest stablecoins in the world and even became the first cryptocurrency selected for settling Visa (V -1.81%) transactions.

In this USD Coin guide, we'll explain how it works and how to decide if you should buy it.

What makes USD Coin unique?

In terms of functionality, U.S. dollar stablecoins essentially all offer the same thing. They aim to maintain a value of $1, and they work like any other digital currency so they can be transferred between crypto wallet addresses.

Blockchain

The most important factors for a stablecoin are transparency and trustworthiness -- areas where USD Coin does a better job than most of its competitors.

Centre, the consortium that manages the USD Coin crypto, releases monthly reports issued by Grant Thornton, LLP, one of the top accounting firms in the country. Its reports provide the number of USDC in circulation and the total value of the reserves backing USD Coin. That's important because it shows there are actual funds in an account for every USDC.

Another point in USD Coin's favor is the type of funds backing it. While some issuers back their stablecoins with a variety of financial instruments, the USD Coin reserves consist of only U.S. treasury securities and cash deposits.

Where USD Coin came from

USD Coin was issued by Circle, a peer-to-peer payments company, and Coinbase Global (COIN -3.75%), a cryptocurrency exchange. Circle first announced plans to launch USD Coin on May 15, 2018, and raised $110 million.

The Centre consortium was established in 2018 to manage USD Coin. USDC became its first initiative when Coinbase offered USDC to its users. Circle and Coinbase are the founding members.

USD Coin launched on Sept. 26, 2018. According to its first report released in October 2018, there were about 127 million USDC in circulation. In 2022, there were more than 55 billion.

How USD Coin works

USD Coin is built on an open-source fiat stablecoin framework developed by Centre. New USDC tokens are minted when people buy them, and they're removed from circulation when people sell their tokens for U.S. dollars.

Let's say you want to buy USD Coin through a crypto exchange. Here's how the three-step tokenization process works:

- You send U.S. dollars to the crypto exchange to purchase USD Coin.

- The exchange uses a USD Coin smart contract to mint the equivalent amount of USD Coin.

- You receive the newly minted USD Coin, and the exchange puts the U.S. dollars you paid into the reserves for USD Coin.

The tokenization process ensures there are reserves backing the entire supply of USD Coin.

If you're selling USD Coin, it's the same process only in reverse. The exchange uses a smart contract to remove the USDC tokens that you're selling from circulation, and it pays you an equivalent amount of U.S. dollars from the reserve.

Can I make passive income with USD Coin?

You can make passive income with USD Coin by lending it, and that's one of the reasons investors buy it. There are several crypto lending programs available that will pay you interest for lending your crypto. Gemini and CoinLoan are among the platforms that support USD Coin lending and offer competitive interest rates.

Since these are lending programs, they're not risk-free. There is the possibility of losing funds if borrowers default on their loans or if the lending platform goes through financial difficulties. Lending platform Celsius is a cautionary tale here. It halted withdrawals in 2022, and then filed bankruptcy, leaving users without access to the crypto they had deposited.

Another popular option is USD Coin staking on decentralized crypto exchanges. Most of these platforms allow you to deposit an equal amount of USD Coin and another cryptocurrency into liquidity pools that are used to facilitate crypto trading. This passive income method carries much greater risk, but you could earn a larger return.

Related investing topics

Unique risks

Since USD Coin is managed by multiple companies, the main risk is that one goes bankrupt. According to Circle, USD Coin is always redeemable 1:1 for U.S. dollars. But if Circle or Coinbase ends up going out of business, it's impossible to be 100% sure that USD Coin will maintain its value.

Stablecoin regulations are also a concern. U.S. lawmakers have been working on a regulatory framework for stablecoins and their issuers that could affect how they're used. It's worth mentioning that USD Coin follows current regulations and would likely have fewer issues with any new rules compared to other stablecoins.

These are relatively small risks, to be fair. With USD Coin's reserves, people who own it should always be able to exchange it for an equivalent amount of U.S. dollars. However, it's important to be aware that this isn't guaranteed. Although USD Coin acts as a digital dollar, it's not as safe as money in a bank account. Most banks have FDIC insurance that covers you if the bank collapses. USD Coin doesn't have this type of protection.

Is USD Coin a good investment?

As a stablecoin, USD Coin isn't designed as an investment. If it works the way it's supposed to work, any USD Coin you buy will be worth the same amount in one year, five years, and so on.

Even though it's not an investment, USD Coin is an option for a passive income stream. Through lending programs, you can easily earn an annual percentage yield of more than 5% on USD Coin. Be careful about doing this with large amounts of money, though. As mentioned earlier, crypto lending programs have failed in the past, leaving users high and dry.

If you're looking for a cryptocurrency investment, it makes more sense to compare other types of cryptocurrencies that aren't stablecoins. Bitcoin (BTC -3.76%) and Ethereum are popular choices, but there are many other interesting projects out there. You could also try investing in cryptocurrency stocks.

How to buy USD Coin

You shouldn’t have any trouble finding USD Coin. Because of its widespread use, a number of crypto exchanges and stock brokers sell it. Here are a few of the major platforms where you can buy USD Coin:

USD Coin is useful for individuals and businesses wanting a digital dollar. It's easy to use, whether you're sending, receiving, or lending. Stablecoins aren't guaranteed, but the transparency of USD Coin makes it one of the most secure options.