Chapter 7 Bankruptcy and Chapter 13 Bankruptcy Statistics

Bankruptcy -- including Chapter 7 and Chapter 13 bankruptcy -- is a last resort for consumers in financial distress, giving them a chance to liquidate their debts and get a fresh start.

That opportunity comes at a cost, both in what consumers pay to file bankruptcy and in the damage it does to their credit score.

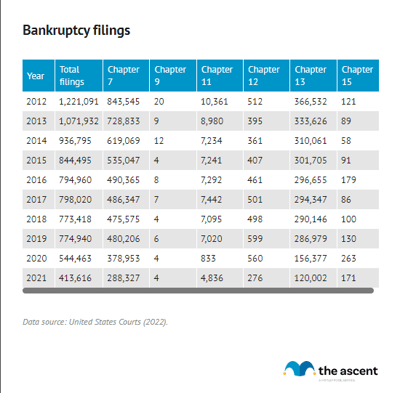

Some good news is that bankruptcy filings were down in 2021 as compared to 2020. Still, almost 414,000 Americans filed for personal bankruptcy that year.

Key findings

- Chapter 7 bankruptcy filings: 413,616 Chapter 7 bankruptcy filings were made in 2021, down 24% from 2020.

- Chapter 13 bankruptcy filings: 120,002 Chapter 13 bankruptcy filings were made in 2021, down 23% from 2020.

- Chapter 11 bankruptcy filings: 4,836 Chapter 11 bankruptcy filings were made in 2021, up 480% from 2021.

Chapter 7 bankruptcy statistics

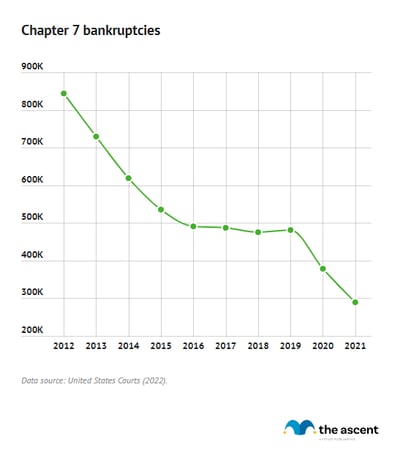

Chapter 7 personal bankruptcies -- also known as liquidation bankruptcy -- are the most common type of bankruptcy filed. Chapter 7 bankruptcy lets the debtor liquidate all nonexempt property and discharge their debts within three to six months

Just over 288,000 Americans filed Chapter 7 personal bankruptcy in 2021, which accounts for roughly 70% of all personal bankruptcies filed.

Still, about 90,000 fewer Americans filed for Chapter 7 bankruptcy in 2021 than in 2020.

It's not surprising that Chapter 7 bankruptcies are the most common type of personal bankruptcies -- the debtor can complete the entire process in a matter of months instead of the years that other types of bankruptcy filings can take.

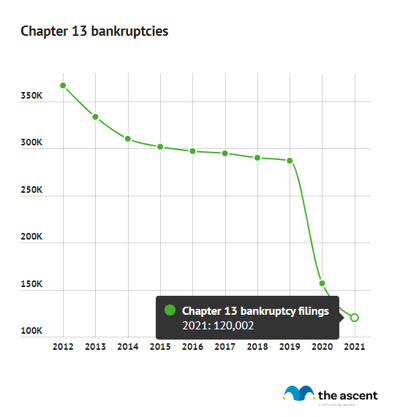

Chapter 13 bankruptcy statistics

The second most common type of personal bankruptcies are Chapter 13 bankruptcies -- in which the debtor commits to a three- to five-year payment plan upon completion of which their remaining debts are discharged.

About 120,000 Americans filed for Chapter 13 bankruptcy in 2021, accounting for roughly a quarter of all personal bankruptcy filings in 2021. The number of Americans that filed for Chapter 13 bankruptcy in 2021 dropped by about 36,000 as compared to 2020.

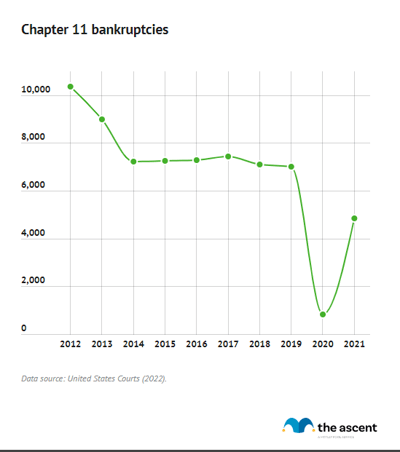

Chapter 11 bankruptcy statistics

In 2021, 4,836 Chapter 11 bankruptcies were filed, an increase of roughly 4,000 from 2020.

In Chapter 11 bankruptcy filings, the debtor commits to a payment plan to repay a portion of their debts and discharge the rest, similar to a Chapter 13 bankruptcy filing (albeit more complicated and expensive). Debtors may elect to file for bankruptcy under Chapter 11 if their total debt exceeds the limits for Chapter 13 bankruptcy.

Bankruptcy filings by state

California, Florida, and Georgia were home to the most personal bankruptcy filings in 2021. Not a huge surprise, given that those states are among the top ten most populous in the country.

The least number of personal bankruptcy filings occurred in Alaska, Vermont, and North Dakota -- some of the least populous states.

Looking at filings per thousand residents, however, tells a different story. In Alabama, 2.9 personal bankruptcies were filed in 2021 for every thousand residents. Nevada, Tennessee, Indiana, Kentucky, and Mississippi similarly had two or more bankruptcies filed per thousand residents.

On the other hand, Illinois had the lowest number of personal bankruptcies filed per thousand residents, just 0.3 -- surprising given its relatively large population. Less shocking were the other states that had among the lowest personal bankruptcy filings per thousand residents: Alaska, Vermont, Maine, and New Hampshire.

Medical bankruptcy and other causes

The data above comes from a survey of consumers who filed bankruptcy between 2013 and 2016. Debtors were able to choose multiple factors that contributed to their bankruptcy.

By far the most common cause of bankruptcy was a loss of income, with over three-quarters of filers stating it was a contributing factor. Unfortunately, most Americans simply aren't prepared for this situation.

The usual recommendation on how much to save in an emergency fund is three to six months of living expenses. In our survey on Americans' financial habits, we found that only 15% felt confident they could go without six paychecks or more before missing financial obligations.

Medical debt is often called the most common cause of bankruptcy, but that's not quite the case. Medical expenses rank second, as they're a factor in bankruptcy filings for 58.5% of consumers.

It should be noted that medical issues aren't just a problem because they're expensive. They can also result in a loss of income and even a job loss. That's why having a plan for managing finances during a medical emergency is important, too.

FAQs

Bankruptcy is a legal process to provide relief to people or other entities unable to repay debt. Filing for bankruptcy allows debtors to eliminate or reduce debt. It can have a significant negative impact on your credit score.

Declaring bankruptcy triggers an automatic stay, which prevents creditors from collecting assets from the debtor who has declared bankruptcy. This provides the party that has declared bankruptcy time to determine a course of action to repay their debts and some breathing room to deal with other financial obligations.

Three steps are required to file for bankruptcy. First, you must get credit counseling through an organization approved by the United States Courts. Second, you must file a bankruptcy petition, usually with the help of a lawyer. Third, you must meet with creditors following the acceptance of the bankruptcy petition.

Chapter 7 bankruptcy, often referred to as liquidation bankruptcy, allows the debtor to liquidate nonexempt property to pay off their debt and discharge the remainder of their debts within three to six months. Qualification for Chapter 7 bankruptcy is based on income. It is mostly used by those with low incomes. Chapter 7 bankruptcy appears on your credit report for 10 years.

Chapter 13 bankruptcy allows the debtor to propose and follow a three to five year repayment plan upon completion of which any remaining debts are discharged. There are limits to how much debt an individual can carry when filing under Chapter 13. Chapter 13 bankruptcy is more attractive than Chapter 7 bankruptcy because it allows debtors to prevent their homes from being foreclosed on as a result of bankruptcy. It also allows debtors to consolidate their debts. Chapter 13 bankruptcy appears on your credit report for seven years.

Filing for bankruptcy can severely impact your credit score for up to a decade, depending on which Chapter you file under. A lower credit score can make it more difficult to be approved for loans or receive favorable terms and can limit your ability to successfully apply for a credit card. That said, there are good credit card options after bankruptcy. Consumers also have ways to build credit after bankruptcy. There are even mortgage lenders that will work with those that have poor credit.

Under Chapter 7 bankruptcy, debtors may be required to liquidate nonexempt property, which includes assets that are not the "necessities of modern life." How that operates in practice is determined on a case-by-case basis and state law also plays a role in which property can be liquidated under Chapter. The bottom line is that debtors filing under Chapter 7 may lose some of their possessions.

Medical debt can be discharged through Chapter 7 or Chapter 13 bankruptcy. Medical debt is usually categorized as non-priority unsecured debt, which can be discharged through bankruptcy.

Chapter 7 bankruptcy stays on your credit report for 10 years. Chapter 13 bankruptcy stays on your credit report for seven years. Credit reports value recency, so it is possible to rebuild your credit score while bankruptcy appears on it as long as payments are made on time. Payments as part of a Chapter 13 bankruptcy repayment plan are also considered on credit reports.

Filing for Chapter 7 bankruptcy can typically cost between $2,910 to $3660, according to Nolo, a publisher of legal advice.

Filing for Chapter 7 bankruptcy requires a $338 filing fee, which can be waived depending on the filer's income.

Filers are required to attend two bankruptcy counseling sessions, which cost $60 or less.

Lawyers' fees are the most expensive part of filing for Chapter 7 bankruptcy. Most filers paid a fee of $1,450 to prepare the bankruptcy petition and represent them in court. Cases cost between $1,000 and $1,750. Those fees can vary even more widely depending on the firm and whether creditors challenge claims made in court, which would extend the case.

Sources

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.