Virgin Galactic (SPCE 2.13%) wants to boldly go where no other company has gone before. It's pioneering human spaceflight for private individuals and researchers. The space tourism company is developing a system that would enable people to experience space travel.

While Virgin Galactic initially expected to begin commercial flights in 2020 and reach profitability the following year, neither has happened yet. However, it's now on pace to start commercial flights from its Delta Class spaceships in 2026. It believes two ships can generate $450 million of annual revenue.

That catalyst could send the company's stock soaring in the coming years. This upside potential has many investors interested in buying the space stock. Here's a look at everything you need to know about Virgin Galactic and adding the aerospace stock to your portfolio.

Stock

How to buy Virgin Galactic stock

How to buy Virgin Galactic stock

Anyone can become a shareholder of Virgin Galactic. The space tourism company came public on the New York Stock Exchange in 2019 via a business combination with a special purpose acquisition company (SPAC) formed by venture capitalist Chamath Palihapitiya.

Although anyone can buy shares in their brokerage account, you'll need to take a few steps to become a shareholder. This four-step guide will show you how to invest in stocks and add the space stock to your portfolio.

Step 1: Open a brokerage account

You'll want to open and fund a brokerage account before buying shares of any company. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one for you.

Step 2: Figure out your budget

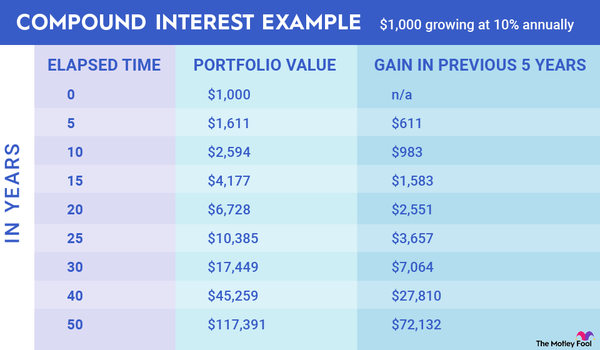

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

You don't have to buy all those stocks at once. You can ease into investing by purchasing one stock at a time. A good way to start is to work toward holding 10 stocks. So, if you have $1,000 to invest right now, you'd want to budget about $100 for each stock.

Step 3: Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about its competitors, its balance sheet, how it makes money, and other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term. Continue reading to learn more about some crucial factors to consider before investing in Virgin Galactic stock.

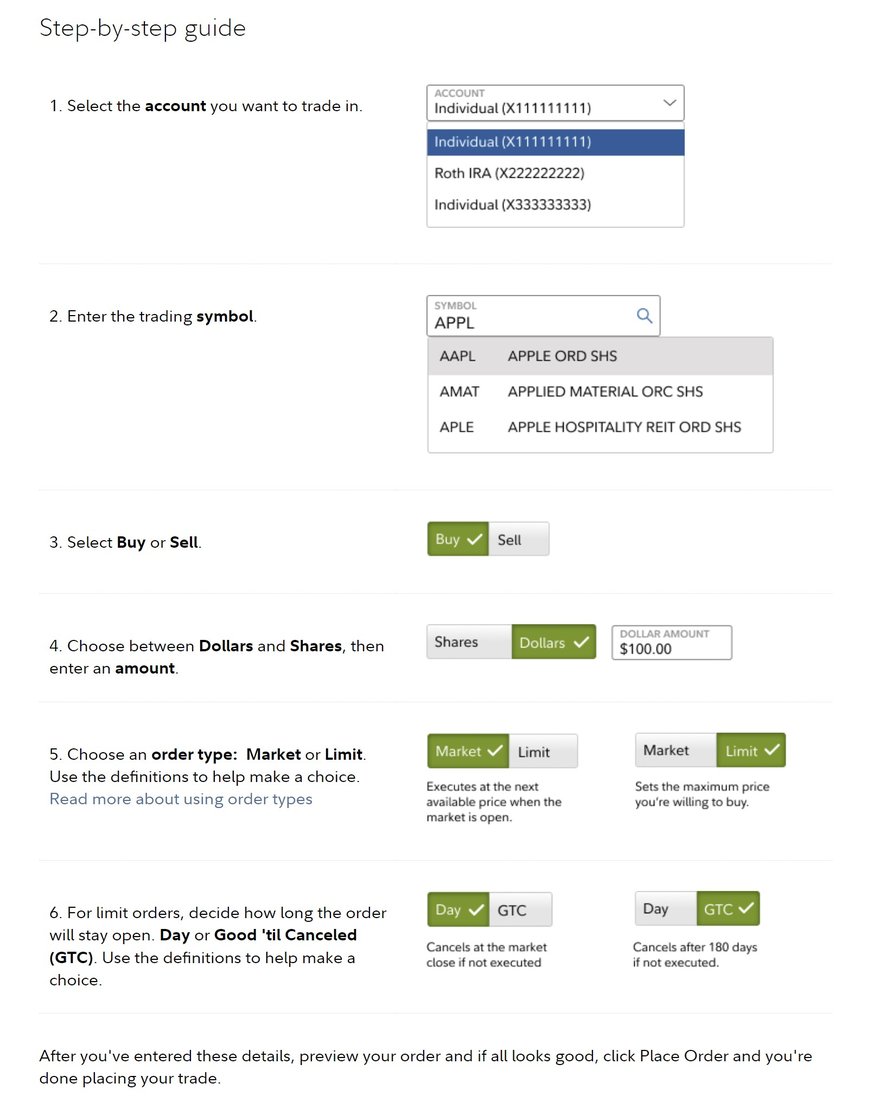

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (SPCE for Virgin Galactic).

- Whether you want to place a limit order or a market order. (The Motley Fool recommends using a market order because it guarantees you buy shares immediately at market price.)

Here's a screenshot of how to buy a stock with the five-star-rated platform Fidelity (which offers a video tutorial and a step-by-step guide):

Once you complete the order page, click to submit your trade and become a Virgin Galactic shareholder.

Should I invest in Virgin Galactic?

Should I invest in Virgin Galactic?

Before buying Virgin Galactic shares, you must decide whether it's the right investment for you. Your portfolio should align with your risk tolerance, return objectives, and values.

With that in mind, here are some reasons you might want to invest in Virgin Galactic:

- You think space travel is the next frontier and will drive robust revenue and profit growth for Virgin Galactic in the future.

- You're comfortable with the risks of investing in Virgin Galactic, including that shares could lose value.

- You don't think Virgin Galactic will have trouble funding its business.

- You don't need dividend income right now.

- You're confident Virgin Galactic will achieve its production schedule and generate revenue from its Delta Class spaceships in 2026.

On the other hand, here are some reasons you might decide against buying shares of Virgin Galactic:

- You don't think space tourism will be a viable long-term business.

- You're not sure Virgin Galactic will ever make money.

- You're seeking companies that pay dividends.

- You're concerned about Virgin Galactic's cash burn rate.

- You're worried that continued stock dilution will weigh on the value of its shares.

Is Virgin Galactic profitable?

Is Virgin Galactic profitable?

Profits are the fuel of businesses. Companies eventually need to make money to fund their operations and growth. Investors should closely analyze a company's profitability. Ideally, they'd like to see that a company is growing its profits or on the path to making money.

Virgin Galactic is light-years away from becoming profitable. The space company is still in the early stages of commercialization and generating limited revenue. As a result, it is posting significant losses and burning through cash.

In the first quarter of 2024, Virgin Galactic recorded only $2 million in revenue from commercial spaceflight and membership fees from future astronauts. While that was a significant improvement from the roughly $400,000 of revenue it produced in the year-ago period, it wasn't close to enough sales to support its operations.

As a result, Virgin Galactic reported a net loss of $102 million during the period. On a positive note, that was an improvement from a $159 million net loss in the previous year due to lower operating expenses and an increase in interest income.

While Virgin Galactic is burning through cash ($113 million of net cash used in operating activities in the first quarter), it has a large cash pile to work with ($867 million). However, it will eventually need to start making money.

Its continued cash burn has forced the company to raise money by selling additional stock (including issuing 5.1 million more shares in the first quarter to raise $7.3 million). The stock sales are diluting existing investors and weighing on the value of its stock price.

Virgin Galactic initially aimed to be profitable by 2021. However, delays in beginning commercial flights have affected its ability to generate revenue and make money. It could finally start making money if its Delta Class spaceships start commercial service in 2026.

Does Virgin Galactic pay a dividend?

Does Virgin Galactic pay a dividend?

Virgin Galactic didn't pay dividends as of mid-2024. The aerospace and space travel company wasn't yet in the position to start returning cash to investors because it's still investing heavily in building out its fleet. Its business still used more cash to fund its operations and capital expenses than it produced, so it likely won't initiate a dividend anytime soon.

ETFs with exposure to Virgin Galactic

ETFs with exposure to Virgin Galactic

Being an active stock picker and managing a portfolio of individual stocks might not be right for you. The good news is you don't have to be an active investor. Thanks to exchange-traded funds (ETFs), anyone can be a passive investor these days. They allow you to invest in a company through a thematic approach or broad market strategy.

Exchange-Traded Fund (ETF)

According to ETF.com, 53 ETFs held 88.3 million shares of Virgin Galactic in mid-2024. Some notable ETFs with exposure to Virgin Galactic to consider are:

- SPDR S&P Aerospace & Defense ETF (XAR 1.1%): This ETF focuses on aerospace and defense stocks. In mid-2024, the fund had 32 holdings, including Virgin Galactic (2% of its assets), and a 0.35% ETF expense ratio.

- Procure Space ETF (NYSEMKT:UFO): The fund focuses on companies in the space industry. The ETF had 35 holdings in mid-2024, including Virgin Galactic (2.9% of its holdings), and a 0.75% expense ratio.

- SPDR S&P Kensho Final Frontiers ETF (ROKT -0.54%): This fund focuses on companies driving innovation in the final frontiers of outer space and the deep sea. In mid-2024, the fund had 32 holdings, including Virgin Galactic (2% of its net assets), and a 0.45% expense ratio.

Will Virgin Galactic stock split?

Will Virgin Galactic stock split?

Virgin Galactic was on the list of companies with an upcoming stock split in mid-2024. However, it wasn't a regular stock split.

The space tourism company planned to complete a reverse stock split due to a low share price (around $1 per share in mid-2024). It was seeking shareholder approval for a reverse split between 1-for-2 and 1-for-20. A reverse split would reduce its outstanding shares to lift its stock price, allowing it to stay in compliance with listing regulations at the New York Stock Exchange.

The company hadn't completed a regular stock split since going public through a business combination with a SPAC in 2019. While shares traded as high as $60 a share after its public market listing, they since have crashed down to earth, falling to less than $1 per share by mid-2024.

Related investing topics

The bottom line on Virgin Galactic

Virgin Galactic has enormous promise. The space tourism company believes it can generate meaningful revenue in 2026 when its first Delta Class spaceship enters service, giving its stock the fuel to rocket in the coming years.

However, Virgin Galactic is still a risky company. It's burning through cash and hasn't previously delivered on its bold commercialization plans. Investors must carefully consider whether it's worth the risk.

FAQ

Investing in Virgin Galactic FAQ

How do I buy Virgin Galactic shares?

You can buy shares of Virgin Galactic with any brokerage account. If you don't have a brokerage account, you'll need to open and fund one first. Here's a list of some of the best-rated brokers and trading platforms. To buy shares of Virgin Galactic, open your broker's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares (if your broker allows fractional shares)

- The stock ticker (SPCE for Virgin Galactic)

- Order type (a limit order or market order)

Double-check the order page and click submit to become a Virgin Galactic shareholder.

Is Virgin Galactic Holdings a good stock to buy?

Virgin Galactic has not been a good stock to buy since coming public in 2019. It has lost over 90% of its value because it's burning through cash to fund its operations and expansion. The company initially expected to begin commercial space flights in 2020 and reach profitability the following year. Neither had happened by mid-2024, causing the company to report limited revenue and heavy losses.

The company believes its revenue will skyrocket in the future. It expects its Delta Class spaceships to start generating revenue in 2026. Virgin Galactic estimates that its first two ships could generate $450 million of annualized revenue. If the company can deliver those ships and revenue expectations, its stock price could soar.

Given the company's history and cash burn rate, investors must realize that Virgin Galactic is a very risky investment. While its stock could take flight as its Delta Class ships enter service, it still has a long way to go before it reaches consistent profitability.

Is Virgin Galactic publicly traded?

Virgin Galactic is a publicly traded company. It came public in 2019 via a business combination with a special purpose acquisition company (SPAC) formed by Chamath Palihapitiya. It trades on the New York Stock Exchange under the stock ticker SPCE.

What is Virgin Galactic's stock ticker?

Virgin Galactic trades on the New York Stock Exchange under the stock ticker SPCE.