The most exciting thing about cryptocurrency investments is that they can skyrocket in value. In 2021, we saw Solana (SOL -2.81%) increase by over 10,000%. Meme token Shiba Inu (SHIB -3.44%) shot up more than 40,000,000%.

Of course, the downside is that prices can fall just as quickly. There's also no guarantee that crypto is here to stay. But after a lengthy bear market, many of the major coins rebounded in the second half of 2023, so crypto investors are cautiously optimistic for 2024 and beyond.

It's obviously impossible to know which cryptocurrency is next to boom. However, we can pick out some possible candidates capitalizing on current trends, including artificial intelligence (AI), decentralized apps (dApps), and digital asset trading, as well as some of the larger cryptos in position to grow even more this year.

Decentralized Application (dApp)

Explosive cryptos

Eight cryptocurrencies to explode in 2024

Here are the cryptocurrencies that could be due for a significant bull run:

1 - 3

1. SingularityNET

SingularityNET (AGIX -1.77%) is a blockchain platform anyone can use to create, share, and monetize AI services. It provides a global AI marketplace where users can purchase all kinds of AI services with the AGIX utility token.

The AI boom has been one of the most exciting recent technological developments, both for cryptocurrency and the world as a whole. SingularityNET is well positioned to capitalize on the trend, with a large team of AI scientists, researchers, and developers. The platform makes it easy for users to buy AI services or develop and sell their own.

SingularityNET already had quite a bit of success early last year, with its price increasing by more than 1,300%. It later declined, likely due to some investors taking their profits. However, it could see more success as AI and the number of companies using AI continue to grow.

2. THORChain

THORChain (RUNE -0.23%) is a decentralized crypto exchange that operates through an automated market maker (AMM) model. It has liquidity pools for cryptocurrencies managed by smart contracts. Anyone can use THORChain by connecting their blockchain wallet to trade over 5,500 cryptocurrencies.

Centralized crypto exchanges have had their share of high-profile issues, including the collapse of FTX in 2022. It's understandable why many investors would want full control of their crypto and use decentralized exchanges when possible.

While many decentralized exchanges are available, THORChain stands out for its experience in the space and recent growth. It was founded in 2018, but business really started picking up toward the end of last year. In November 2023, it had about $1 billion per week in swap volume.

3. Fetch.ai

Fetch.ai (FET -1.44%) is an AI lab that allows individuals or organizations to build their own autonomous agents. The agents can then handle real-world tasks for the user. Agents store data and interact with one another on a blockchain platform so they can collaborate without human interaction.

FET tokens are the native cryptocurrency for Fetch.ai. As such, they're used to make payments on its network. This is another cryptocurrency that did well in 2023 due to the hype around AI technology. Its value went up by almost 300% toward the end of the year. While that's a sizable gain, based on the kinds of returns other popular projects have gotten, there's likely still plenty of room to keep growing.

4 - 6

4. Bitcoin

Like Ethereum (ETH -0.86%), Bitcoin (BTC 0.22%) is already a top cryptocurrency -- the top cryptocurrency, to be exact. While it's certainly not a dark-horse crypto that's going to triple in value, it has had some very positive news to start the year.

After years of waiting, the Securities and Exchange Commission (SEC) finally approved Bitcoin ETFs on Jan. 10, 2024. There are now 11 Bitcoin ETFs available, and they saw $4.6 billion in trading volume on the first day. The SEC approval makes investing in the market's largest cryptocurrency easier than ever and could lead to more institutional investors buying Bitcoin.

Although all cryptos are volatile, Bitcoin's size makes it somewhat safer since it's more likely to stick around. If you're looking for a comparatively low-risk crypto investment that could do well in 2024, Bitcoin is worth considering.

5. Monero

Monero (XMR 3.27%) is the best-known privacy coin, which means it is a cryptocurrency with anonymous, untraceable transactions. It uses privacy-enhancing technology to keep the sender, recipient, and amount of every transaction hidden.

This coin has been around since 2014, a long time in a market that moves as quickly as cryptocurrency. It's an interesting investment now because of increasing crypto regulation in many countries, including the United States.

There are plenty of people who want to keep their cryptocurrency transactions private, especially as regulations become stricter. That gives Monero a clear use case and makes it a dark-horse pick for a crypto that could see continued success.

6. Sei

Sei (SEI -0.23%) has set its sights on bringing financial markets to the blockchain. It was co-founded by Jayendra Jog, previously a software engineer at Robinhood (HOOD -4.3%), and Jeff Feng, who had experience at Goldman Sachs (GS 1.4%).

Sei is built for trading digital assets and is compatible with the Ethereum virtual machine (EVM). While it's still in the early stages, having only launched in 2023, it has built a strong team so far with 28 full-time developers.

It's always promising when a cryptocurrency has a clear problem it aims to solve, as Sei does with blockchain-based financial trading. The technology behind it is also impressive, with its twin-turbo consensus allowing for near-instant trades.

7 - 8

7. Aave

Aave (AAVE -0.85%) is a decentralized finance (DeFi) protocol and lending platform. It allows users to lend and borrow cryptocurrency. Everything is done with smart contracts, so there's no intermediary required. Users can earn interest on the digital assets they lend.

Aave has liquidity pools for many popular cryptocurrencies, such as Tether (USDT 0.01%) and DAI (DAI 0.01%). One reason Aave could be a long-term winner is that, in addition to crypto lending, it has expanded into real-world assets, partnering with Centrifuge.

As part of that partnership, Aave has built a real-world asset (RWA) market that allows companies to tokenize parts of their businesses. Investors can buy tokens offered by those businesses, and the issuers of the tokens can then borrow stablecoins against their assets.

8. Ethereum

At first glance, Ethereum might seem out of place here. It's far from under the radar. It has been the second-largest cryptocurrency for years, so most crypto investors know about it.

While we're probably past the point where Ethereum shoots up by 10,000%, it still has serious growth potential. It was the first blockchain to offer smart contracts, which developers can use to build dApps. Ethereum's first-mover advantage has given it a sizable lead over similar competitors.

Ethereum went through its long-awaited change to a proof-of-stake system in September 2022, significantly improving its energy efficiency. The upgrade also means it's now possible to stake Ethereum and earn more, which could help attract more investors. Overall, Ethereum has great growth potential without the extreme volatility of smaller cryptos. There are also several interesting Ethereum stocks to consider adding to your portfolio.

Related investing topics

Should I invest?

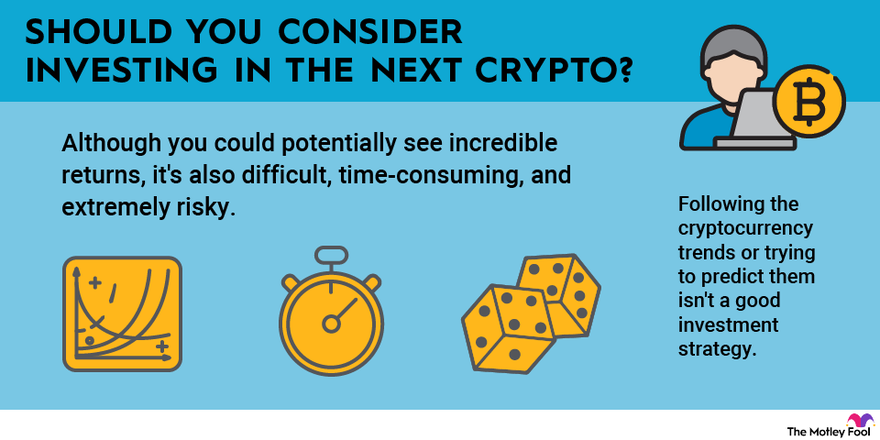

Should you consider investing in the next crypto that explodes?

It's tempting to try to find that next big cryptocurrency. Even though you could potentially see incredible returns this way, it's also difficult, time-consuming, and extremely risky.

For starters, you'll need to look for cryptocurrencies outside the market leaders. Smaller cryptocurrencies have greater growth potential but are also more likely to fold, so there's a bigger chance of losing your entire investment. To balance that out, you might want to put some of your money into cryptocurrency stocks or large-cap coins.

Researching those smaller cryptocurrencies takes time. And even if a project looks like a sure-fire winner, anything could happen in the crypto market. Your carefully researched investment could go nowhere, while a practically useless cryptocurrency goes to the moon just because it has Shiba Inu or Dogecoin (DOGE -2.76%) in its name.

Following cryptocurrency trends or trying to predict them are not good investment strategies. There's nothing wrong with giving it a shot, but keep your expectations -- and the amount you invest -- very low.

What is the next cryptocurrency to explode in 2024 FAQ

Which crypto will boom in 2024?

Cryptos that could boom in 2024 include SingularityNET and Fetch.ai, both of which may capitalize on AI's popularity. Bitcoin is another crypto that could be poised for a strong performance in 2024, thanks to the SEC's approval of Bitcoin ETFs.

What crypto is most likely to explode?

The crypto that's most likely to explode is SingularityNET, a platform for creating, sharing, and monetizing AI services.

What coin will skyrocket in 2024?

A coin that could skyrocket in 2024 is Fetch.ai. It allows users to create their own AI agents, and it was on the rise at the end of 2023.