You probably interact with artificial intelligence (AI) more often than you think. AI is powering the algorithm arranging your Netflix (NFLX -0.93%) menu, the software expediting your Amazon (AMZN -1.61%) package, and the brains behind many of the smartphone apps you use every day.

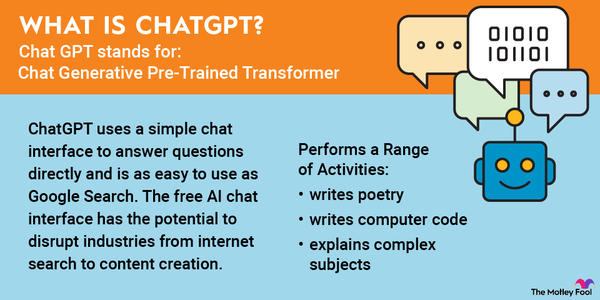

If you've used ChatGPT, the OpenAI chatbot that has wowed users by writing code and instantly answering complex questions, you've gotten a glimpse into the next frontier in AI, known as generative AI. Big tech companies and others are racing to develop the leading AI chatbot and other generative AI technologies.

Artificial Intelligence

If you want portfolio exposure to AI companies but don't want to identify individual AI stocks, you can invest in an AI-focused exchange-traded fund (ETF). AI ETFs provide exposure to a broad range of the best AI companies, eliminating the need to research and choose individual stocks on your own.

Best AI ETFs

Best AI ETFs to buy in 2024

| AI ETF | Assets Under Management | Expense Ratio |

|---|---|---|

| Global X Robotics & Artificial Intelligence ETF (NASDAQ:BOTZ) | $2.63 billion | 0.68% |

| ROBO Global Robotics and Automation Index ETF (NYSEMKT:ROBO) | $1.25 billion | 0.95% |

| iShares Robotics and Artificial Intelligence ETF (NYSEMKT:IRBO) | $639.5 million | 0.47% |

| First Trust Nasdaq Artificial Intelligence ETF (NASDAQ:ROBT) | $523.5 million | 0.65% |

Keep reading to learn more about each of these AI ETFs.

1. Global X Robotics and Artificial Intelligence ETF

1. Global X Robotics & Artificial Intelligence ETF

Established in 2016, the Global X Robotics & Artificial Intelligence ETF (BOTZ 0.13%) is a fund that seeks to "invest in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence." That includes enterprises working in industrial robotics, automation, non-industrial robots, and autonomous vehicles.

BOTZ currently holds 43 stocks. Its top five holdings, which account for about 43% of the fund's assets, are:

- Nvidia (NVDA -0.79%): A semiconductor maker whose chips are used in a wide variety of applications -- including autonomous vehicles, virtual computing, and cryptocurrency mining -- and are central to many AI technologies

- ABB (OTCPK:ABBN.Y): Swiss maker of industrial automation and robotics products for use in utilities and infrastructure

- Intuitive Surgical (ISRG -0.32%): Maker of the da Vinci robotic surgical system, which allows for minimally invasive surgeries with precise control

- Keyence (KYCCF 2.64%): A Japanese company that makes factory automation products, such as sensors and scanners

- SMC Corp (OTC:SMCAY): Japanese manufacturer of automatic control equipment for a variety of industrial applications

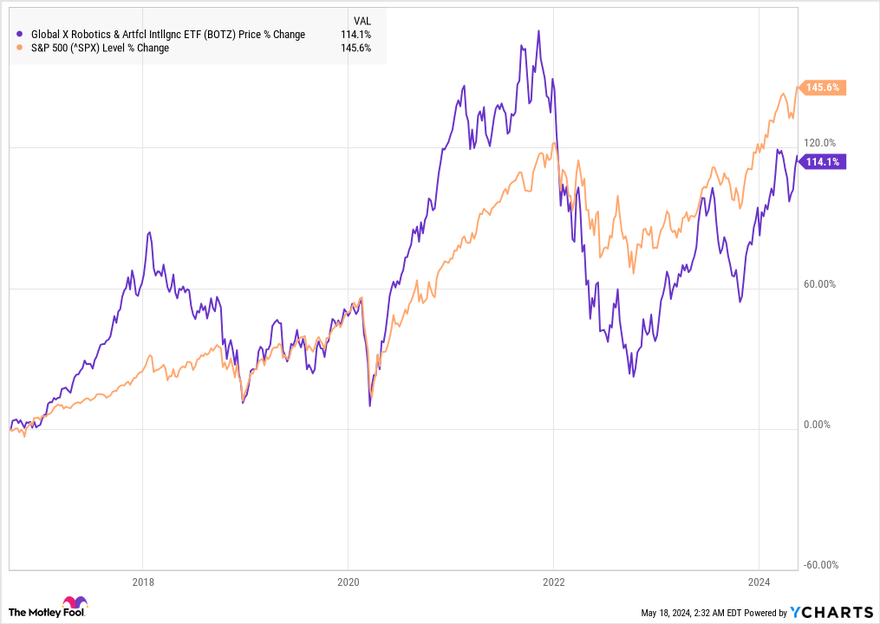

As the chart below shows, shares of the ETF have underperformed the S&P 500 since its launch in 2016. The share price fell sharply in 2022, in line with the broad sell-off in tech stocks, although BOTZ has narrowed the gap since then.

BOTZ offered a modest dividend yield of 0.2% at the time of this writing, but it is better suited as a growth-oriented investment. Its expense ratio of 0.68% is higher than what you'd pay for an index fund, but it's also reasonable for the fund's performance history.

2. ROBO Global Robotics and Automation Index ETF

2. ROBO Global Robotics and Automation Index ETF

The ROBO Global Robotics and Automation Index ETF (ROBO 0.74%) is focused on companies driving "transformative innovations in robotics, automation, and artificial intelligence." ROBO invests in companies primarily focused on AI, cloud computing, and other technology companies.

Cloud Computing

ROBO holds 77 different stocks, with no single holding accounting for more than 2.2% of the ETF's value. Its top five holdings comprise only about 9% of the fund's total value. These five companies include Intuitive Surgical, the maker of the da Vinci surgical robot, Nvidia, and three others:

- Teradyne (TER -0.23%): A maker of automatic test equipment used in the semiconductor industry for wafer-level and device-package testing

- Zebra Technologies (ZBRA -1.35%): A technology company known for products such as barcodes and scanners, RFID tags and transponders, and related tracking devices.

- Kardex Holding (KRDXF 14.78%): A Swiss company that provides automated storage and intralogistics solutions.

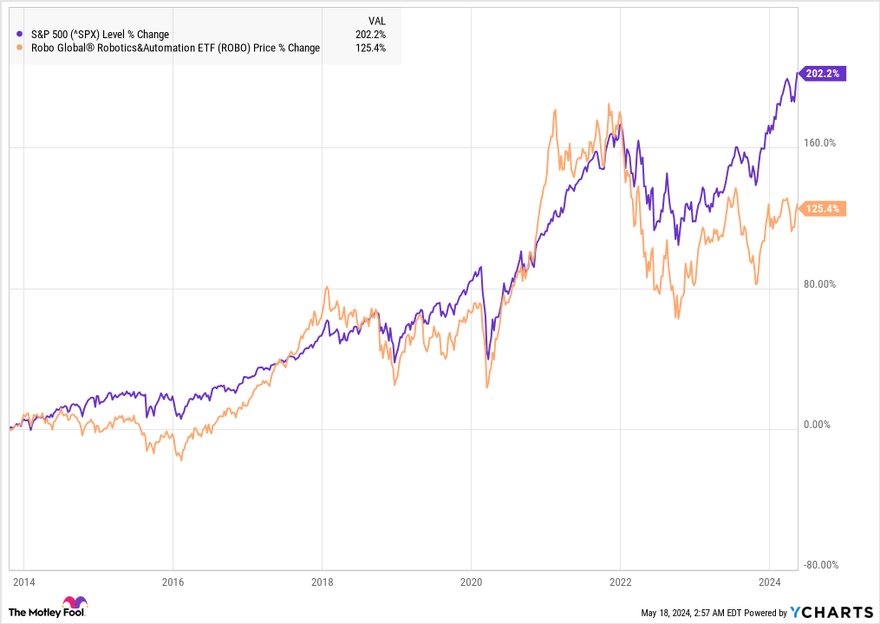

Since its inception in 2013, ROBO has underperformed the return of the S&P 500, as the chart below shows. It trails the broad market index, with dividends factored into the return. ROBO pays a dividend yield of 0.05%, and its expense ratio is 0.95%.

3. iShares Robotics and Artificial Intelligence ETF

3. iShares Robotics and Artificial Intelligence ETF

The iShares Robotics and Artificial Intelligence ETF (IRBO 0.18%) aims to track the results of an index of developed and emerging market companies that could benefit from the long-term opportunities in robotics companies and AI.

IRBO was formed in 2018 and has less than $1 billion of assets under management. With 109 stock holdings, it's now well diversified. Many of its top holdings also give investors exposure to fast-growing small-cap companies.

The fund's top five investments, which account for about 9% of IRBO's assets, include Nvidia and four others:

- MicroStrategy (MSTR -1.07%): An enterprise software focused on analytics that may be best known for its aggressive Bitcoin purchases.

- Arm Holdings (ARM -0.17%): Arm is a chip designer best known for power-efficient CPUs that power smartphones and, increasingly, data centers to run AI applications.

- Spotify Technology (NASDAQ:SPOT): Spotify is best known as the leading music and podcast-streaming services, and the company has taken significant steps toward profitability in recent quarters.

- Matterport (MTTR 2.56%): Matterport's technology creates digital rendering of physical objects and spaces, often known as "digital twins." The technology is most commonly used in the real estate industry to offer virtual tours. Matterport is being acquired by CoStar Group (CSGP -1.11%), so it will soon disappear from the ETF.

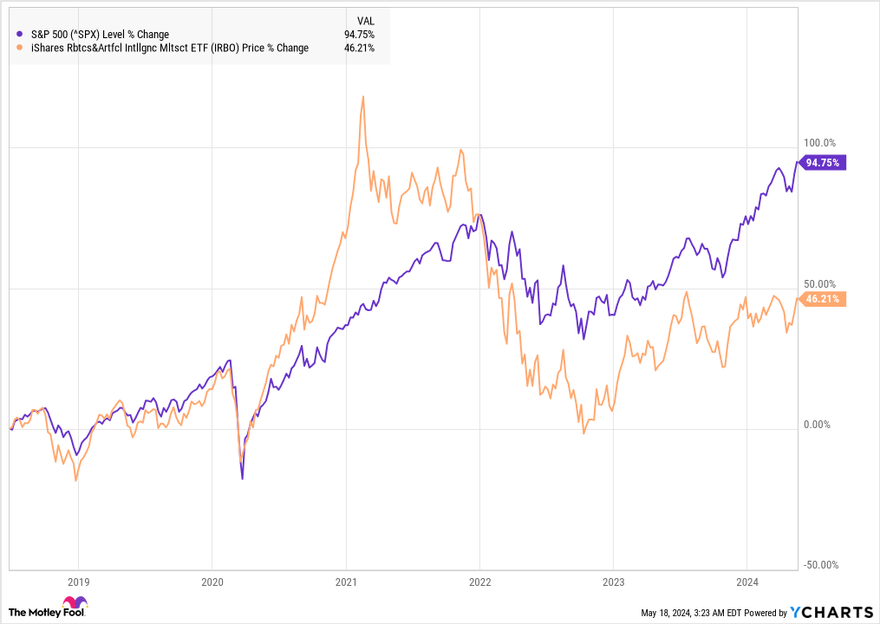

As you can see from the chart below, IRBO has underperformed the S&P 500 since its founding. The ETF fell in 2022 when tech stocks crashed.

IRBO's expense ratio is competitive at 0.47%, and its dividend yield at the time of this writing was 0.94%. The fund's performance will likely be heavily influenced by the overall performance of cloud stocks since it seems more exposed to cloud stocks and chipmakers than AI companies.

4. First Trust Nasdaq AI and Robotics ETF

4. First Trust Nasdaq Artificial Intelligence & Robotics ETF

First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT 0.55%) seeks to track the Nasdaq CTA Artificial and Robotics index, which comprises companies engaged in AI and robotics in technology, industrials, and other sectors.

The fund currently holds 108 stocks, and the top five holdings include:

- Darktrace (LSE:DARK.L): A global cybersecurity technology company, including autonomous response technology and machine learning technology it calls an enterprise immune system.

- AeroVironment (AVAV 0.85%): AeroVironment makes unmanned aerial devices, or drones, in addition to military technology like missile systems.

- QinetiQ Group (OTC:QINETIQ): QinetiQ, pronounced "kinetic," is a British multinational defense technology group known for defense and security systems and autonomous systems like drones and unmanned ground vehicles.

- Valeo (OTC:VLEEY): Valeo makes products and systems for automakers, including powertrain systems and driving assistance systems.

- Mobileye Global (MBLY -0.73%): Mobileye develops autonomous vehicle and driver-assist technology, and is now a subsidiary of Intel.

Related investing topics

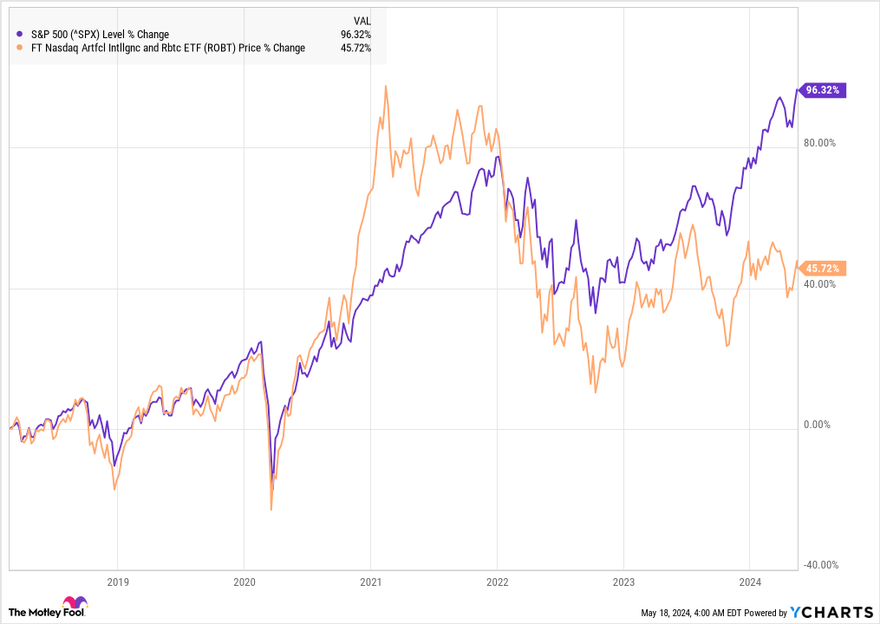

The First Trust ETF offers an expense ratio of 0.65% and a dividend yield of 0.24%. Although its trading history is relatively short, you can see from the chart below that its performance has lagged the S&P 500 recently.

Should I buy?

Should I buy AI ETFs?

The best way to decide which ETF to buy is to consider which stocks a fund holds and how many of them are true AI companies. A fund's expense ratio, dividend yield, and past performance are also important, and you can opt to invest in a basket of all four of these AI ETFs to maximize your diversification.

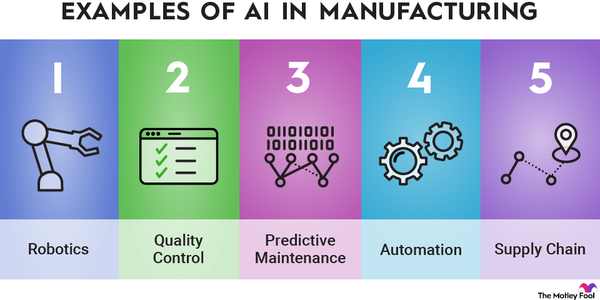

Over time, AI, like chatbots, will grow only smarter and play a greater role in our daily lives. Already, AI represents a global market worth hundreds of billions of dollars, and its wide range of practical applications includes smartphone face recognition, predictive algorithms in internet search, smart home devices, and autonomous vehicles. So, pay attention to the AI market now, and you may find yourself reaping the rewards in years to come.

FAQ

Investing in Artificial Intelligence ETFs: FAQ

Which ETF is best for AI?

AI investors have several options in ETFs. The best-known of the AI ETFs above is BOTZ, which holds a number of well-known AI stocks, including Nvidia and Intuitive Surgical.

AI investors may also want to consider an ETF that tracks the Nasdaq-100, such as the Invesco QQQ ETF (NASDAQ: QQQ), because big tech companies with exposure to AI make up almost half of the fund.

Does Vanguard have an AI ETF?

Vanguard does not currently offer an AI-focused ETF. However, the asset manager offers an information technology ETF that includes several AI stocks.

What is the best AI to invest in?

The best-known AI stock right now is Nvidia, and it's also been the most successful stock in AI. Past performance does not guarantee future returns, but it makes sense to invest in ETFs with exposure to Nvidia and other AI chip stocks as they emerge.

Does Charles Schwab have an AI ETF?

Charles Schwab does not have an AI ETF. However, the brokerage firm does have an AI "theme" that contains as many as 25 AI stocks that Schwab account holders can buy together based on Schwab's proprietary algorithms and research.