If you're looking to gain exposure to Bitcoin (BTC 0.06%) but prefer the convenience of trading like you would with a stock, then a Bitcoin exchange-traded fund (ETF), like the Grayscale Bitcoin Trust ETF (GBTC 0.72%) might be the solution you need.

Investing in this ETF offers a more accessible way to gain exposure to Bitcoin without the complexities of direct cryptocurrency transactions. Here's everything you need to know about Grayscale Bitcoin Trust ETF and how to get started investing in it.

Exchange-Traded Fund (ETF)

What is it?

What is Grayscale Bitcoin Trust ETF?

The Grayscale Bitcoin Trust ETF is an investment fund that provides investors with exposure to Bitcoin by tracking the CoinDesk Bitcoin Price Index. When you buy shares of Grayscale Bitcoin Trust ETF, you are effectively purchasing exposure to the real-time (spot) price of Bitcoin since the fund directly holds Bitcoin as its underlying asset.

Grayscale Bitcoin Trust ETF trades much like any stock traded on an exchange, as opposed to mutual funds that trade only once per day at market close. It has a bid price, which is the highest price a buyer is willing to pay for a share, and an ask price, which is the lowest price at which a seller is willing to sell a share. This makes it easy to buy and sell shares of the fund during market trading hours, similar to how you would trade shares of any publicly listed company.

Grayscale Bitcoin Trust ETF is not only a convenient way to invest in Bitcoin but also a very large and popular ETF in its niche. As of June 2024, it averaged about 5.5 million shares traded daily and managed more than $19.13 billion in assets under management (AUM).

How to buy

How to buy Grayscale Bitcoin Trust ETF

Buying Grayscale Bitcoin Trust ETF involves the same steps as purchasing any other stock or ETF. Here's a step-by-step example with visual aids to guide you through the process.

Step 1: Open a brokerage account

First, you'll need a brokerage account. Many options are available, but for the purpose of this example, we'll use Interactive Brokers. It's important to choose a brokerage that suits your investment style and needs, whether you prioritize low fees, extensive research tools, or customer service.

Step 2: Figure out your budget

Before investing in Grayscale Bitcoin Trust ETF, decide how much you are willing to commit. Remember, this ETF, like Bitcoin itself, is highly volatile and carries a significant risk of loss. Consider how much of your total investment portfolio you are comfortable allocating to the Grayscale Bitcoin ETF, both in terms of dollars and as a percentage of your overall investments.

Step 3: Do your research

The Grayscale Bitcoin Trust ETF is just one of several Bitcoin ETFs available on the market. Before making a purchase, it's wise to research the fund and compare it to its competitors. Look at factors like expense ratios, the size of the fund, liquidity, and the exact nature of the exposure to Bitcoin each fund offers.

Expense Ratio

Step 4: Place an order

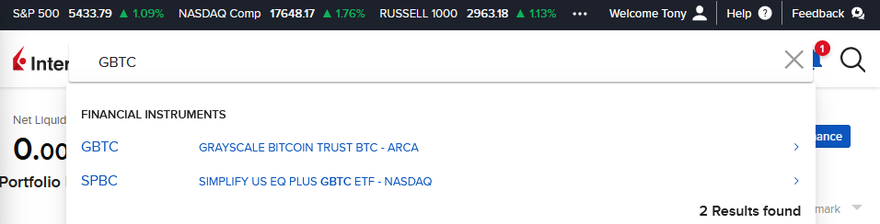

Once you've decided to buy Grayscale Bitcoin Trust ETF, you need to place an order through your brokerage account. Start by entering its stock ticker in the search bar and then clicking it.

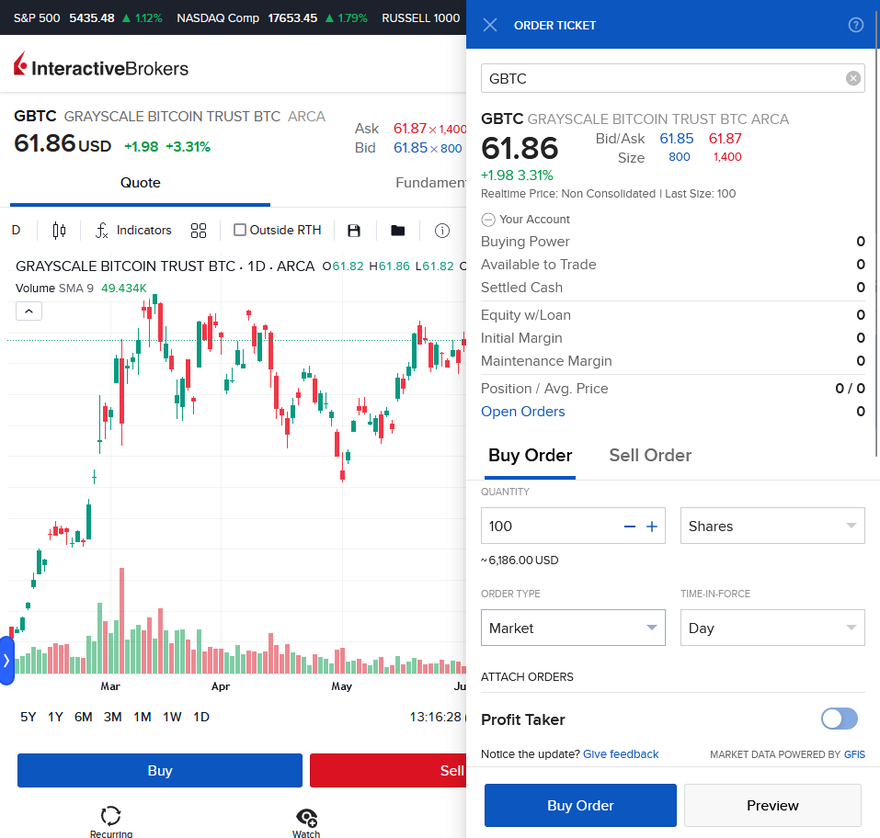

Then, click the Buy button, which will bring up the order pop-out screen. Here, you can specify how many shares you wish to purchase and the type or order you wish to use.

If you select a market order, your order will be executed at the current market price, which means you buy the shares at the best available price at the time of the order. However, if you have a specific price in mind, choose a limit order and specify the price you're willing to pay. With a limit order, your order will only be executed if the stock's price reaches or falls below your specified price.

Once you are satisfied, click the Buy Order button at the bottom to execute your purchase. If successful, your account will be debited the cash cost and now have the Grayscale Bitcoin Trust ETF shares.

Holdings

Holdings of Grayscale Bitcoin Trust ETF

The Grayscale Bitcoin Trust ETF is classified as a spot Bitcoin ETF, meaning its primary holdings are actual Bitcoin rather than just futures based on Bitcoin's price. These Bitcoins are securely stored with Coinbase Custody Trust Company, LLC, which acts as the custodian for the assets.

As of June 2024, the Grayscale Bitcoin Trust ETF's total holdings amounted to 283,965.9955 Bitcoins. This substantial cache of Bitcoin translates to approximately 0.00088870 Bitcoins per individual share of the ETF. Investors who buy shares of Grayscale Bitcoin ETF are essentially buying a proportional slice of this pooled Bitcoin.

Should I invest?

Should I invest in Grayscale Bitcoin Trust ETF?

Deciding whether to invest in Grayscale Bitcoin Trust ETF is a personal decision that hinges on your financial goals and tolerance for risk. If your primary objective is to gain exposure to Bitcoin through a traditional brokerage account, trading the Grayscale Bitcoin ETF can be an excellent choice.

It offers the convenience of trading just like any other stock, bypassing the complexities and technical challenges associated with buying Bitcoin directly through a cryptocurrency exchange and managing your own digital wallets. This makes Grayscale Bitcoin ETF particularly appealing to investors familiar with the stock market but new to cryptocurrencies.

Additionally, if you are comfortable with long-term ETF investments and are looking for aggressive but risky growth potential, the Grayscale Bitcoin Trust ETF could be a suitable option. Although it is true that this ETF, like Bitcoin itself, is highly volatile and can experience significant price fluctuations, it has also seen periods of substantial returns.

Dividends

Does Grayscale Bitcoin Trust ETF pay a dividend?

The Grayscale Bitcoin Trust ETF does not pay a dividend because its underlying asset, Bitcoin, does not generate yield. Bitcoin is a digital currency and does not offer dividends or interest payments like traditional income-generating investments, such as stocks or bonds.

The Grayscale Bitcoin ETF might not be the right choice for investors whose primary goal is to generate income from their investments. A dividend ETF may be more suitable.

Expense ratio

What is Grayscale Bitcoin Trust ETF's expense ratio?

The Grayscale Bitcoin Trust ETF charges a 1.5% expense ratio. This expense ratio represents the annualized percentage deducted from your total investment to cover the ETF's operational fees and expenses. For instance, if you invested $10,000 in Grayscale Bitcoin ETF, you could expect to pay about $150 per year in fees.

You don't pay this fee directly out-of-pocket; instead, it is deducted from the returns of the ETF on an ongoing basis. This means the net value of your investment reflects all fees paid, making it crucial to consider the effect of the fees on your investment returns over the long term.

It's important to note that higher expense ratios can be undesirable because they compound and can significantly eat into your total returns. The Grayscale Bitcoin Trust ETF expense ratio is on the higher side. This is somewhat typical for funds that offer specialized exposure to investments, such as cryptocurrencies.

Historical record

Historical performance of Grayscale Bitcoin Trust ETF

Grayscale Bitcoin Trust ETF debuted on Jan. 11, 2024, so it does not have a long enough track record to evaluate its historical performance. A practical approach would be to look at the historical performance data of Bitcoin itself. Since the Grayscale Bitcoin ETF holds Bitcoin, the ETF's performance is closely tied to that of Bitcoin.

| 1-Year | 3-Year | 5-Year | 10-Year |

|---|---|---|---|

| 149.12% | 22.37% | 51.38% | 60.29% |

Related investing topics

The bottom line on Grayscale Bitcoin Trust ETF

The Grayscale Bitcoin ETF provides a straightforward, traditional way for investors to gain exposure to Bitcoin without the complexity of direct cryptocurrency management. It mimics the price movements of Bitcoin by directly holding the digital asset, making it a suitable option for those looking to incorporate cryptocurrency into their investment portfolio via a familiar stock exchange platform.

Keep in mind, however, that Grayscale Bitcoin Trust ETF charges a fairly high expense ratio, and the potential for high returns comes with greater risk. Treat it as a high-volatility sector ETF.

FAQ

Investing in Grayscale Bitcoin Trust ETF FAQ

Is Grayscale Bitcoin Trust an ETF?

Yes, as of Jan. 11, 2024, Grayscale Bitcoin Trust ETF is an ETF. Before then, it was a closed-end fund (CEF).

How to buy Grayscale Bitcoin ETF?

You can buy shares of Grayscale Bitcoin Trust ETF through most brokerage accounts by placing an order, just as you would with any other stock or ETF.

Can anyone buy Grayscale Bitcoin Trust?

Grayscale Bitcoin Trust ETF is available to most U.S. retail investors, although accessibility may vary depending on the specific policies and restrictions of your brokerage firm.