Checks are used to pay other people, pay employees, and pay for purchases and services. There are a number of circumstances that require a checkbook.

Writing a check isn't complicated, but it's an often-overlooked life skill. Use our step-by-step guide to learn how to write a check.

How to write a check in six steps

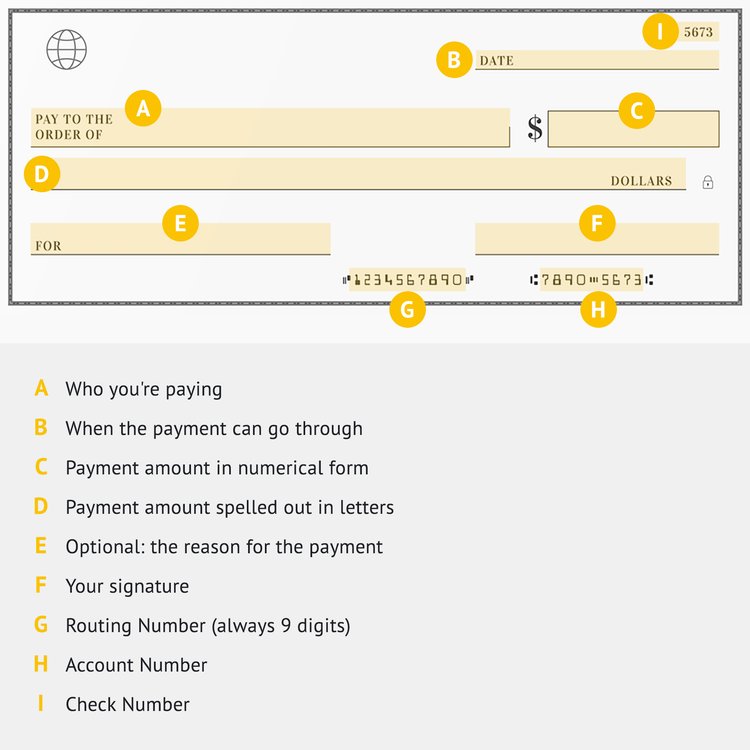

Here are the six steps involved when writing a check:

1. Fill out the date

The upper right-hand corner of the check is where you'll add the date.

2. Add a payee

Checks include a line that says, "Pay to the order of." This is where you'll add the name of the person, company, or organization you are paying.

3. Write the numerical check amount

Add the payment amount in the box to the right of the payee line. You'll end up writing the payment amount twice. In this instance, write the amount numerically ("$100," not "One Hundred Dollars").

It's good practice to write the amount as close to the left-hand border of the box as possible. This can help prevent someone from adding additional numbers to the amount.

4. Write out the check amount in words

Under the payee line is a spot to write out the check amount using words. If the check amount is $152.86, you'll write it out as: "One-hundred fifty-two dollars and 86/100." Take time to make sure that both check amounts match up.

5. Add a note

Any details you want to add to your check go on the line marked "Memo." Some payees require you to list specific information on the memo line like a checking account number or Social Security number.

You can also make a personal note, like "Rent payment." If your checkbook keeps carbon copies of each check, having a note in the memo line can help you remember what the check was for.

6. Sign the check

No check is complete and valid without a signature. When you fill out a check, your signature goes on the line in the bottom right corner of the check.

Where is the routing number on a check?

The routing number is the first number printed on the bottom-left side of a check. Every bank has its own nine-digit routing number. Routing numbers are sometimes referred to as a routing transit number or an ABA routing number.

Where is the account number on a check?

Your bank account number is also featured on your checks. It's the second set of numbers on the bottom of a check following the routing number. Account numbers are typically 10 to 12 digits.

Compare checking accounts

We recommend comparing checking accounts to make sure you're getting the best fit for you. Here's a list of our favorite accounts.

FAQs

-

A check is a financial document that allows the check holder to receive money from the check writer's bank account. A check must be signed by the check writer to be valid.

-

You write a check by filling out the date, the person or organization you are paying, and the check amount (numerically and written out in words). Your check is valid once you add your signature. You can also add reminder notes or account information in the check's memo section.

-

Always include cents when you write a check. Write the cents after the dollar amount and decimal point. When writing out the check amount, start with the dollar amount, followed by the word "and." Then write out the number of cents as a fraction. For example, 35 cents is written as 35/100. If you are writing a check for $100, you would write the cents as 00/100.

-

A check for one thousand dollars would be written numerically as $1,000.00. In words, it would be written as: "One thousand dollars and 00/100."

-

The routing number is the nine-digit number listed on the bottom-left side of a check. It's the first number listed on the bottom of a check and comes before the account number.

-

Your bank account number is the second set of numbers printed on the bottom of a check following the routing number. Most account numbers are 10 to 12 digits long.

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.