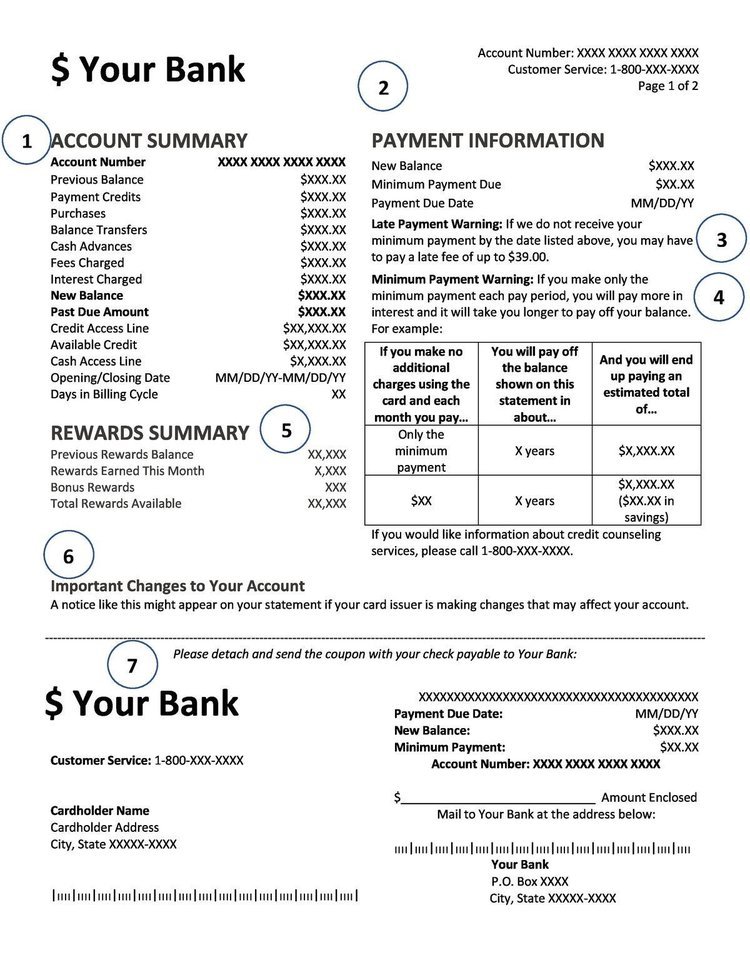

4. Minimum payment warning

The minimum payment warning usually includes a table to help you understand how long it will take to pay back your balance if you only make the minimum payment. Often, that period is several years -- and that's if you don't charge any more to your card in the meantime.

It may also include a comparison section showing how much more quickly you could pay off your balance if you paid more than the minimum. Some credit card statements also include a phone number you can call for credit counseling if you're struggling with your credit card debt.

5. Rewards summary

Your credit card statement should have a rewards summary if you earn credit card rewards. This section contains the following information:

- Previous rewards balance: This was your rewards balance prior to this billing cycle.

- Rewards earned this month: This tells you how many rewards you earned during this billing cycle.

- Bonus rewards: If your card offers bonus rewards in certain categories, your statement may call out how many rewards you earned in these categories.

- Total rewards available: This tells you how many rewards you have available to use right now.

Visit your online credit card account or contact the card issuer by phone to see how much those rewards are worth and what you can spend them on.

6. Important changes to your account

This section highlights any significant changes your card issuer plans to make to your account in the near future. These might be changes that specifically apply to you, like triggering a penalty APR because you've made a number of late payments. Or it could be things that apply to all cardholders, like a change to the card's APR.

Your credit card statement should tell you which of your transactions these changes will affect and when they'll go into effect. If you have any questions, contact your card issuer for more information.

7. Payment coupon

If you pay your credit card bill by mail, you must cut off this payment coupon (usually found on the bottom of the first page of your credit card statement) and send it in with your check. There should be a spot on the coupon for you to write the amount of the payment you're making. This helps speed up the payment process and ensures your card issuer applies your payment to the correct account.

If you pay your credit card bill online or have the money automatically debited from your bank account, you don't have to do anything with the payment coupon.

8. Account activity

The account activity section of your credit card statement lists all the transactions you made during the current billing cycle, including the date of the transaction, the merchant's name, and the dollar amount. Some credit card issuers also attach a reference number to each purchase. That way, if you have a question about a transaction that's showing up on your statement or you suspect you may be a victim of identity theft, you can quickly tell the card issuer which purchase you're referring to.

If you carry a balance from one month to the next, you did a balance transfer, or you took a cash advance, you'll find a more detailed breakdown of the fees and interest you incurred in this section.

9. Fees and total interest to date

Your credit card statement may include a brief table summarizing how much you've paid in interest and credit card fees for the year to date. Let this serve as motivation for you if you're trying to pay off credit card debt.

10. Interest charges

The interest charges section gives you a more detailed explanation as to how your credit card issuer calculates the interest you owe. It may have separate sections for purchases, balance transfers, and cash advances if they all have different APRs. You'll also find information about a promotional APR here, if your account has one, including expiration dates.

You might see symbols like (v) or (d) after the interest charges section. These are a sort of mini glossary. Some of the most common terms and symbols you might see include:

- Promotional APR: This is a lower APR than the standard APR and it only lasts for a certain number of months after you open your account. It may apply to purchases, balance transfers, cash advances, or all of these.

- (v): This stands for "variable." It means your card's interest rate is tied to the prime rate or a similar benchmark that may change over time. If it does change, your interest rate may increase or decrease accordingly. The card issuer does not need to notify you of these changes in the Account Changes section because this relationship is spelled out in your cardholder agreement.

- (d): This means your card issuer uses the daily balance method to calculate your interest charges. This method totals up your actual daily balance on every day of your billing cycle and multiplies this by the daily rate, which is 1/365 of your APR.

- (a): This means your card issuer uses the average daily balance method to calculate your interest charges. This is where it takes the average balance on each day of your billing cycle, adds them up, and multiplies them by the daily rate.

What if you find an error on your credit card statement?

If you find a charge you believe is inaccurate, try disputing it with the merchant first. Otherwise, you'll need to notify your credit card in writing within 60 days of the date the charge appeared on your billing statement. The credit card company will have 30 days to respond.

Your letter should include the following information:

- Your name and account number

- Type of charge

- Dollar amount of the disputed charge

- Date of the disputed charge

- A statement that explains why you believe the charge was made in error

While the charge is pending, you won't need to pay the disputed amount or any associated interest or fees. You will, however, be responsible for paying the undisputed balance as usual.

Still have questions?

Here are some other questions we've answered: