How do I calculate my mortgage payment?

There are a few different things that we think of when we say "mortgage payment." Your most basic form of mortgage payment is just the principal and interest charges, often known simply as "PI" or "P+I." This is the base mortgage payment everyone has.

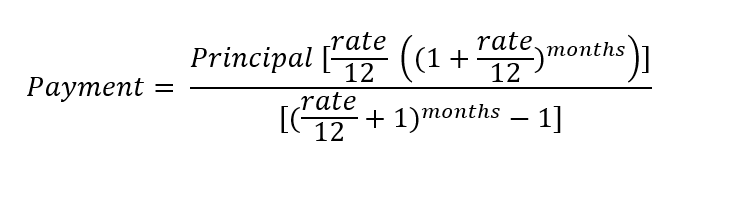

Although the allocations of interest and principal change every month, the payment remains the same throughout the life of the loan if your interest rate is fixed. Your payment is based on three simple factors: how much you borrow, at what rate you borrow it, and for how long you need to pay it back.

Most people don't try to calculate their mortgage payment by hand, since it can be a pretty complicated process, and instead use a handy mortgage calculator like this one. But, if you're financially curious, the formula looks like this:

'%3E%3CanimateTransform attributeName='transform' type='rotate' repeatCount='indefinite' dur='2s' values='0 364 104;360 364 104' keyTimes='0;1'/%3E%3C/circle%3E%3C/svg%3E)

The payment that's on your monthly mortgage statement, however, is more than just your base payment. It often also includes real estate taxes, and homeowners insurance, which is why this payment plus escrow is commonly called PITI.

In addition, in some cases extra fees like homeowners association (HOA) assessments are also included in the mortgage payment, as well as extra insurance for related natural disasters. If you have a down payment of less than 20% of the home's purchase price (like most Americans), you will likely also have to pay for mortgage insurance, such as private mortgage insurance (PMI) on a conventional loan. If you get an FHA loan, it'll be mortgage insurance premium (MIP).

To calculate your new mortgage with these additional expenses included, just click "show additional inputs" on the mortgage calculator above and add your estimated figures. It will get you a very close estimate of what to expect.

Things to know before buying a house in Illinois

Illinois has real estate that's very well priced, but it makes up for that, in part, with very high property taxes. At 1.73% of a property's assessed fair market value, Illinois is the 6th most expensive state for real estate tax. If your home there is assessed at $202,200, you'll pay a whopping $3,507 per year in taxes.

Fortunately, Illinois is really far from the ocean, so rising sea levels from climate change are not a concern, but increasingly heavy precipitation is. Rainfall during the four wettest days of the year has increased by 35%, leading to serious flooding along waterways in both spring and summer. Climate change is also leading to more hot days, which can cause droughts throughout the summer, and increase the need for air conditioning. The state is also prone to tornadoes, logging an average of 27 per year.

If your new home is anywhere near a waterway, even a small creek or stream, it could pay to get extra coverage like flood insurance. Ask your insurance agent when you're pricing your homeowners insurance what's appropriate, even if it's not required. You can also plug that number into the Illinois mortgage calculator to help give you a better estimate of your overall payment.

Tips for first-time home buyers in Illinois

The Illinois Housing Development Authority offers three different down payment assistance programs: IHDAccess Forgivable Mortgage, IHDAccess Deferred Mortgage, and IHDAccess Repayable Mortgage. For each of these programs, the borrower must qualify on income and credit, based on the underwriting guidelines that are current when they apply.

Home buyer education is required, as well as a small contribution from your own funds. You will need to provide 1% of the home's purchase price or $1,000, whatever is greater.

IHDAccess Forgivable Mortgage

The IHDAccess Forgivable Mortgage is a silent second mortgage that can be used toward an Illinois home buyer's down payment and closing costs. Borrowers can receive up to 4% of their home's purchase price, not to exceed $6,000.

This silent second doesn't require a payment, and is forgiven over time. The entire balance will be forgiven if you stay in your home for 10 years and don't refinance during that period.

IHDAccess Deferred Mortgage

Much like the Forgivable Mortgage, the IHDAccess Deferred Mortgage offers a silent second mortgage to help a buyer with their down payment and closing costs. This assistance program, however, requires repayment when the borrower either refinances the home or sells it. If the home is never sold, a balloon payment of the full amount borrowed will be due at the end of 30 years.

IHDAccess Deferred Mortgage provides up to 5% of the home's purchase price, or $7,500, to qualified borrowers and is loaned at zero interest, ensuring that it doesn't grow over time.

IHDAccess Repayable Mortgage

The IHDAccess Repayable Mortgage is similar in spirit to the others, except that it offers 10% of a home's purchase price, up to $10,000, for down payments and closing costs. The term is also significantly different. Instead of 30 years, you only have 10 years to repay this loan, and you must repay it monthly. Fortunately, the interest rate is 0%, so it won't cost you any more than the original $10,000.

Advice for all first-time borrowers

Along with the specific home buyer assistance programs in Illinois, you should apply for other loans with appealing terms for first timers, like FHA loans or conventional loans. Both have low down payment requirements, making them easier to secure, and can be used on a vast array of homes.

In order to qualify for any mortgage, you'll want to work hard to make yourself into the best candidate. Here are a few tips:

- Boost your credit score with on-time payments and low credit card utilization

- Pay off debt to improve your debt-to-income ratio

- Secure a steady job (or don't leave your current job)

- Save for both closing costs and your down payment

In addition, guard your credit carefully by not opening any new accounts or applying for credit too soon before your loan application. Each time you apply or open a new credit account, your credit will take a little hit. Inquiries take two years to fall off your credit report, so plan accordingly.