Minnesota housing market

The housing market in Minnesota has jumped by just 0.8% year over year, as of July 2023, with the average median single family home sales price coming in at $364,700. During the same period, the number of homes sold fell by 18.5% and the number of homes for sale fell 10.1%. The median sales price of a Minnesota home in July 2023 was about $63,000 more than it was three years prior, when homes of any type were at a median of $284,800.

This staggering growth in home values is likely due to an ongoing housing shortage that has been going on since the beginning of the pandemic. In July 2023, there were just two months' worth of supply for home buyers to choose from, which did not change at all year over year. This is almost certainly why homes for sale in Minnesota are still bringing, on average, 101% above listing price.

If you're ready to buy a home in this competitive market, check out our list of best rated mortgage lenders before taking the plunge. Getting several quotes for home mortgages can help you make the most out of your purchasing dollars.

How do I calculate my mortgage payment?

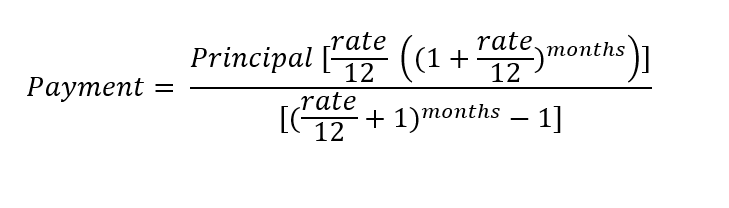

To calculate your monthly mortgage payment, we recommend using our Minnesota mortgage calculator. The formula to calculate it manually is very complex. Here is the equation:

'%3E%3CanimateTransform attributeName='transform' type='rotate' repeatCount='indefinite' dur='2s' values='0 364 104;360 364 104' keyTimes='0;1'/%3E%3C/circle%3E%3C/svg%3E)

To calculate your monthly mortgage payments in Minnesota, first enter your estimated mortgage loan amount, next the term of your loan, and then the interest rate you think you'll qualify for. Keep in mind the higher your credit score, the more likely you'll be to get the most competitive rate available. The term of your loan is the number of years you have to repay your mortgage. The most common terms are 30-year and 15-year mortgages.

In addition to the mortgage's principal and interest, you will need to add monthly insurance costs, taxes, and other fees. Property taxes and origination fees are sometimes rolled into the loan. Our Minnesota mortgage calculator also allows you to add taxes and insurance to your monthly payment.

The mortgage calculator for Minnesota also has an option to enter your down payment amount. The more you put down, the less you will need to borrow and the lower your monthly mortgage payments will be.

What other costs do I have to pay?

There are other monthly expenses you'll need to account for, like homeowners insurance and property taxes. When you use our mortgage calculator for Minnesota, remember that property taxes paid as a percentage of owner-occupied homes are on average 1.05%, the 19th highest in the country. Property taxes may change based on your county.

Homeowners may also be part of a homeowners association (HOA) and have to pay a monthly HOA fee in addition to their mortgage payment. HOA fees usually cover the maintenance of common areas, and often include services like trash pickup. To enter these additional costs into the above mortgage calculator for Minnesota, just click "Additional inputs" (below "Mortgage type").

You may also need to account for private mortgage insurance (PMI). Homeowners will have to pay PMI if they don't make at least a 20% down payment on their home. With all these different costs, it is helpful to use our Minnesota home loan calculator. Our Minnesota mortgage calculator will help break down your costs so you can see what your monthly mortgage payments will look like in different scenarios.

For those looking to refinance an existing mortgage, our Minnesota mortgage calculator can also help you determine your monthly payment -- and you can check out our list of the best refinance lenders to get that process started.

Things to know before buying a house in Minnesota

Before you buy a home in Minnesota, it's important to make sure you have your finances in order. Here are the factors financial institutions take into account:

Minnesota has a diverse geography. About a third of the state is covered in forests and the "Land of 10,000 Lakes" is known for having almost 12,000 bodies of freshwater that are at least 10 acres. Minnesota borders Lake Superior and is part of North America's Great Lakes Region. The North Star State is known for its outdoor activities, beautiful landscapes, historical sites, and attractions, and is home to many Fortune 500 companies.

More than half of those living in Minnesota live in the Minneapolis-Saint Paul metropolitan area. Also known as the "Twin Cities," the typical home value in Minneapolis during the first quarter of 2023 was $361,500. Due to Minnesota's geography, some of the Gopher State's most common natural disasters include floods, severe storms, tornadoes, wildfires, and winter storms.

Minnesota also averages about 110 days a year with at least one inch of snow, and snow in every month of the year except July. If you like the snow, then Minnesota may be the right place for you! It is important to be informed of the impact severe weather can have on the area you are interested in.

Learn more: Home buyer checklist

Tips for first-time home buyers in Minnesota

Here are some important tips for first-time home buyers in Minnesota. There are several programs available for first-time home buyers through Minnesota Housing, the state's housing finance agency.

Minnesota Housing offers several programs to provide access to safe, decent, and affordable housing, and to build stronger communities across the state. In 2022, Minnesota Housing distributed $2.18 billion in resources and served 109,080 households.

Here are the different programs Minnesota offers:

Minnesota Housing - Start Up

Start Up is a Minnesota mortgage program for eligible first-time home buyers, available through participating lenders. Start Up offers:

- Affordable interest rates

- Down payment and closing cost assistance loan options for eligible borrowers

- Income limits up to $142,800

- Acquisition cost must fall under certain limits based on where you live

Minnesota Housing - Step Up

Step Up is a Minnesota statewide program for repeat home buyers or current homeowners to purchase or refinance a home. Step Up offers:

- Affordable interest rates

- Down payment and closing cost assistance loan for eligible borrowers

- Income limits up to $185,700

- Purchase price/refinance loan amount must fall under certain limits

Minnesota Housing - Monthly Payment Loan

This Minnesota program is designed to help home buyers afford the costs of purchasing a home. This program is available with Start or Step Up and borrowers can receive monthly payment loans up to $18,000, to be put toward closing costs and the down payment. The loans are fully amortized over 10 years and additional eligibility requirements apply.

Minnesota Housing - Deferred Payment Loan

This loan is meant for first-time home buyers and is available with Start Up only. Borrowers can get up to $16,500 with Deferred Payment Loan or $18,000 with Deferred Payment Loan Plus. There are other benefits to this loan, however borrowers must fit certain criteria to qualify for the loan. Both of these are balloon loans, however, so be prepared to pay the balance when you sell, refinance, or pay off your primary mortgage.

First-time home buyer loans and programs

Here are other first-time home buyer programs to consider:

- FHA loans are mortgages back by the Federal Housing Authority and require a 3.5% down payment.

- VA loans are for military service members and require a 0% down payment.

- USDA loans are government-backed loans for eligible properties and require a 0% down payment.

- Fannie Mae and Freddie Mac are conventional loans that require a 3% down payment.

Decide on a home-buying budget

Once you have decided on the best program and have shopped around with different lenders, it is important to decide on a home-buying budget. Many experts recommend your monthly house payment (including additional costs) be no more than 30% of your monthly income. You should also have enough money saved for closing costs (e.g. attorney's fee, title insurance, taxes, etc.). Other fees such as loan fees, inspections, and processing costs are not usually covered by the loan.

Read more: Best mortgage lenders for first-time home buyers

Still have questions?

Here are some other questions we've answered: