How do I calculate my mortgage payment?

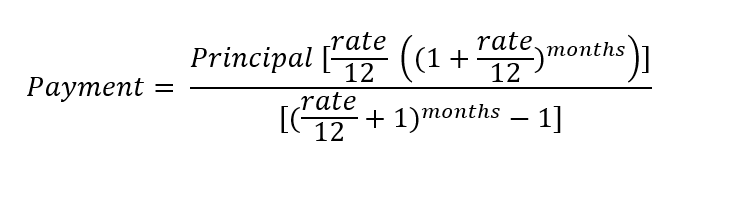

There's no real reason you should need to calculate your mortgage payment by hand, that's why we built this mortgage calculator. But if you want to see how the sausage is made, use this equation below:

'%3E%3CanimateTransform attributeName='transform' type='rotate' repeatCount='indefinite' dur='2s' values='0 364 104;360 364 104' keyTimes='0;1'/%3E%3C/circle%3E%3C/svg%3E)

A mortgage payment derived from this calculation will only yield the principal and interest payment. Although there was a time when that was enough, today's mortgage payments include a variety of other fees, depending on what's applicable to your home. Your may also wrap in costs like:

Besides mortgage insurance, which is a fee your bank will pay directly each month, these other fees are 1/12 of the total bill, and are paid into an escrow account to be held until the bill comes due. For example, your homeowners insurance will be split into 12 equal payments that you give the bank each month as part of your home's payment. Each of those is deposited into your escrow account, and when the bill is due, the bank will pay it using your escrow funds.

To calculate your new mortgage with these additional expenses included, just click "show additional inputs" on the mortgage calculator above and add your estimated figures. It will get you a very close estimate of what to expect.

Things to know before buying a house in New York

New York homes can be very expensive or very inexpensive, depending on where you live in the state, as values are widely spread, but you can count on fairly high taxes no matter how much you pay. New Yorkers pay an average of 1.23% of their home's assessed fair market value in taxes, meaning that if your home is assessed at $306,000, you'll pay $3,755 per year in taxes.

New York has seen some very extreme warming due to climate change, with areas of the state increasing by as much as 3 degrees Fahrenheit in the last century. This is not only increasing the intensity of flooding and drought, it's adding intensity to coastal storms. As sea levels rise, New York is losing shoreline and more and more homes are becoming vulnerable to flooding from storm surge. All and all, it's not a great picture for coastal New York.

If you live in New York, especially coastal New York, you'll want to invest in insurance well beyond your homeowners insurance policy. Flood and wind insurance are both becoming increasingly necessary to protect your home, and you might as well have them in place before you need them. Ask your insurance agent for a quote, then plug that number into the New York mortgage calculator to help give you a better estimate of your overall payment.

Tips for first-time home buyers in New York

If you're a first-time home buyer in New York state, you're in luck: New York has many great down payment assistance programs for you. Depending on where your future home is located, you'll either be looking for one of these two programs:

SONYMA has two programs that apply to first-time home buyers, the Down Payment Assistance Loan and the DPAL Plus ATD Program. And HPD has the HomeFirst Down Payment Assistance Program that can be used in any of the five boroughs of New York City.

Down Payment Assistance Loan

The Down Payment Assistance Loan program through SONYMA is down payment and closing cost assistance available to homeowners. It's a forgivable loan for up to $15,000, based on your home's purchase price at 0% interest.

Keep in mind that:

- This mortgage is a second mortgage that is forgivable, but only if you remain in your home for the first 10 years of ownership.

- 1/120 of your loan will be forgiven each month.

- You will have to repay the remaining balance if you sell your home or refinance it prior to the end of your second mortgage forgiveness period.

- You must contribute 1% of your home's purchase price from your own funds.

DPAL Plus ATD Program

Some New Yorkers will qualify for the DPAL Plus ATD Program through SONYMA. This is another down payment assistance program, but limited based on income. It provides up to $30,000 for closing costs and down payment assistance. It has very similar structure to the Down Payment Assistance Loan above, with these additional caveats:

- You must have a maximum income limit of 60% of the area median income.

- Your home must be priced under the limit for your family size and area.

- You must use all your liquid assets toward the purchase first, minus $10,000.

- The DPAL Plus ATD Program can be used to pay down your home's mortgage up to an 80% loan to value, allowing you to only borrow 80% of your home's value and eliminating mortgage insurance.

HomeFirst Down Payment Assistance Program

The HomeFirst Down Payment Assistance Program is designed to help first-time home buyers in the five boroughs of New York City with incomes not to exceed 80% of the area median income. That loan looks like this:

- It provides up to $100,000 for down payment and closing costs assistance, not to exceed 20% of the home's purchase price.

- It's a silent second mortgage that is forgivable starting on the sixth anniversary of the loan's origination. If the loan is $40,000 or less, it will be forgiven by 20% per year; if it's more than $40,000, at a rate of 10% per year. Ultimately, the smaller loans are forgiven in 10 years total and the larger ones in 15 years.

- Buyers must occupy the home for the length of their second mortgage.

- Buyers must provide 3% of their own money as a down payment

- Buyers must attend a home buyer education course.

Advice for all first-time borrowers

No matter if you're buying a small apartment in a co-op or choosing a sprawling rancher upstate, understanding the factors that impact your mortgage loan can help you better prepare for it. Although everyone will tell you your credit is the most important thing, it's not everything, and you'll also need to be a good candidate by:

- Maintaining steady employment for at least two years with the same employer or in the same field.

- Having consistent income that is documented and that you pay taxes on.

- Keeping low or no balances on your credit cards, so your debt-to-income ratio is low.

- Paying all your debts on time to avoid surprise collection accounts.

- Seasoning your down payment funds in a bank account so they can be verified by your lender.

In addition, you may want or need to establish an account for home-related expenses. Sometimes the bank will want to see that you can cover anywhere from two to six months of house payments, including your escrow, depending on your specific circumstances. If this is the case, establish a separate account for this money so it doesn't get tied up with your other savings.

And remember, your underwriter will check your credit and loan profile again just prior to closing to ensure that nothing has changed fundamentally about you or your financial picture. This means that you have to resist opening new credit accounts, making large purchases on existing accounts, or changing jobs before closing day. These are just a few reasons that underwriters can ultimately reject your loan approval in the 11th hour.