How do I calculate my mortgage payment?

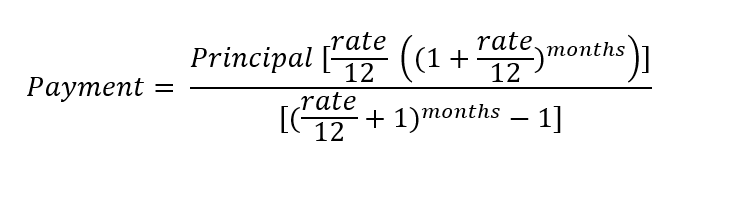

Figuring your own mortgage payment can be a headache if math isn't your strong suit, but that's why we have this mortgage calculator, to make your work a little easier. If you want to do the calculating yourself, the formula is below:

'%3E%3CanimateTransform attributeName='transform' type='rotate' repeatCount='indefinite' dur='2s' values='0 364 104;360 364 104' keyTimes='0;1'/%3E%3C/circle%3E%3C/svg%3E)

Modern mortgage payments generally include much more than just principal and interest, but this is where the math starts. Once you have that base payment, sometimes called your P+I payment, you'll be able to get price quotes for your homeowners insurance and use last year's taxes to help estimate your PITI. PITI is the payment that includes principal, interest, taxes, and insurance.

Your lender may include other expenses, too, depending on what applies to your home and how much your down payment is. The mortgage payment that shows on your coupon may also include expenses like:

To calculate your new mortgage with these additional expenses included, just click "show additional inputs" on the mortgage calculator above and add your estimated figures. It will get you a very close estimate of what monthly payment to expect.

Things to know before buying a house in North Dakota

North Dakota real estate is really affordable, but before you dive in, take a look at the state's average property tax rate. It's 10th out of the country, at 1.42% of the assessed fair market value of a home. That means that if your home's value is assessed at $116,800, you'll pay $1,658 on average to the tax authority each year.

The state is seeing intense effects from climate change, including an increase for most of the state by about two degrees Fahrenheit. More heavy storms are expected due to the higher temperatures, which can increase the amount of rain in each downpour, as well as increase the risk of flooding for homes even remotely close to water sources like rivers or lakes.

Due to increasing risk of flooding, you're going to be smart to have more than just a basic homeowners insurance policy in place, since much of North Dakota is quite flat, allowing high waters to travel far from their source. Buying flood insurance is much cheaper than trying to self-fund flood recovery, so talk to your agent for the best policies for your future home. Once you have the details, you can also plug that number into the North Dakota mortgage calculator to help give you a better estimate of your overall payment.

Tips for first-time home buyers in North Dakota

North Dakota has two assistance programs for first-time home buyers, available through the North Dakota Housing Finance Agency.

DCA

The DCA program provides closing cost assistance to low-income home buyers up to 3% of their mortgage amount in the form of a credit that can be used toward their down payment, closing costs, and prepaid items. Borrowers must meet income guidelines based on their county and family size, with the highest incomes for a family of four to not exceed $88,650.

Recipients must complete a home buyer education course prior to closing, must occupy the property, and have to contribute $500 to their own closing out of pocket.

Start

Similar to DCA, Start provides 3% of a home's mortgage in assistance to qualified borrowers, but will allow higher income caps. Borrowers also are not required to attend a home buyer education course, though they must occupy the home the funds are used with, and must contribute at least $500 of their own money to their home's closing.

Advice for all first-time borrowers

Even if you don't qualify for assistance through North Dakota, you may find a great deal on a mortgage through the USDA, depending on where you want to live in the state. VA programs also offer a zero down option if you're a veteran.

No matter what program you choose or where you live, there are a few qualities that will make you look like a much stronger borrower, including maintaining steady employment for at least two years, keeping your down payment money in a savings account that's separate from your other funds to make it easy to verify, paying your bills on time, and carrying as little debt as possible to lower your debt-to-income ratio.

You may be surprised to learn that you don't need stellar credit to secure a home loan, but good credit is still important. Having savings is too, since there are a lot more expenses with owning a home than simply coming up with closing costs one time.