How do I calculate my mortgage payment?

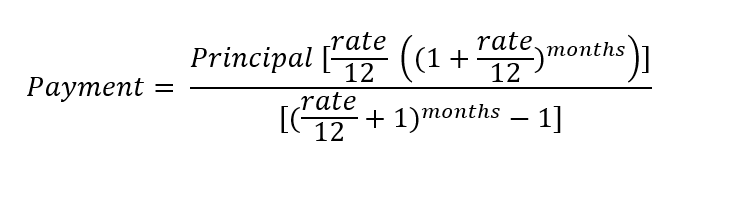

Most people choose to use a mortgage calculator like this one to calculate their payment. But, if you're financially curious, the formula looks like this:

'%3E%3CanimateTransform attributeName='transform' type='rotate' repeatCount='indefinite' dur='2s' values='0 364 104;360 364 104' keyTimes='0;1'/%3E%3C/circle%3E%3C/svg%3E)

Mortgage payments typically include principal, interest, real estate taxes, and homeowners insurance, commonly referred to collectively as PITI. Sometimes, extra fees like homeowners association dues are also included in the mortgage payment, as well as extra insurance for related natural disasters, like wildfires.

For many first-time home buyers, and other borrowers with less than a 20% down payment, mortgage insurance will also be part of your mortgage payment -- at least for a while. If you had a conventional loan, you'll pay for PMI (private mortgage insurance). If you buy a home with an FHA loan, it'll come with MIP (mortgage insurance premium).

To calculate your new mortgage with these additional expenses included, just click "show additional inputs" on the mortgage calculator above and add your estimated figures. It will get you a very close estimate of what to expect.

Things to know before buying a house in Wyoming

Wyoming has very reasonable real estate prices, and real estate taxes to match. It's ranked 41st in the nation for taxes as a percentage of property value, at 0.58%. That means that if your home is assessed at $184,000, you'll only pay $1,058 per year in taxes.

Sadly, Wyoming is one of the states that is experiencing the most increase in temperatures due to climate change. This is having serious effects that are changing Wyoming forever. For example, the snow pack that residents of the state rely upon for long-term melt is declining and retreating, leading to more droughts and increasing the chance of wildfires.

A basic homeowners insurance policy might be sufficient for many parts of Wyoming, but as the state heats up, investing in wildfire insurance won't hurt. Even if you're not at risk of wildfires today, the rapidly changing climate of the state makes tomorrow unpredictable. Ask your insurance agent what insurance is appropriate, even if it's not required. You can also plug that number into the Wyoming mortgage calculator to help give you a better estimate of your overall payment.

Tips for first-time home buyers in Wyoming

The Wyoming Community Development Authority offers two down payment assistance programs to help first-time home buyers get into their first home. These products are very similar, with just a few key differences.

Home$tretch DPA

The Home$tretch Down Payment Assistance program is a 0% second mortgage that requires no payments until your home is sold, you refinance, or you pay off your original mortgage. It has a $15,000 cap and requires a buyer to provide $1,500 of their own money, which can be a gift.

Amortizing DPA

The Amortizing Down Payment Assistance program is very similar, but instead of being a 0% loan with no payments, it's a regular second mortgage with a 10-year term and a competitive interest rate. You'll pay this assistance off over the first 10 years of your ownership. The balance is due if you sell your home or refinance it before the 10 years are up. It's also for up to $15,000 and requires a $1,500 contribution, even if it's a gift.

Advice for all first-time borrowers

Whether you qualify for a home mortgage purchase program in Wyoming or not, you can still apply for other loans with appealing terms for first-timers. USDA has low down payment programs that will be useful for buyers in much of the state, provided they can meet the income qualifications. There are also other low down payment loans, like FHA loans or conventional loans.

But before you apply to any or all of these programs, focus on these moves to become a solid mortgage borrower:

- Maintain steady employment. Lenders want you to be on the job for at least two years with no gaps.

- Keep a reliable payment history. Pay all your bills on time, as that's proof you can pay your mortgage, too.

- Have low outstanding debt. The lower your debt, the better. This also lowers your debt-to-income ratio, which makes you look like a responsible borrower.

- Season your closing funds. Having your closing and down payment funds in a separate account allows your bank to verify their source and keep a paper trail.

Once you've applied for your loan and received your pre-approval, do all you can to maintain these four items at the same or better level as when you applied. Underwriters check them more than once during the lending process, and if there is a significant change, it can cause your loan approval to be canceled.