How Are Partnerships Taxed?

By default, a business with two or more owners is called a partnership. Like a sole proprietorship, partnerships are not legal entities and don’t require a state filing to get started.

Most partnerships form through agreements that outline how the partners will split profits and liabilities. You can further formalize a partnership by becoming a limited liability partnership (LLP), which turns your business into a legal entity that shields owners’ personal assets from business debts.

Partnerships are pass-through entities, where partners report and pay income taxes based on their portion of partnership income. For example, if you and I run a partnership where we split profits evenly, I’d be responsible for paying tax on half of the business’s income through our personal tax returns.

Unlike C corporations, partnerships don’t pay an entity-level tax. Though partnerships pay no business income taxes, they file information return Form 1065 each year to relay income and deductions information to the IRS.

Partnership taxation isn’t reserved for partnerships. Limited liability companies (LLCs) may elect partnership taxation, among other options.

How to file partnership taxes

Follow these four steps to file your partnership taxes.

Business Credit Card Comparison

Consider these business credit cards that offer a convenient and efficient way to separate personal and business expenses, simplifying accounting and tax reporting.

Additionally, business cards can provide valuable perks such as rewards points, cashback, and expense tracking tools, enhancing financial management and the potential to help save money in the long run.

| Offer | Our Rating | Welcome Offer | Rewards Program | APR |

|---|---|---|---|---|

Ink Business Unlimited® Credit Card

Apply Now for Ink Business Unlimited® Credit Card

On Chase's Secure Website. |

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Earn $750 bonus cash back Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. | Earn unlimited 1.5% cash back on every purchase Earn unlimited 1.5% cash back on every purchase made for your business |

Intro: 0% Intro APR on Purchases Purchases: 0% Intro APR on Purchases, 12 months Balance Transfers: N/A Regular: 18.49% - 24.49% Variable |

Ink Business Preferred® Credit Card

Apply Now for Ink Business Preferred® Credit Card

On Chase's Secure Website. |

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Earn 120,000 bonus points Earn 120,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. | Earn 3 points per $1 in select business categories Earn 3 points per $1 on the first $150,000 spent in combined purchases on travel, shipping purchases, Internet, cable and phone services, advertising purchases made with social media sites and search engines each account anniversary year. Earn 1 point per $1 on all other purchases-with no limit to the amount you can earn. |

Intro: N/A Purchases: N/A Balance Transfers: N/A Regular: 21.24%-26.24% Variable |

1. Draft annual financial statements

Before you embark on filing your business partnership taxes, prepare the three basic financial statements: balance sheet, income statement, and statement of cash flow. The information in these financial statements provides a basis for your tax software or tax professional to complete the filing.

Those who use accounting software should get through this step more quickly than those who keep their books by hand.

2. File partnership information return Form 1065

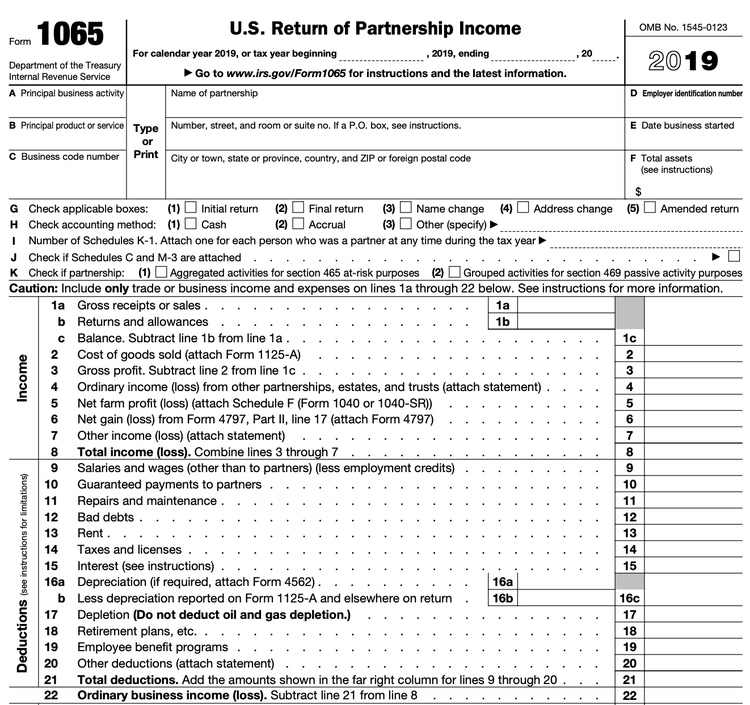

Partnerships report revenue and business tax deductions on Form 1065. Though partnerships don’t pay income tax at the company level, the IRS still wants to see what the business is up to. Form 1065 is called an “information return” because the IRS doesn’t expect an income tax payment attached to the filing.

Partnerships file information return Form 1065 to report business income, deductions, and credits. Image source: Author

Line 22 on Form 1065 shows a partnership’s ordinary income or loss. Partners split up and report their share of income or loss on their personal income tax returns. A partnership agreement delineates how profits and losses are shared among partners.

Form 1065 will prompt you to file a plethora of tax forms to report more specifically about business operations, from depreciation to the cost of goods sold. Tax software will walk you through it, but you’ll want to have your financial statements and accounting software open during the process.

3. Issue Schedules K-1 to each partner

A Schedule K-1 is like an employee’s Form W-2. Partnerships issue a Schedule K-1 to each partner to decree each partner’s share of business profits or losses. Partnerships report any taxable earnings a partner received during the year on a partner’s K-1.

The two sections you’ll spend the most time filling in are guaranteed payments (lines 4a through 4c) and the partner’s share of profits (line 1). We’ve talked a bit about the latter, so let’s dive deeper into the former.

A guaranteed payment is the closest thing to a salary for a partner. Guaranteed payments promise a partner a specific amount of compensation regardless of company performance.

Absent a guaranteed payment arrangement, a partner’s income relies solely on his or her share of business earnings, which leaves too much to chance in some companies. Guaranteed payments are taxed as ordinary income to the partner and are a deductible business expense to the partnership.

Most partnerships pay their partners through a mix of guaranteed payments and a share of business profits. Image source: Author

The K-1 not only provides information about a partner’s taxable income, but it also gives the IRS an update on the partner’s capital account, which is essentially the value of a partner’s stake in the business. A partner’s share of company debts is also listed on the K-1.

If you’re filling out Schedule K-1 without tax software, make sure you download the Schedule K-1 that corresponds to Form 1065. You don’t want to be halfway through the form and suddenly realize you downloaded Schedule K-1 for S corporation shareholders.

4. File your individual return

You’ve gotten to step four without paying income taxes on your partnership income. With the Schedule K-1 your partnership provided in hand, you’re ready to file your personal taxes.

Partnership income -- whether it came as a guaranteed payment or as a share of your business’s profits -- is taxed at your individual tax rate. Business partners also pay 15.3% of their earnings in self-employment taxes. File Schedule SE to calculate self-employment taxes.

Limited partners in a limited partnership (LP) -- which differs from an LLP -- don’t pay self-employment taxes on their share of partnership profits. If you don’t know whether this applies to you, it probably doesn’t.

FAQs

-

Partnership tax returns are due on the 15th day of the third month after the company’s year-end. Calendar-year partnerships, which are most common, must file Form 1065 by March 15.

Remember, partnerships don’t pay income tax; business profits are taxed on their owners’ personal returns, which are due on April 15. So you’re submitting your partnership return by March 15 and making a business tax payment by April 15.

You can file for an automatic six-month business tax extension if you need more time to prepare your business tax return. However, you’re still required to pay your taxes by April 15.

-

Partnerships of all flavors -- general partnerships, LPs, and LLPs -- enjoy partnership taxation.

LLCs with more than one owner are also automatically taxed as partnerships.

-

Check out The Ascent’s small business tax tips to save on your partnership taxes. There are deductions and tax credits made specifically for small business owners, so make sure you’re taking advantage.

Partner with tax software on your partnership taxes

Using self-employment tax software will undoubtedly cut down on time spent filing your partnership taxes and could help you identify deductions and credits you didn’t know about.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Related Articles

View All Articles