If you’re investing in real estate investment trusts (REITs) or simply considering buying a rental property, you may have noticed mention of foreclosures. Foreclosure is a specific legal action with some really huge implications for the future.

What is foreclosure?

What is foreclosure?

When real estate is foreclosed upon, this means that the owner of the mortgage has taken the property it secures to repay the debt that’s owed against it. Usually, it’s because the borrower has failed to make timely payments.

However, foreclosure can also happen because of other issues that will trigger the acceleration clause in the mortgage agreement, such as failing to maintain the property or attempting to transfer the title into someone else’s name without paying off the outstanding mortgage. Foreclosure is a problem for any property that’s mortgaged, including commercial properties, but we mostly talk about it in terms of residential properties because this is the most common type of foreclosure.

The steps leading up to a foreclosure

The steps leading up to a foreclosure

Foreclosures can vary slightly depending on the laws of the state in which you live, but generally speaking, they follow fairly similar steps. The time from start to finish of any foreclosure can vary based on a number of factors, but the state in which the foreclosure takes place has the largest influence.

- Miss a payment. Most mortgages allow the borrower to pay their payment up to the 15th of the month without a penalty. But cross into that 16th day, and you’re going to start to accrue added fees and catch the attention of your mortgage holder.

- Receive a demand letter. After two missed payments, you’ll get a demand letter. This is basically requesting your past due payments and late fees, along with a list of ways to resolve the issue.

- Receive a notice of default. Three missed payments, or being 90 days past due, result in a notice of default in most cases. You can still redeem your property, but your reinstatement period kicks off with the letter, and if you don’t catch up before it’s over, foreclosure begins.

From here, the process depends on your state, but you will lose your home, it will be sold to someone else, and you will have to move out. A foreclosure stays on your credit record for seven years, and you may or may not be liable for any outstanding balance on your mortgage that the lender was unable to recover by selling the property.

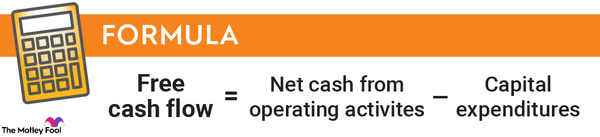

Collateralized Debt Obligation

Avoiding foreclosure

Avoiding foreclosure

Depending on at what point during the pre-foreclosure process you can pull together enough money to redeem your real estate, you have a few options to avoid foreclosure. First, obviously, you can just pay everything you owe to the bank. This works if you can borrow the money from someone or somewhere. If you don’t, though, you can still ask the bank for help.

Your bank doesn’t want your house. It really doesn’t. It wants you to keep on paying your payments and not to have to mess with your property, so it’s very inclined to work with you if you’ll only call and discuss the issue. There are lots of different tools that banks can use, including special forbearances if you’re experiencing a temporary hardship like the loss of a job or a short-term medical issue.

You may also be eligible for a short refinance, which allows the lender to refinance your loan with more manageable terms. Generally, the “short” part implies that you’re going to end up with a loan less than what you had before, but it’s still often cheaper for the bank to eat a little bit of your principal than to have to sell your home.

Related investing topics

The impact of widespread foreclosure

The impact of widespread foreclosure

A few foreclosures here and there don’t really make a ripple in the pond for most real estate markets. However, sometimes a lot of foreclosures happen at once, and that’s not great for the wider world. During the Great Recession, it wasn’t uncommon for blocks and blocks of houses to largely be for sale at greatly reduced prices due to foreclosure.

Because so many borrowers had negative equity in their homes, they didn’t feel they were losing anything by walking away from them. This created a situation where already sagging real estate prices became heavily depressed in areas of high foreclosure. Across the U.S., foreclosures climbed like never before, with some areas of California and Florida having foreclosure rates that topped 5% in 2008.

In 2008, more than 2 million homes had at least one foreclosure filing, up from 717,000 in 2006. This might not seem like a lot, but consider that in the current housing market, there were only about 1 million units available for sale in April 2023, which represented 2.9 months of housing supply. Basically, six months of homes were swept into foreclosure in just one year.