There's no shortage of hype around artificial intelligence (AI) these days. Investors are piling into AI stocks, and AI has become the latest buzzword in corporate America. Mentions of AI have soared on earnings calls, and analysts are peppering CEOs with questions about how they're using new AI tools like ChatGPT.

If you're a beginning investor who's interested in investing in AI, however, you may not know where to start. As with any emerging technology, there's a lot of noise around AI, and it can be difficult to separate the signal.

In this look at AI investing for beginners, we'll review the meaning of artificial intelligence and the four types of AI, discuss some options for investing in AI, and explore the pros and cons of AI investing and whether it's the right move for you.

Four common types of AI

Four common types of AI

Artificial intelligence generally refers to computers and machines doing tasks, such as machine learning, that normally require human intelligence or to the ability of computers to learn to recognize patterns and draw conclusions by being trained with data.

Artificial Intelligence

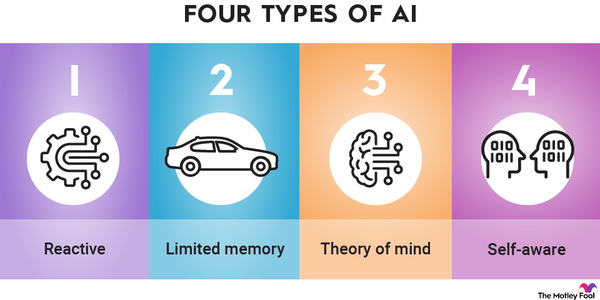

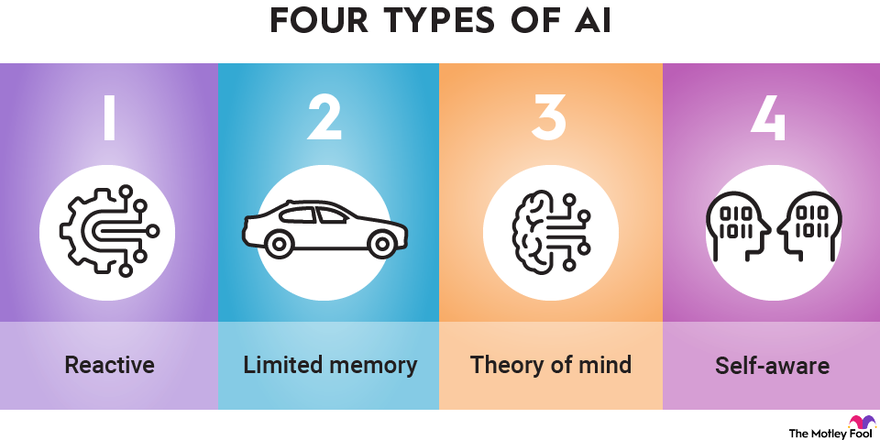

According to today's classification system, there are four primary types of AI: reactive, limited memory, theory of mind, and self-aware.

1. Reactive AI

Reactive AI is considered the most basic form of AI. As the name suggests, it describes a type of AI that provides a predictable response to the information it receives. Unlike other forms of AI, reactive AI cannot learn from previous actions. Some examples include Deep Blue -- IBM's (IBM -1.05%) chess-playing supercomputer -- and spam filters that sort emails.

2. Limited memory AI

Limited memory AI is the next-most evolved form of AI. It's able to learn from experience and combines it with pre-programmed information to complete difficult tasks. It's the most common form of AI today.

For example, autonomous vehicles use limited memory AI to interpret the movements of other cars around them and respond accordingly. The information is not saved in the car's long-term memory because it's unneeded.

3. Theory of mind AI

Theory of mind AI refers to an AI with advanced decision-making capabilities similar to humans. They can understand and remember emotions and adjust their behavior accordingly. Researchers are still working on developing a theory of mind AI.

4. Self-aware AI

Finally, self-aware AI is considered the most sophisticated form of AI; it describes machines that are aware of their emotions and the emotions of those around them.

This type of AI may still be in the distant future and is the kind that worries technologists and others who have said that AI could be a threat to humanity.

How to start investing in AI

How to start investing in AI

There are a number of ways to get exposure to AI stocks, but they predominantly fall into two categories. You can invest in AI exchange-traded funds (ETFs) or AI stocks. Let's look at some of the options in each one.

Global X Robotics & Artificial Intelligence ETF

The Global X Robotics & Artificial Intelligence ETF (BOTZ 2.52%) is the biggest AI ETF on the market, with net assets of $1.7 billion. The ETF's size helps make it more stable than some smaller funds and less at risk of redemptions (i.e., when investors take their money out of an ETF).

Global X Robotics counts as its top holdings Intuitive Surgical (ISRG 0.59%), the maker of the Da Vinci surgical robot; Nvidia (NVDA 6.18%), the top AI chipmaker; and ABB (OTC:ABB), a Swiss manufacturer of automation and robotics, including electric vehicle charging infrastructure.

The fund has an expense ratio of 0.69%, making it reasonably affordable for investors looking for easy exposure to a diversified basket of AI stocks.

ROBO Global Robotics and Automation Index

The ROBO Global Robotics and Automation Index ETF (NYSE:ROBO) is only modestly smaller than the Global X Robotics ETF, weighing in with net assets of $1.34 billion. ROBO has some holdings similar to Global X Robotics but is more diversified, with no stock making up more than 2.3% of the fund, while holdings in Global X top out at 10%.

Once again, Intuitive Surgical takes the top spot in this ETF, followed by Kardex Holding (KRDXF -10.83%), another Swiss company that makes pick-and-place robots for warehouses and other automated logistics solutions. ROBO's third-largest holding is Azenta (AZTA 1.32%), which specializes in automated systems for the life sciences industry.

ROBO has an expense ratio of 0.95%, making it modestly more expensive than Global X Robotics.

Nvidia

If you're interested in AI stocks, Nvidia is a good place to start. Nvidia is the leading AI chipmaker; the company invented the graphics processing unit (GPU), which has become popular in applications such as gaming and cryptocurrency mining. Its GPUs are also useful for handling AI algorithms like those needed to run autonomous vehicles.

Nvidia stock exploded past the $1 trillion market cap mark following blowout guidance in its first-quarter earnings report. The company shocked Wall Street with the level of demand it's seeing for AI chips. Management said it would ramp up production in the second half of the year to meet demand.

C3.ai

Another AI stock that's been attracting a lot of attention is C3.ai (AI 3.02%), the software-as-a-service platform for enterprise AI.

C3.ai uses AI to develop customized solutions for its customers. Its product suites include inventory optimization, demand forecasting, and process optimization. For example, C3.ai developed a system to help a large utility customer protect itself from disruptions, like weather and cyberattacks, and get customers to conserve energy better.

However, C3.ai's numbers haven't been impressive. Revenue growth is flat, and the company is reporting wide losses. However, C3.ai seems to have a first-mover advantage in enterprise AI, and the business could ramp up as AI attracts more attention.

C3.ai recently launched a new generative AI product suite, including enterprise search, which could help forge new growth for the company.

Pros and cons

Pros and cons of investing in AI

| Pros | Cons |

|---|---|

| AI is a disruptive technology expected to add trillions in economic value. | It's hard to pick winners with an emerging technology. |

| Most companies are trying to leverage the power of AI. | The hype is palpable, and AI stocks could already be in a bubble. |

| The winners from the AI revolution could see huge stock gains. | There's still a lot of uncertainty around AI, especially on the regulatory front. |

Is AI investing right for you?

Is AI investing right for you?

AI investing isn't right for everyone, and as a beginner, it's a good idea to invest only a small portion of your portfolio in AI stocks, as this is a high-risk sector. Still, the upside potential could be enormous, so it makes sense to get at least a bit of exposure to AI stocks.

Consider some of the names above and focus on stocks with sustainable competitive advantages, both within artificial intelligence and outside of it.