You may know of Venmo as a payment app, but the company also has a credit card called the Venmo Credit Card. This credit card earns cash back rewards, syncs seamlessly with the Venmo app, and has no annual fee. Earnings are automatically transferred to your Venmo account balance, and you can use them in various ways, including purchasing crypto. Read our full Venmo Credit Card review to see if this is the right rewards credit card for you.

Venmo Credit Card

Good/Excellent (670-850)

Intro APR

Purchases: N/A

Balance Transfers: N/A

Regular APR

20.24% to 29.24%, Variable

Rewards Earn 3% back on your top spend category, 2% on the next category, and 1% on other purchases

1% - 3% back

Annual Fee

$0

Welcome Offer

N/A

-

Offers an unlimited 2% and 3% rewards in the top two eligible spending categories, has no annual fee, and syncs with the Venmo app for added convenience.

-

- No annual fee

- Custom cash back

- Earn up to 3% cash back

- No earnings cap

- Custom card with QR code

- No welcome bonus

-

- No annual fee

- Automatically earn up to 3% cash back

- Earn 2% on the next category

- Earn 1% on the rest of your purchases

- Convert rewards to crypto

- The Venmo Credit Card lets you earn custom cashback rewards and syncs seamlessly with the Venmo app

- Keep tabs on card activity in the app, right with all your Venmo spending – every purchase, payment, split, and reward

Credit card comparison

We recommend comparing options to ensure the card you're selecting is the best fit for you. To make your search easier, here's a short list of standout credit cards.

| Offer | Our Rating | Welcome Offer | Rewards Program | APR | Learn More |

|---|---|---|---|---|---|

|

Rating image, 5.00 out of 5 stars.

5.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Discover will match all the cash back you've earned at the end of your first year. N/A | 1% - 5% Cashback Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically. |

Intro: Purchases: 0%, 15 months Balance Transfers: 0%, 15 months Regular: 17.24% - 28.24% Variable APR |

||

|

Rating image, 5.00 out of 5 stars.

5.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Up to $300 cash back Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) — worth up to $300 cash back. That's 6.5% on travel purchased through Chase Travel, 4.5% on dining and drugstores, and 3% on all other purchases. | 1.5% - 5% cash back Enjoy 5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases |

Intro: 0% Intro APR on Purchases and Balance Transfers for 15 months Purchases: 0% Intro APR on Purchases, 15 months Balance Transfers: 0% Intro APR on Balance Transfers, 15 months Regular: 20.49% - 29.24% Variable |

Apply Now for Chase Freedom Unlimited®

On Chase's Secure Website. |

|

Apply Now for Chase Sapphire Preferred® Card

On Chase's Secure Website. |

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

75,000 bonus points Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠. | 5x on travel purchased through Chase Travel℠, 3x on dining and 2x on all other travel purchases Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more. |

Intro: N/A Purchases: N/A Balance Transfers: N/A Regular: 21.49%-28.49% Variable |

Apply Now for Chase Sapphire Preferred® Card

On Chase's Secure Website. |

Full Venmo Credit Card review

This credit card is a good fit for: Regular Venmo app users who want to earn up to 3% cash back rewards without paying an annual fee.

Top perks

These are the top highlights of the Venmo Credit Card.

No annual fee

There is no annual fee to use this card. Not all credit cards without an annual fee earn rewards, but this one does. This card may be a good option if you want to earn rewards without paying a yearly fee.

Earn up to 3% cash back

With the Venmo Credit Card, you can earn up to 3% cash back. Here's a breakdown of how you will earn rewards with this card:

- Earn 3% cash back on your top eligible spending category. Eligible categories include:

- Dining and nightlife

- Travel

- Bills and utilities

- Health and beauty

- Grocery

- Gas

- Transportation

- Entertainment

- Earn 2% cash back on your second top eligible spending category

- Earn 1% cash back on other purchases

No cap on earnings

There is no cap on earnings. That means you can earn unlimited rewards, even in your top spending categories. Some cash back credit cards have a cap on how much cash back you can earn. Since there is no cap, you can spend and earn as you wish.

Flexibility with how you use rewards

You have some flexibility with how you use your cash back earnings. Your earnings are automatically transferred to your Venmo app account balance at the end of each statement period. You can use your cash back rewards in several ways, including:

- Pay a friend

- Make a purchase with an authorized retailer

- Pay your Venmo Credit Card balance

- Transfer the money to your bank account or debit card

- Keep your funds in your Venmo balance

Venmo also lets you use your cash back rewards to buy crypto. You can purchase Bitcoin, Ethereum, Litecoin, or Bitcoin Cash through Venmo.

Read more: Best Crypto Credit Cards

Feature-packed app capabilities

As a Venmo Credit Card user, you'll have access to many useful features within the Venmo app. You can easily track your credit card spending, split the cost of purchases with friends, and shop online with participating retailers using your virtual Venmo Credit Card.

If you ever lose your physical card or want to start using your card before it arrives, you can request a virtual card within the Venmo app. These features can help you better manage your spending habits and make using your card even easier.

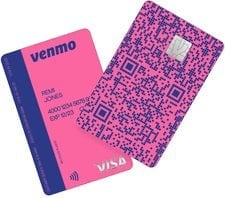

Custom credit card with QR code

You can choose what physical credit card style you want to have from several color combinations. Your card will also feature your unique Venmo QR code. Your friends can scan your QR code to pay you. This feature may help facilitate speedy payments.

What could be improved

The Venmo Credit Card has many benefits, but it also has at least one drawback worth mentioning.

No welcome offer

Many other rewards credit cards provide a welcome offer to new cardmembers. These welcome offers can be an excellent way to earn extra points or cash back. The Venmo Credit Card has no welcome offer of any kind. If you're looking for a rewards card with bonus welcome points, you'll need to look elsewhere.

Suggested credit score

This credit card is intended for consumers with good to excellent credit. A FICO® Score of 670 or higher is recommended. Remember, it's possible to get approved with a lower credit score or be denied with a higher credit score. In addition to credit score, other factors, such as income and current debt, are considered.

The Venmo Credit Card is right for you if:

The Venmo Credit Card may be a good fit if you're looking for a no annual fee card that earns up to 3% in rewards.

You may also want to apply for this card if these things are true for you:

- You use the Venmo app regularly

- You want to earn 2% and 3% rewards in your two top spending categories

- You regularly spend money in eligible earning categories

- You want a rewards credit card with no rewards cap

If you're not a Venmo app user or don't spend significant amounts of money in the eligible top spending categories, this card may not be ideal for you. A different cash back rewards card may work better for your needs. Check out our best cash back cards list to learn more about other top rewards cards.

Our credit card methodology

At The Motley Fool Ascent, we rate credit cards on a five-star scale (1 = poor, 5 = best). Our rating criteria includes rewards rates, welcome bonuses, fees, and perks like travel credits and 0% intro APR offers to evaluate our ratings.

We combine these factors with an evaluation of brand reputation and customer satisfaction to ensure you're getting the best card recommendations. Learn more about how The Ascent rates credit cards.

FAQs

-

No, the Venmo Credit Card has no annual fee.

-

When applying for the Venmo Credit Card, you must have a Venmo account that has been open and in good standing for at least 30 days.

-

You'll earn 3% on your top spend category and 2% on your second top spend category. The following purchase categories qualify for top spend earning: dining and nightlife, travel, bills and utilities, health and beauty, grocery, gas, transportation, and entertainment.

Our Credit Cards Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

The Motley Fool owns shares of and recommends Visa.