Albert is a one-stop shop for saving, investing, and budgeting. You can do it all through the app, though after a 30-day free trial, you're on the hook for monthly fees. Find out whether it's worth the crunch, what the disadvantages of Albert are, and how it compares to similar budgeting apps.

Pros

- Manage and budget money in one place (all users)

- Access to human advisors (premium)

- Early paycheck (premium)

Cons

- Monthly fee (all users)

- Limited customer service

- Complicated fees

What is Albert?

Albert combines money management and budgeting under one roof. Basically, you get the perks of a bank, brokerage, and budgeting app rolled into one. Baked into these accounts are neat features you get automatically.

What you get:

- Automatic savings based on what you can afford

- Cash advances against your next paycheck

- Insurance options and discounts

- A custom investment portfolio

- Genius service for access to human advisors

FYI, some features are locked behind a premium Genius subscription. More below on the difference between a regular Albert and a premium Genius membership.

How does Albert work?

You open accounts on Albert and link to third-party accounts to track everything.

You start by linking all of your accounts to the app. Albert uses the same security measures as any major bank, keeping your financial information private. Once you've linked the app to your checking, savings, and investment accounts, it tracks your account balances and net worth. Most importantly, it keeps your finances organized.

You can bank and invest through the app. That said, Albert is not a bank, and all banking services are provided through FDIC-insured banking partners, which are actual banks.

What we like about Albert

Manage your money under one roof

Most personal finance apps offer either banking, investing, or budgeting. Albert gives you all three, and you can access everything with one app -- one interface to rule them all. No more flipping between apps to buy stocks, check your direct deposit, and create a rainy day fund. You can do it all on the Albert app. It's a huge perk, and a rare one at that.

Accounts you can open through Albert:

- Checking

- Savings

- Investing

To use all the features of these accounts, you need a premium Genius membership, which reduces the utility somewhat. Premium will cost you an extra $60 per year.

Genius gives you access to human advisors

A subscription with Genius gives you access to human financial advisors, available seven days a week to answer any financial questions you have. For example, if you're curious about how to pay off loans, save for a vacation, or open a college fund for your child, an expert can give you step-by-step directions. You can try Genius for free for 30 days.

Gives you access to your paycheck two days early

If your funds tend to run low shortly before your next paycheck is due, Albert may advance you the money two days before your check is set to hit your account.

Identify where you can save money

Albert analyzes your spending habits to learn where you can best save.

The app examines your spending and uses an algorithm to calculate how much money you can afford to save each week. It will then go a step further and set the money aside automatically, prioritizing your goals. For example, it may transfer 90% to a rainy day fund and 10% to a vacation fund.

Guides you through basic investing

The app can create a custom investment portfolio tailored to meet your specific goals. It can also offer you guidance through a team of human advisors. But if you'd prefer to go your own way, you can pick and choose individual investments.

Albert gives you access to fractional share trading. You can buy stocks for as little as $1.

Insurance options

Albert an help you find life, auto, home, and renters insurance through the app. It offers coverage discounts and connects you to policy options. The convenience of doing this in one place may make your life easier.

Compare savings rates

Make sure you're getting the best account for you by comparing savings rates and promotions. Here are some of our favorite high-yield savings accounts to consider.

| Account | APY | Bonus | Next Steps |

|---|---|---|---|

Open Account for SoFi Checking and Savings

On SoFi's Secure Website.

4.90/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

up to 4.00%

Rate info

Earn up to 4.00% Annual Percentage Yield (APY) on SoFi Savings with a 0.70% APY Boost (added to the 3.30% APY as of 12/23/25) for up to 6 months. Open a new SoFi Checking and Savings account and pay the $10 SoFi Plus subscription every 30 days OR receive eligible direct deposits OR qualifying deposits of $5,000 every 31 days by 3/30/26. Rates variable, subject to change. Terms apply at sofi.com/banking#2. SoFi Bank, N.A. Member FDIC.

Min. to earn: $0

|

Earn $50 or $300 and +0.70% Boost on Savings APY with direct deposit. Terms apply.

Earn up to 4.00% Annual Percentage Yield (APY) on SoFi Savings with a 0.70% APY Boost (added to the 3.30% APY as of 12/23/25) for up to 6 months. Open a new SoFi Checking and Savings account and pay the $10 SoFi Plus subscription every 30 days OR receive eligible direct deposits OR qualifying deposits of $5,000 every 31 days by 3/30/26. Rates variable, subject to change. Terms apply at sofi.com/banking#2. SoFi Bank, N.A. Member FDIC. |

Open Account for SoFi Checking and Savings

On SoFi's Secure Website. |

Open Account for CIT Platinum Savings

On CIT's Secure Website.

4.80/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

3.75%

Rate info

3.75% APY for balances of $5,000 or more; otherwise, 0.25% APY

Min. to earn: $5,000

|

N/A

|

Open Account for CIT Platinum Savings

On CIT's Secure Website. |

Open Account for Western Alliance Bank High-Yield Savings Premier

On Western Alliance Bank's Secure Website.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

3.80%

Rate info

The annual percentage yield (APY) is accurate as of January 8, 2026 and subject to change at the Bank’s discretion. Refer to product’s website for latest APY rate. Minimum deposit required to open an account is $500 and a minimum balance of $0.01 is required to earn the advertised APY.

Min. to earn: $500 to open, $0.01 for max APY

|

N/A

|

Open Account for Western Alliance Bank High-Yield Savings Premier

On Western Alliance Bank's Secure Website. |

Platinum Savings is a tiered interest rate account. Interest is paid on the entire account balance based on the interest rate and APY in effect that day for the balance tier associated with the end-of-day account balance. *APYs — Annual Percentage Yields are accurate as of January 9, 2026: 0.25% APY on balances of $0.01 to $4,999.99; 3.75% APY on balances of $5,000.00 or more. Interest Rates for the Platinum Savings account are variable and may change at any time without notice. The minimum to open a Platinum Savings account is $100.

Based on comparison to the national average Annual Percentage Yield (APY) on savings accounts as published in the FDIC National Rates and Rate Caps, accurate as of February 17, 2026.

For complete list of account details and fees, see our Personal Account disclosures.

The annual percentage yield (APY) is accurate as of January 8, 2026 and subject to change at the Bank’s discretion. Refer to product’s website for latest APY rate. Minimum deposit required to open an account is $500 and a minimum balance of $0.01 is required to earn the advertised APY.

The national average rate referenced is from the FDIC’s published National Rates and Rate Caps for Savings deposit products, accurate as of February 17, 2026. For more information, you can check the FDIC website.

What could be improved

Monthly fee

Albert charges you a monthly fee after its 30-day trial. Most modern banking and brokerage apps don't charge monthly fees. The fee gets more expensive if you want to pay for Albert's premium membership perks, including a cash back debit card.

No way to reach a human by phone call

Not everyone is tech savvy, and it would be nice to have someone on the other end of a phone to walk you through any features or tech issues that you find confusing. You can text customer support -- I did, and a representative responded quickly -- but you might prefer a call instead.

Complicated fees

The difference between the regular Albert vs. premium Genius subscription is confusing. Albert doesn't charge many fees, but it's very difficult to understand exactly what you're getting.

I even asked customer service for clarity, but I didn't receive a simple side-by-side comparison. Most competitors make it easy to discover what you're paying for. That a "modern" app like Albert doesn't do this is both off-putting and annoying.

The website isn't transparent about interest rates, either. It's difficult to tell what rate you'll get for opening a savings account, and whether your rate hinges on your premium membership.

Difficulty closing accounts

Many users complain of difficulty closing accounts. That's partially due to Albert's account closure policy. You can't close your accounts until your balance is $0, but it can take days for your money to transfer out of Albert.

If you forget to disable Smart money features, Albert will automatically add more money to your account, forcing you to pause the service and restart the process -- and therefore spend even longer closing your account.

You can't easily close your account with a couple of taps. I asked customer service (via text) to help me close my account, and I was asked to answer a question beforehand ("why are you canceling"). Then the representative helpfully disabled automatic payments for me and told me how to deactivate my account, which I appreciated.

How to close your Albert account:

- Tap the hamburger menu on the upper left of the home page

- Tap Payments

- Tap Help Center

- Tap Deactivate or Close My Accounts

- Tap Continue

- Tap Skip or provide feedback (optional)

- Tap Confirm

- Tap Continue

- Swipe to deactivate

- Tap Okay

I recommend you go through a customer service agent to close your account so they can disable automatic transfers to Albert.

Since Albert charges a monthly subscription fee, time is money. That the app makes it difficult to close your account is not a good sign and could cost you.

Tipping the company

Albert lets you tip the platform. Some users have done it by accident and regretted it. It's an odd feature for a personal finance app, and you may dislike it on principle. Now you know.

No investment options for retirement

While you can select from a list of stocks and funds, the app doesn't support retirement plans.

How much does Albert cost?

Albert charges $9.99 per month, and $14.99 per month for premium Genius membership. The monthly fee is mandatory. Here's what you get for each membership tier:

Albert membership:

- Track budgeting and spending

- Automatic saving

- Identity protection

- Fee and bill increase alerts

- Credit score and report monitoring

- Cancel subscriptions.

Genius membership:

- Checking: An "Albert Cash" checking account with a cash back debit card.

- Early deposits: Get your direct deposits up to two days early.

- Advice: 24/7 access to financial advisors via text. You can schedule video calls.

- Fraud protection: Albert notifies you of suspicious transactions and credit updates.

- Smart money: Albert makes your bank and investing accounts smarter and automatic.

- Free ATM withdrawals: Withdraw from more than 55,000 in-network ATMs fee free.

Some Genius members will get additional perks, like Instant Overdraft Coverage, which lets you overdraft your checking account for between $25 to $250 with no penalty. This is something the app decides on an individual basis (you have to apply for the perk).

Other fees:

- $3.50 ATM out-of-network fee

- $4.99 for fast bank account transfers

Albert online ratings

App store reviews are high, though recent reviews are mixed. The technology seems sound. The root of the mixed reviews is the fact that Albert used to be a freemium model, but it recently switched to paid.

A bunch of users are salty about suddenly being charged, and many describe difficulties with closing accounts. That said, some customers are very pleased with fast customer service.

- iOS app rating: 4.6/5.0 stars

- Android app rating: 4.3/5.0 stars

Albert platform

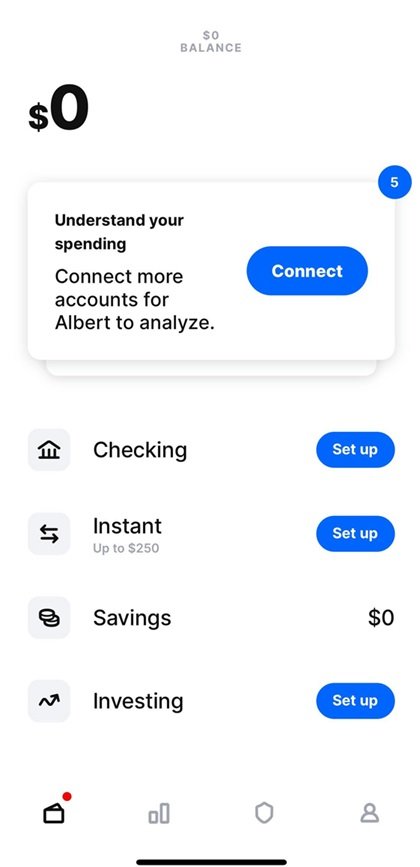

Albert's app was clean and easy to navigate. My personal favorite feature was reaching out for help through text and getting responses in under five minutes. That said, you must go through a lot of tabs to connect all your relevant accounts. It feels a little overwhelming at first.

Albert app home account screen. Image source: Albert, captured by author.

Is Albert safe?

Albert is a reasonably safe place to put your money. Your information is encrypted and transferred using SSL, the same security protocol used by the major financial institutions. Money in your bank accounts is FDIC insured through partner banks, and money in your brokerage account is protected by the SIPC, up to typical limits.

Albert's partner banks include Sutton Bank, Coastal Community Bank, and Wells Fargo.

Alternatives to Albert

If you want an app that does simple budgeting better: Rocket Money is a good alternative for anyone looking for a budgeting tool that can help reduce unwanted subscriptions, negotiate bills on your behalf, and monitor your credit. It's very easy to use, with a beautiful interface that prioritizes the things you care about most.

If you want an app that does collaborative budgeting better: Monarch Money is a good alternative for anyone who already has a good handle on monthly payments and needs a robust, comprehensive, and customizable financial management tool. You can share access with partners and financial advisors.

Albert might be right for you if:

- You want to budget, bank, and invest in one place.

- You're willing to pay a monthly membership to consolidate your finances.

- You prioritize organizing your money through Albert over transparent fees and features.

-

Review sources

- https://help.albert.com/hc/en-us/articles/16768060313111-Albert-s-Terms-of-Use

- https://albert.com/about/investing

- https://help.albert.com/hc/en-us/articles/16797322661143-Albert-Insurance-Services

- https://help.albert.com/hc/en-us/articles/21583583733271-How-much-does-Albert-cost

- https://help.albert.com/hc/en-us/articles/360036374534-How-to-contact-Albert

- https://albert.com/about/financial-dashboard

- https://albert.com/about/cash

- https://apps.apple.com/us/app/albert-budgeting-and-banking/id1057771088

- https://play.google.com/store/apps/details?id=com.meetalbert&hl=en_US

- https://help.albert.com/hc/en-us/articles/115002423654-How-you-re-protected

- https://albert.com/

FAQs

-

Take advantage of the free 30-day trial to familiarize yourself with all that Albert offers. Thirty days should give you enough time to determine how many features you'll make use of.

-

It may. If you're not tech-savvy or otherwise run into issues, the inability to call customer service may become a roadblock.

-

It all depends on how many Albert features you'll use. If you're using it as a basic budget planner, there are certainly cheaper options. If you'll milk all the features, and the app ends up saving you money, it could be a bargain.

Motley Fool Stock Disclosures

Wells Fargo is an advertising partner of Motley Fool Money. Discover Financial Services is an advertising partner of Motley Fool Money. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dana George has positions in Apple and Target. The Motley Fool has positions in and recommends Alphabet, Apple, and Target. The Motley Fool recommends Discover Financial Services. The Motley Fool has a disclosure policy.