It’s elusive at first, even ethereal. Still, the work invested to capture it is worthwhile. I’m talking about customer lifetime value (CLV).

CLV is an important business metric. It helps model out financials. It provides insight into business decisions. It identifies your most valuable customers.

Even so, many businesses fail to figure out customer lifetime value. Let’s help you avoid that situation by outlining how you can determine and use CLV in your business.

Overview: What is customer lifetime value?

The lifetime value of a customer is intended to assess the financial worth of each customer. It gauges the amount your business can reasonably expect to earn from a customer over the entire lifetime of the relationship.

The CLV metric can be used to measure how long it takes a business to recoup the investment required to acquire a new customer and retain them, such as costs associated with sales and marketing efforts. This is critical to the financial health of a business since you want to ensure profitability and continued revenue growth.

Customer-facing teams, such as sales and customer service groups, have direct impact on CLV since they are responsible for client management, and their actions can reduce or extend the time a customer remains engaged with a business. Usually, CLV is calculated and tracked by a finance group, and sharing CLV with customer-facing teams helps your business retain high-value customers.

Here’s a customer lifetime value example: The CLV of Amazon’s Prime members is more than double the amount for non-Prime customers. That’s how Amazon learned it needed to start focusing efforts to grow and retain Prime members.

So it continually expanded the benefits of membership, such as offering free shipping and free streaming of movies and TV shows. Thanks to CLV, Amazon realized where its most valuable customers lived and zeroed in on them.

Customer lifetime value vs. lifetime value: What’s the difference?

The terms "customer lifetime value" and "lifetime value" refer to the same thing. In practice, in the business world, the term "lifetime value" is much more common. It's faster to say and the customer is always implied.

Please note that "lifetime value" is often abbreviated as LTV, but we prefer the abbreviation CLV. This avoids confusion with the already well-established banking abbreviation for "Loan-to-value" ratio, an entirely unrelated concept.

How to calculate customer lifetime value

Because customer lifetime value models future potential, calculating CLV can be as sophisticated as you need it to be. A straightforward approach is using revenue. Or you can perform a complex analysis, including factors like cash depreciation over time, then layering that onto a cohort analysis.

To help you get started with customer lifetime value calculation, let’s look at a simple example. Once you’ve mastered this, you can pursue deeper calculation methods to meet the needs of your business.

Step 1: Average order value (AOV)

You begin calculating customer lifetime value by understanding how much revenue you generate from the average customer. This is the average order value (AOV).

To calculate AOV, look at a time period that makes sense for your business. Many choose a year. The goal is to pick a time frame that’s a good representation of customer purchase behavior to account for any sales variances that might occur over that time.

For example, a coffee shop may find that sales are higher in the winter and fall months, when people want a hot drink, but lower in the spring and summer.

Total the revenue made in that time period. Then divide that total revenue by the total number of orders (aka sales) generated during that same time period. The calculation looks like this:

- Average order value = Total revenue/Total number of orders

Let’s say, you typically generate $15,000 in revenue per month from an average of 200 sales. This amounts to an AOV of $75.

Pro Tip: Because this is an average, not all customers will generate the same AOV. For instance, if you sell products or services at different pricing tiers, some customers may buy more expensive products while others buy the cheaper ones. So if you want to identify your most valuable customers, perform a customer segmentation analysis.

This analysis divides up your customer population based on different characteristics. In this case, you’ll want to break up customers into different groups based on the pricing tiers to better understand CLV for each tier.

Customer segmentation is easier to execute with the help of a CRM system. The best CRM software can automatically segment your customers based on the factors that matter to you, and even include CRM features that help your business in many other ways as well.

Step 2: Average purchase frequency (APF)

Now that you know how much customers spend with you on average, it’s time to include how often. Loyal customers may buy from you regularly while others shop infrequently. The average purchase frequency (APF) captures this.

To calculate APF, determine the total sales in the same time period used for average order value. Divide that by the number of unique customers that made a purchase. Unique customers mean if a customer made multiple purchases in the selected time period, you only count them once.

The result gets you the number of times the average customer purchases from you. Here is the calculation:

- Average purchase frequency = Number of purchases/Number of unique customers

Staying with the $15,000 per month example, since you make that revenue from 200 sales, and let’s say those purchases were made by 50 customers, the APF is 4.

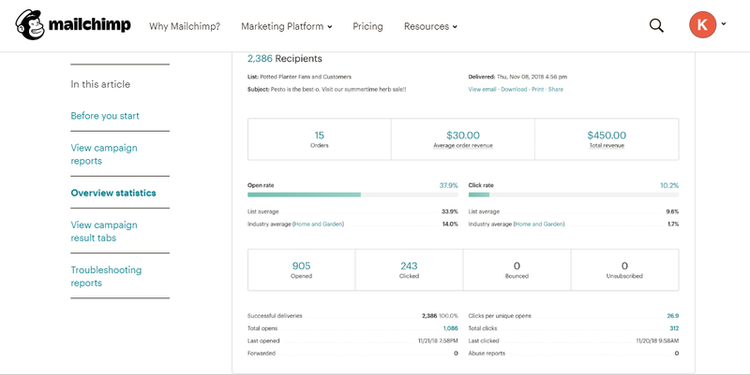

Pro Tip: Since APF identifies how often customers buy from you, increasing the average purchase frequency is a great way to grow revenue. This can be done by executing an email marketing campaign using software like Mailchimp to encourage repeat buys.

Using email marketing with the help of software like Mailchimp can encourage customers to make repeat buys, increasing average purchase frequency. Image source: Author

Step 3: Customer value (CV)

Next, multiply the AOV and APF numbers calculated previously to arrive at customer value (CV). This tells you how much revenue the average customer brings to your business over the selected time period.

The calculation looks like this:

- Customer value = Average order value x Average purchase frequency

Continuing with our example, since AOV is $75 and APF is 4, each customer delivers an average of $300 in revenue per month. So the CV is $300.

Pro Tip: A customer’s value to your business can extend beyond the revenue they represent. Loyal customers will recommend your business to others, generating new customers at a low cost to your company. So view CV as just one metric to evaluate the value of a customer.

Step 4: Average customer lifespan (ACL)

Average customer lifespan is the last piece of the CLV puzzle. It’s also the hardest to accurately calculate. After all, you’re trying to predict the future.

The customer’s lifespan is the amount of time between their first purchase and their last before they no longer patronize your business. You can take an average of this timeframe across all your customers to arrive at the average customer lifespan (ACL).

To calculate ACL, you add up all the customer lifespans and divide by the total number of customers:

- Average customer lifespan = Sum of customer lifespans/Number of customers

If that’s not possible, say, if your business is new, another means of deriving average customer lifespan is to divide 1 by your churn rate. The calculation looks like this:

- Average customer lifespan = 1/Churn rate

Churn is a measure of the customers your business is losing. To calculate churn, subtract the number of customers you had at the start of a time period, say a month, by the number of customers at the end of that time period. Then divide this amount by the number of customers at the start of the time period.

Here’s the churn rate calculation using a month as the time frame:

- Churn rate = Customers at start of month - Customers at end of month/Customers at start of month

Pro Tip: If you don’t have the info to use any of the aforementioned methods, you can apply an average customer lifespan of one to three years. This estimate is highly dependent on the type of business you run.

A barber might have the same customer for more than three years. So use what makes sense for your business based on the customer patterns you’re seeing.

Step 5: Customer lifetime value (CLV) formula

Now that you’ve calculated all the pieces needed, it’s time to put them together to derive the customer lifetime value.

The simple approach is to multiply customer value by the average lifespan. The lifetime value calculator, in this case, is as follows:

- Customer lifetime value (simple) = Customer value x Average customer lifespan

In our example with a customer value of $300 per month, if the average lifespan is three years, or 36 months, since all our values are monthly, then the customer lifetime value is $10,800. This means you want to spend less than $10,800 per customer in marketing, sales, and other costs, or you’re losing money.

Pro Tip: The next level of CLV sophistication accounts for your business costs, so that you acquire insight into the profitability of each customer. To do this, include your gross margin in the CLV formula.

Here’s what the customer lifetime value formula looks like when accounting for profit:

- Customer lifetime value (with profit) = Customer value x Average customer lifespan x Gross margin

Gross margin tells you the percentage of each sale that’s your profit. You calculate it by taking total revenue minus total costs divided by total revenue.

Be sure to use totals from the same time period applied in your other calculations. So the formula looks like this:

- Gross margin = Total revenue - Total costs/Total revenue

In our customer lifetime value model, let’s say cost per month is $6,000. To derive gross margin, we take $15,000 per month in revenue minus $6,000. The resulting $9,000 is divided by $15,000 to arrive at a gross margin of 0.6.

Since the gross margin is 60%, then the customer lifetime value becomes $6,480. That’s a significant difference from the initial $10,800, so it’s worthwhile putting the effort into determining your profit margin and including it in the CLV formula.

How to analyze customer lifetime value for your business

So you’ve calculated customer lifetime value. What does that mean to your business? How do you interpret and understand the results?

As in Amazon’s case, CLV had a significant impact on how it developed its business growth strategy. The same can happen to your business. Let’s look at some implications.

One of the key benefits of customer lifetime value is that it informs your limits in terms of costs to acquire and retain a customer. This insight can be used to determine how many sales and support staff you can afford to hire. It’s also a great metric to track, and as it changes over time, you can take action to prevent its decline and promote its growth.

You can dig into the factors that drive customer lifetime value and use them as KPIs (key performance indicators) for your business. For example, if you want to increase the average purchase frequency, you can take concrete actions, like email marketing, to grow this metric. Just be sure you’re employing customer analytics to acquire the necessary data to use this approach.

You can also apply customer lifetime value in forecasting and planning your company’s budgets. Knowing the CLV for each customer, you can determine the amount of growth you’re anticipating for the next fiscal year. For instance, if you plan a price increase, multiply that by average order size to arrive at a revenue target.

Lastly, by employing customer segmentation, you can break down CLV by customer segment to determine where your most valuable customers live. Software like Agile CRM can help you segment your customers, and it can even calculate CLV for you.

Through software such as Agile CRM, you can segment customers to drill down to those with the best customer lifetime values. Image source: Author

FAQs

-

Customer lifetime value is specific to every business. A CLV for one business won’t apply to another. So the way to gauge if your CLV is good is to ensure your costs are below the CLV amount.

For instance, in our example calculations, we determined a CLV of $6,480 after accounting for gross margin. In this case, we’d break down marketing and sales efforts to a cost per customer number to ensure it stays below $6,480.

That said, it’s up to you to determine how far below the CLV you want your costs to be. One way to evaluate a good CLV for your business is to identify which groups of customers represent the segment with a combination of high CLV and low cost (if using the simple CLV calculation). This would be your best CLV.

Divide up your customer population into different segments to compare their CLV. Start by looking at a minimum one year time period. Then dissect your customers by different parameters, like conversion rate or return on ad spend (ROAS), to discover which combination of characteristics equates to a high CLV with low costs, or the highest CLV overall if accounting for gross margin in your CLV calculation.

-

Before working to improve CLV, be sure your customer data is centralized in a CRM. This way, you’ve got all the data required to improve CLV in one place.

Once your data is centralized, you can improve CLV by tackling the underlying metrics. Improve any of these, and you do the same for CLV.

We mentioned using email marketing to grow average purchase frequency. You can also build a loyalty program.

To grow average order value, you can offer a discount if customers purchase multiple products. Amazon famously did this by providing free shipping on orders over a certain amount, thus increasing AOV.

Grow a customer’s average lifespan with your company by delivering exemplary customer service. You can also strengthen relationships with customers through personalized gestures such as offering a birthday discount.

-

You can take a customer lifetime value marketing approach. This means evaluating your marketing efforts using CLV as the core performance metric. Once you uncover customers with the best CLV through customer segmentation, you can refine your sales and marketing to target these types of customers.

After doing that, look at the CLV for each of your marketing campaigns and lead generation efforts. Perhaps customers with good CLV come from social media or specific types of sales tips. In this way, you can identify the tactics that deliver customers with a good CLV for your company, then focus efforts around these areas.

You’ll also want to do the same for retention. Understand the tactics that grow retention metrics such as customer lifespan. And since the reality is that not all customers are equal, you’ll want to determine which segments of existing customers represent those with the best CLV to focus retention efforts on.

A last word about customer lifetime value

Once you’ve calculated customer lifetime value, make it part of your company culture to optimize the business towards achieving the best possible CLV, such as including CLV on a sales dashboard and incorporating it in your sales analytics.

With CLV in hand, you can make improvements across the organization. You can reduce costs for customers with lower CLV while increasing spend on acquiring and retaining customers with higher CLV. You can map out the customer lifecycle, also called the customer journey, to identify all the customer touchpoints with your company and correlate those touchpoints to the ones that result in customers with high CLV to understand where they come from.

A company focused on CLV can optimize many areas of the business. That’s how Amazon grew to become a success, and with customer lifetime value in hand, you can do it too.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.