Small business payroll software is not all built alike. Not every business needs all the bells and whistles of payroll software solutions, but some companies might need a more comprehensive suite of tools. Paycor is not just a standalone small business payroll software solution -- it's more of a comprehensive platform for HR, human capital management (HCM), and employee benefits. Let's see how Paycor stacks up in the world of small business payroll software.

Pricing Plans: Pricing ranges from $99 plus $6 per person per month (Basic) to $229 plus $16 per person per month (Complete). Exact pricing will vary based on size and complexity of your business, and features of your Paycor plan.

-

Ease Of useRating image, 4.00 out of 5 stars.4.00/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

SupportRating image, 4.00 out of 5 stars.4.00/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

PricingRating image, 4.00 out of 5 stars.4.00/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

FeaturesRating image, 4.00 out of 5 stars.4.00/5 Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

= Best

= Excellent

= Good

= Fair

= Poor

-

- Comprehensive human capital management (HCM) tools

- Extensive integrations with more than 200 third-party apps

- Full-service payroll with automatic payroll runs

- Packages are complicated and pricing is unclear -- no price information published on the website

- May have too many advanced features for smaller businesses

- Might not integrate with your favorite accounting software

Paycor is a fully integrated human capital management (HCM) solution that includes a solid payroll software component.

Available as a cloud-based modular application, Paycor offers full-service payroll along with numerous HR and employee management features such as Time & Labor Management, Employee Scheduling, Benefits Management, and Recruiting & Applicant Tracking.

Who is Paycor for?

Although Paycor offers a variety of custom HCM and payroll solutions for small to medium-sized businesses, we're going to focus on its Small Business bundle, which is designed for companies with between one and 39 employees. The Small Business bundle offers three plans, starting with the Basic plan, but you can scale up to a more robust plan at any time.

Paycor product features

Paycor is a full-service payroll software that is built into a larger suite of HR tools to help with hiring, onboarding, and managing talent. There's a wide range of functions and capabilities that you can take on with Paycor, beyond just paying your workers.

Let's look at a few highlights of the Paycor experience -- for payroll processing and more.

Full-service payroll

Paycor is more than "just" payroll, but that doesn't mean its payroll software is an afterthought. This is a powerful payroll processing solution that can tackle everything your small business might need to make sure people get paid on time with accurate tax withholdings.

The Paycor payroll experience includes:

- AutoRun: Paycor lets you set up automatic payroll runs and schedule pay runs in advance. This is a convenient, lower-touch experience compared to some other payroll apps that require you to log in every time you run payroll.

- OnDemand Pay: A growing trend in small business payroll is earned wage access (EWA), which lets hourly workers, gig workers, and contractors get convenient, early access to their pay. Paycor gives you the flexibility to offer on-demand pay to hourly workers, which can be a valuable extra perk.

- Direct deposit or Paycor Visa® card: Paycor lets you pay people via direct deposit to bank accounts, or via a special pre-loaded (reloadable) Visa debit card that is connected to and funded by the workers' earned wages via Paycor.

- Paycor Mobile Wallet: This feature is for workers who want earned wage access (EWA) so they can get paid anytime, not just at payday. The Paycor Mobile Wallet includes financial wellness tools and the reloadable Paycor Visa® Card.

- Real-time calculations: You can make payroll adjustments in real time, without waiting for batch processing.

Tax compliance

Paycor offers a wide range of tax compliance features, beyond just filing tax forms like W-2s and 1099s. You get a full tax compliance dashboard with proactive alerts and tax recommendations, such as how to set up a new employee for tax purposes based on where the employee lives, or how to comply with state-specific laws.

Automatic deductions and wage garnishments

Good payroll software should help your company (and your workers) get tax withholdings and other payday deductions handled automatically. Paycor does all this, and more! With Paycor, you can set up automatic deductions for taxes (federal, state, and local), workers' compensation insurance, and special wage garnishments that your workers might owe, such as child support or certain other types of debt repayments.

Payroll reports

Paycor makes it easy to run a wide range of payroll reports, whether it's for tax documents like W2s, or other quarterly and annual tax forms like 940s, 941s and 944s. The Paycor payroll software also enables your team to run special reports like Payrun Audit, Cash Requirement, Unpaid Employees.

Customizable plans for payroll and more

Paycor can work with you to customize your payroll services, so you can do less of the work yourself -- or add optional plans for extra help and bigger value. Here are a few ways to customize your payroll with Paycor:

- Payroll professional services: Outsource your payroll processing to Paycor. Let it handle the details of payroll and compliance so you can take one more item off your to-do list.

- Workers' comp support: Get professional help with your company's workers' comp, so you can avoid surprises and ensure higher standards of accuracy.

- Time and scheduling: Paycor can help you manage your employees' work schedules and hours, handle paid time off requests, and stay in control of your budget.

- Benefits administration: Help everyone at your company have a happier time during open enrollment, with clearer visibility of benefits and costs.

- Recruiting: Get support with recruiting. Paycor can help you streamline your process, send text messages to job candidates, reward employees for new hire referrals, and more.

Hundreds of integrations

One big strength of Paycor is that it offers hundreds -- over 200 -- third-party apps and integrations from various technology partners. Paycor even has its own app "Marketplace," where you can find a wide range of apps for all kinds of business functions, from accounting to benefits to retirement plan solutions.

Whatever you want to accomplish with your human capital management (HCM), whatever you want your business to be better at, Paycor can likely help connect you with the right partner.

Paycor's pricing

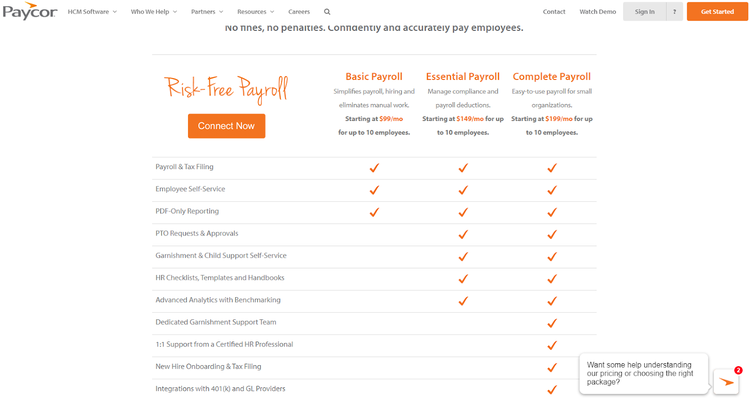

Paycor offers Small Business (1-39 employees) and Mid-Market (40+ employees) bundles, with the Small Business bundle offering three payroll plans to choose from. Pricing below reflects the cost of each plan for up to 10 employees:

- Basic Payroll: Includes full-service payroll, tax calculation and filing, employee self-service features, and PDF reporting. The Basic Payroll plan starts at $99 per month for up to 10 employees.

- Essential Payroll: Includes all Basic features as well as garnishment and child support self-service, HR templates, and advanced analytics. The Essential Payroll plan starts at $149 per month for up to 10 employees.

- Complete Payroll: Includes all Basic and Essential features as well as one-on-one support from a certified PR professional, new hire onboarding and tax filing, and integration with 401(k) and accounting software applications. The Complete Payroll plan starts at $199 per month for up to 10 employees.

Paycor offers three plans, all designed for small businesses. Image source: Author

If you currently have more than 10 employees, you will need to obtain a custom quote from Paycor for your business.

In addition to the features found in the Paycor small business plans, there are a variety of add-on modules available from Paycor. These include Time & Labor Management, Employee Scheduling, Benefits Management, and Recruiting & Applicant Tracking, with all add-on modules priced separately.

Paycor's ease of use

Paycor's initial implementation is handled by Paycor support personnel, who configure and enter all employee information, testing the software thoroughly prior to it going live.

Once live, you can access all Paycor features from the customizable Command Center, which is equipped with intuitive navigation and the ability to remove any features or functions that are not being used.

You'll also have the option to add other features at a later date.

Paycor's Command Center serves as a hub for access to payroll, HR, and employee data. Image source: Author

To expedite payroll processing, Paycor uses a pay grid that shows all current employees, with salaried, hourly, and contract employees listed on the grid. If using Paycor's timekeeping feature, you can easily approve employee time cards in the system, with the approved hours automatically populating in the pay grid.

This eliminates the need to import hours from the timekeeping application. Employee pay information can be changed at any time prior to running payroll, with the new information available immediately. Once payroll entry is completed, you can view the summary page and make any last-minute changes prior to completing the pay run.

Working with Paycor support

Mentioned earlier, Paycor handles all initial product setup, and new users are trained in the application prior to it going live. Paycor also offers a variety of resources, including access to a robust help system from within the application.

There are also pages of resources for Paycor users, though most of the white papers and guides are centered around HCM topics like applicant tracking and HR management. Paycor users can request support online or by calling the software's toll-free number.

There is also an option to contact one of the many Paycor sites that are located throughout the U.S.

Benefits of Paycor

If you have employees, you need an easy, efficient way to pay them. Paycor offers that and a whole lot more, including complete HR and employee compliance solutions, solid reporting and analytics, and a good selection of add-on modules designed to enhance and expand upon the core application.

Paycor can be a particularly good option for those that use their mobile phones to run their business, since payroll can be processed from your mobile device. Paycor can also be particularly beneficial to businesses that desire access to HR resources.

Growing businesses should take a look

While payroll is arguably the most important employee management component, small businesses can often find themselves struggling to remain in compliance with numerous HR rules and regulations.

That's where Paycor shines; the platform offers a number of HCM features, such as applicant recruiting and tracking, candidate search options, and workforce insights features.

It also comes with access to an HR support center, as well as guidance from an HR pro, should it be necessary. All this adds up to a complete HCM solution that can prove invaluable, particularly to growing businesses.

How Paycor Compares

| Online access | Direct deposit | Prepares federal tax forms | Employee access to payroll documents | |

|---|---|---|---|---|

| Paycor |

|

|

|

|

| Gusto |

|

|

|

|

| QuickBooks Payroll |

|

|

|

|

| OnPay |

|

|

|

|

| Payroll Mate |

|

|

FAQs

-

Yes. Paycor offers a Small Business bundle for small businesses with 1-39 employees, as well as a mid-market option for those with 40+ employees.

-

Yes. Paycor's mobile app is compatible with both iOS and Android smartphones and tablets and allows employees to access a number of Paycor's features.

-

There is an onboarding option available in the Paycor's Complete plan for small businesses.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.