When you get fired or laid off, you’re often faced with many major financial decisions. Along with figuring out how to pay your bills, you may need to decide what to do with your 401(k).

Because your 401(k) may represent a big portion of your savings, it’s vital to consider all your options. In this article, we’ll cover what to do with your 401(k) if you lose your job.

What is a 401(k)?

What is a 401(k)?

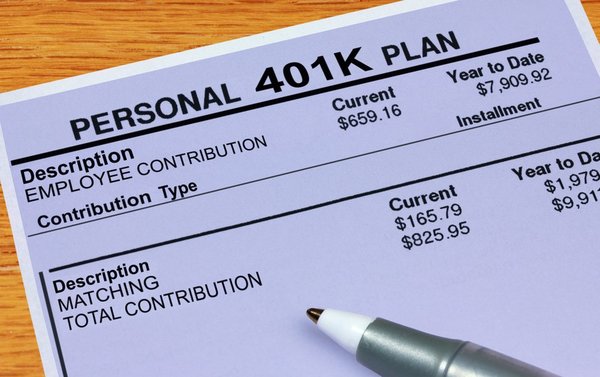

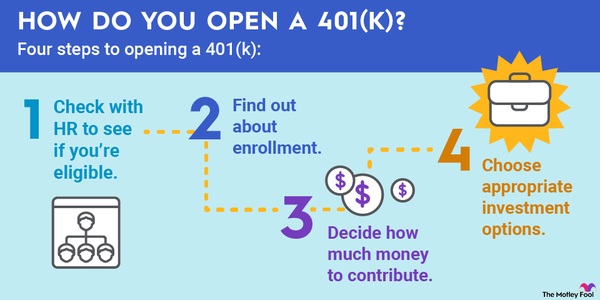

A 401(k) is an employer-sponsored retirement plan. You contribute a percentage of your salary and get tax advantages for doing so -- either for the year you contribute if you have a traditional 401(k) or when you withdraw the money if you have a Roth 401(k). Depending on your employer, you may also get a company 401(k) match for a percentage of your contributions.

You choose your own investments, typically mutual funds and exchange-traded funds (ETFs). Your 401(k) balance grows according to how your investments perform.

The money you contribute to a 401(k) always belongs to you, although you may face penalties if you take out money before age 59 1/2. However, your employer’s plan may have a 401(k) vesting schedule, which means you may have to wait a certain period before you legally own the money your employer contributed.

What happens to your 401k if you're fired or laid off?

What happens to your 401k if you're fired or laid off?

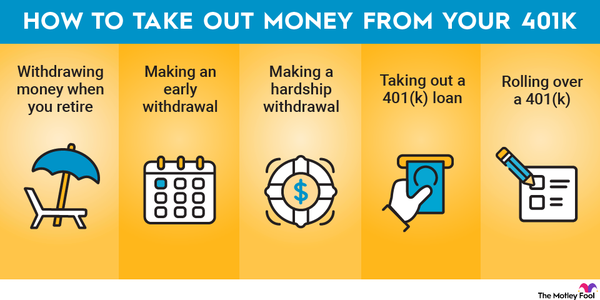

Whether you’re fired or laid off, or you quit your job, the rules for your 401(k) are the same. You can:

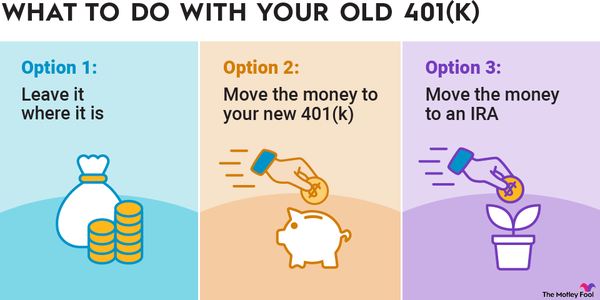

- Leave your money in your old employer’s 401(k), provided that the plan allows it.

- Roll it over into a new employer’s 401(k) or an individual retirement account (IRA).

- Cash it out and pay the applicable taxes and penalties.

Let’s explore each option for your retirement savings account in a bit more detail

1. Leave it in your old employer’s 401(k)

1. Leave it in your old employer’s 401(k)

You can typically leave your money in your old employer’s 401(k) after you leave your job. You can’t make additional contributions to your retirement account, but you’ll still be allowed to manage your money.

Generally, keeping your 401(k) money with your former employer is a decent option if the fees are low, you’re satisfied with your investment options, and you don’t mind monitoring multiple investment accounts.

One exception: If you have less than $5,000 in the account, your company can automatically boot you out of its employee investment fund if the plan has a force-out provision.

If the balance is between $1,000 and $5,000, the employer can roll it over into what’s known as a safe harbor IRA. Your money will typically be placed in ultra-conservative investments, plus you may pay a monthly fee, which translates to limited growth.

If your balance is less than $1,000, your old company could cut you a check. In that case, you could be on the hook for taxes and early withdrawal penalties.

2. 401(k) or IRA rollover

2. 401(k) or IRA rollover

If you’re switching to a new job, you could opt for a 401(k) rollover into your new employer’s plan, as long as the plan allows it. Before you do so, look at the new plan’s fees and investment options and be sure they’re at least on par with your old plan. Rolling the money into a solo 401(k) may also be an option if you’re starting your own business or you have self-employment income.

You can also choose an IRA rollover at the brokerage of your choosing. This is often a smart move when your new employer doesn’t have a 401(k) or its plan has high fees. An IRA gives you virtually unlimited investment options, plus the fees are typically minimal.

Regardless of whether you roll your 401(k) balance into a new 401(k) or an IRA, you’ll preserve the tax-advantaged status of the account. You also won’t be hit with early distribution penalties as long as you follow a few rules that we’ll discuss shortly.

3. Cash it out

3. Cash it out

Taking your 401(k) balance as a lump-sum distribution is also an option -- and it may be a tempting one if you’ve lost your job and you’re struggling with day-to-day expenses. But cashing out early is best avoided unless you’ve exhausted all other options.

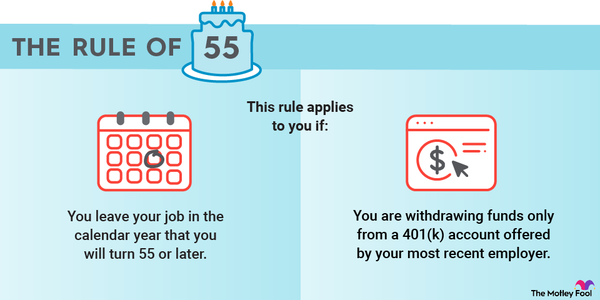

When you cash out your 401(k) before age 59 1/2, you typically owe a 10% penalty plus income taxes on your distribution. Note that the rule of 55 gives a break to older workers. If you leave your job the year you turn 55 or later (or age 50 if you’re a public safety worker), you can avoid the early distribution penalty on money from your most recent employer’s account. You’ll owe income taxes unless you’re withdrawing money from a Roth 401(k), though.

If you’re cashing out before retirement age, that lump-sum 401(k) distribution will cost you big time. The IRS requires your plan administrator to automatically withhold 20% for taxes -- and you could still owe at tax time if that’s not enough to cover the taxes and penalty.

Fidelity estimates that someone cashing out a $50,000 balance early could pay $20,500 in taxes and fees, assuming a 24% marginal federal tax rate and 7% state income tax, plus the standard 10% penalty. Of course, that estimate doesn’t account for the investment gains you miss out on because your money has less time to compound in the market.

How to roll over your old 401(k)

How to roll over your old 401(k)

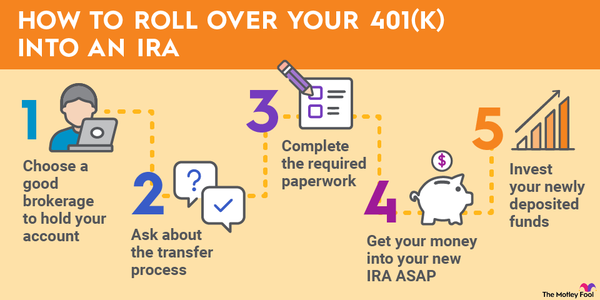

Whether you’re rolling over your 401(k) into a new employer’s plan or an IRA, your first step is to open your new account. It’s typically easiest to stick with the same type of account, i.e., traditional or Roth. It’s possible to roll over a traditional 401(k) into a Roth IRA (Roth to traditional conversions aren’t allowed), but you’ll owe taxes on the rolled-over balance. However, if you roll over a Roth 401(k) into a Roth IRA, you shouldn't owe taxes.

Next, you’ll contact the old plan’s administrator. They may need some paperwork, such as a letter of acceptance, along with some basic information and your new account number.

You’ll typically have the option of a direct rollover, which means the money goes straight to your new account, or an indirect rollover, which means you get a check. Then, you have to redeposit the money into a new retirement account within 60 days to avoid taxes and penalties. Always choose the direct rollover whenever possible.

So what’s the best option?

So what’s the best option?

First, let’s talk about the worst option, which is cashing out. Unless you have no other way to pay for necessities, avoid taking a lump-sum distribution since you’ll give up important 401(k) benefits. Otherwise, the best option boils down to how your old 401(k) compares to your other options, as well as your personal preferences.

If you’re happy with your investment options and the fees are relatively low, leaving your money in your old 401(k) may make sense, particularly if you don’t have a new job lined up yet or your new employer doesn’t offer a retirement plan. You can always roll it over to another account later on if you choose. If you’re hired by a new company that offers a relatively comparable 401(k), though, you may want to roll it over so that you have fewer accounts to manage.

Finally, if you want the lowest fees possible and you’re comfortable managing your account, check out your IRA rollover options.

Related investing topics

Wrapping up: What to do with your 401(k) when you lose your job

Wrapping up: What to do with your 401(k) when you lose your job

Losing your job can be devastating to your finances. But if you can afford to keep your money invested, either by staying in your old company's 401(k) or rolling it over into a new account, you'll reap the long-term benefits of investing in a tax-advantaged account.

If you haven't lost your job, but you're worried your position is vulnerable to layoffs, focus on building your emergency fund as much as you can. That way, you won't have to cash out your retirement savings for short-term needs.

FAQs: What to do with your 401(k) when you leave your job

FAQs: What to do with your 401(k) when you leave your job

Do you keep your 401(k) if you get fired?

Yes. Your contributions, your employer’s vested contributions, and their earnings belong to you, even if you get fired. You can leave them in your old employer’s plan if the rules allow you to, roll over the money into a new account, or cash out.

Can your employer hold your 401(k) after termination?

If you don't direct your employer to roll over your money to a new account or cut you a check, your money may stay invested in the old 401(k). But your employer generally can't hold onto your 401(k) contributions, vested match funds, or earnings. However, if you have an outstanding 401(k) loan, they may require you to repay it before distributing funds.

Can an employer take back their 401(k) match?

Your employer can take back its 401(k) match if the funds haven’t fully vested. For example, if your company uses a five-year graded vesting schedule (meaning matching funds would gradually vest over five years) and you left after three years, you’d be 60% vested. If your account had $10,000 worth of employer contributions, you’d get to keep $6,000. The remaining $4,000 would go into a 401(k) forfeiture account.