Shares of PayPal (PYPL -1.13%) have certainly taken investors on a roller coaster ride in recent years, mostly descending into the depths of disappointment.

The stock soared to dizzying heights as everyone piled into fintechs in 2021. However, the party came to an abrupt end as the pandemic's tailwinds faded and the Federal Reserve tightened its grip by raising interest rates, sending the stock into a downward spiral.

Today, PayPal is 76% below its all-time high price of $310 per share and has traded in a range between $50 and $95 over the past couple of years. It is priced at a cheap valuation, and under CEO Alex Chriss, who took over in 2023, the company is looking to reignite growth and get back on track. Here's why investors may want to consider this fintech giant today.

PayPal's struggles

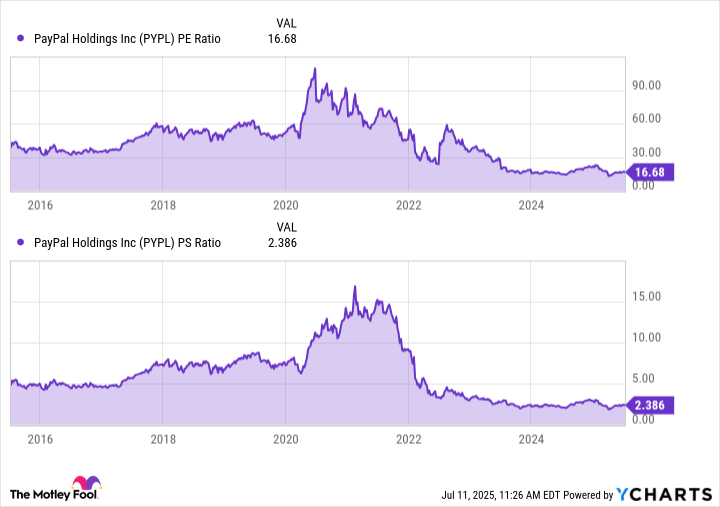

PayPal grew a lot during the pandemic, adding customers at a staggering pace as digital payment adoption accelerated. Its rapid growth had investors paying a steep premium for the stock. At that time, the fintech was valued at as much as 109 times earnings and as much as 16.9 times sales.

Investors were highly optimistic about its prospects, but the company was unable to deliver, and the stock took a massive hit instead. With shares well below their peak, they trade at reasonable valuations today: a price-to-sales ratio (P/S) of 2.39 and a price-to-earnings ratio (P/E) of 16.7. At these valuations, investors are showing little optimism about the company.

PYPL PE Ratio data by YCharts.

PayPal looks to build on its strong brand

The company has a few things working in its favor. It has one of the most-used payment apps in the U.S., with a 71% penetration rate, according to Morning Consult. In a survey by Motley Fool Money, 85% of respondents who use digital payment apps said they use PayPal, significantly outpacing Block's Cash App (54%), which was second.

The fintech continues to grow steadily, too. Last year, revenue rose 7% to $31.7 billion, while its diluted earnings per share (EPS) of $3.99 were up around 4% year over year. However, to warrant a higher valuation and grab investor interest, PayPal will need to improve its margins and accelerate its growth.

Under Chriss, the company aims to transform from payments to a comprehensive commerce platform. Part of this approach is to create a "winning checkout" by accelerating the rollout of an upgraded online checkout, with its Fastlane offering playing a key role.

According to the company, this one-click solution significantly reduces checkout times by 32%. It boosts conversion rates for merchants and is an integral part of its small and medium-size business (SMB) strategy.

How stablecoins could play an important role

Other recent news that could bode well for PayPal is the recent stablecoin initiatives in the U.S. The Senate recently passed the bipartisan Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act for short), which provides a framework for regulating digital tokens pegged to the value of assets. The bill requires full reserve backing for issuers, monthly audits, and money laundering safeguards, among other regulations.

Image source: Getty Images.

PayPal was one of the first major financial institutions to enter the stablecoin market with the launch of its PayPal USD dollar-backed stablecoin (PYUSD) in 2023. The coin is pegged to real-world assets, including U.S. dollar deposits, U.S. Treasury notes, and other similar cash equivalents. PayPal has even used its stablecoin for business-to-business payments, including transactions with Ernst & Young and Alphabet's Google.

PayPal views PYUSD as a tool to help connect the traditional economy and Web3. Chriss said that the company is committed to enabling a "commerce-ready ecosystem" through PYUSD for cross-border transfers, vendor payments, payouts, and bill paying. This is one way the fintech is looking to spur growth and stay ahead in the highly competitive and evolving payments landscape.

A buy at today's valuation

PayPal is working to reignite growth, and its stablecoin is one part of the puzzle. The company is integrating PYUSD into more products to help facilitate faster, cheaper payments for merchants. This can help lower costs in cross-border transactions and improve the back end of payments, which tends to rely on older infrastructure.

And it will continue to push and improve its SMB offerings with the PayPal Complete Payments platform and grow its digital advertising business, too, as it aims to expand its commerce platform.

The stock is relatively cheap, and the company is undertaking several initiatives that I think have the potential to spur growth. It guided for gross profit to grow 5%, while adjusted EPS growth will be around 8% at the midpoint this year.

Management is targeting what it terms a "low teens-plus" EPS increase by 2027 and has aspirations for 20%-plus EPS growth in the longer term.

I think PayPal is worth taking a chance on. Its cheaper valuation gives some margin for safety if growth doesn't pick up. And if it can reignite growth, it could lead to a revaluation and send the stock higher from here.