There's a certain allure to so-called "overnight" success stories, whether the protagonist is an artist, an athlete, or some other figure. Yet the reality is that these rags-to-riches narratives rarely unfold overnight.

This same misplaced fascination often manifests in investing. Many people chase the "next big thing" by buying speculative penny stocks, or by employing complex strategies using options and derivatives. Too often, however, these approaches end in disappointment -- leaving investors wary of the stock market.

Curiously, the lottery doesn't seem to inspire the same skepticism. Is the psychology of buying a lottery ticket different from the psychology of investing in stocks? And is an investment in an early-stage, pre-revenue business like Archer Aviation (ACHR 3.77%) more promising or more risky than playing the lottery? Let's find out.

Should you buy a lottery ticket?

There's an undeniable appeal to the lottery. For just a few dollars, you can buy the dream of generational wealth and the glamor of financial independence.

Yet there is an inconvenient factor involved: The odds of hitting the jackpot are typically hundreds of millions to one. Buying a lottery ticket isn't much different from dropping a few dollars on the ground and walking away.

Like sports betting, the lottery carries an almost addictive pull. But at least in sports wagering, some participants employ sophisticated models and run scenarios to hedge outcomes or limit losses. No such tools exist for the lottery. Winning boils down purely to chance -- either you win or you don't. And seasoned investors understand that luck is not a reliable investment strategy.

Image source: Getty Images.

What is Archer Aviation?

Archer Aviation specializes in developing electric vertical takeoff and landing (eVTOL) aircraft -- essentially, flying electric taxis. While the concept may sound like something pulled from Star Trek, the future of aerial mobility may be much closer than it appears.

Archer's aircraft have a wide range of potential applications, particularly in densely populated urban environments. Traditional modes of transportation -- trains, subways, and taxis -- often struggle with congestion and scheduling limitations. These pain points spurred the creation of ride-hailing companies such as Uber Technologies and Lyft, which gave consumers access to on-demand personal transport. Archer envisions a similar model, but using the sky.

The company has attracted a number of mainstream partners. For example, United Airlines has formed a strategic relationship with Archer -- exploring how its aircraft could relieve clogged shuttle routes and streamline short-distance travel. Interest expands into the public sector as well: The U.S. military has expressed potential use cases, particularly for stealth missions. Archer also has an alliance with defense specialist Palantir Technologies, as the two work closely on designing next-generation aviation systems.

While Archer may seem niche at first glance, Wall Street estimates that the low-altitude market could grow to $9 trillion over the coming decades -- a signal that Archer's futuristic vision may be grounded in tangible, scalable opportunities.

Is Archer Aviation stock a better investment than a lottery ticket?

I see an investment in Archer as comparable to a venture capitalist's portfolio bets. The risks are evident: The company is pre-revenue, operates in a highly capital-intensive industry, and relies heavily on regulatory approvals before its technology can be commercialized.

This is where the lottery analogy becomes useful. Like a lottery ticket, Archer stock is speculative. If the company doesn't execute on its road map, investors could lose most, if not all, of their capital.

However, unlike the lottery, speculative stocks can still carry a meaningful probability of creating shareholder value.

Even in a downside scenario where Archer grows more slowly than anticipated or cedes market share to competitors, the company could remain an attractive acquisition candidate for the right partner, offering some potential to recover losses.

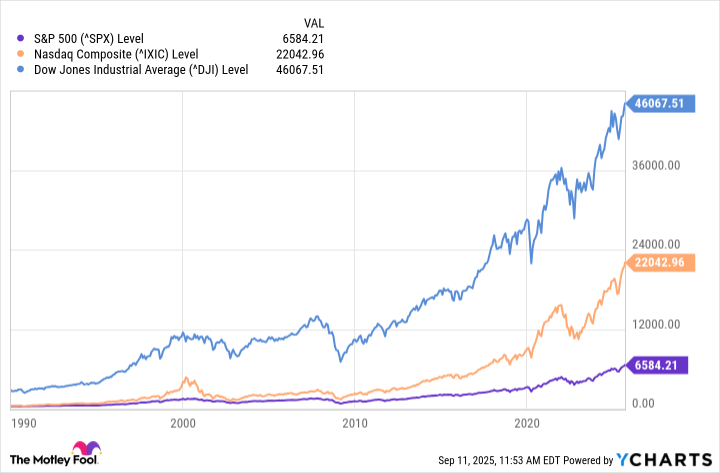

The broader context also matters. Historically, equities tend to appreciate over time, reinforcing the notion that participating in the stock market is ultimately a rewarding decision despite the perceived risk. This is important to understand, as it supports the idea that participating in the stock market is still worthwhile. The lottery, by contrast, is designed with a negative expected value. Archer, while volatile, is not structurally rigged against investors.

For these reasons, I would take a chance on Archer stock over purchasing a lottery ticket any day.