| Thursday's Markets | |

|---|---|

| S&P 500 6,831 (-0.56%) |

|

| Nasdaq 22,749 (-0.26%) |

|

| Dow 47,955 (-1.61%) |

|

| Bitcoin $71,463 (-2.35%) |

|

| Thursday's Markets | |

|---|---|

| S&P 500 6,831 (-0.56%) |

|

| Nasdaq 22,749 (-0.26%) |

|

| Dow 47,955 (-1.61%) |

|

| Bitcoin $71,463 (-2.35%) |

|

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

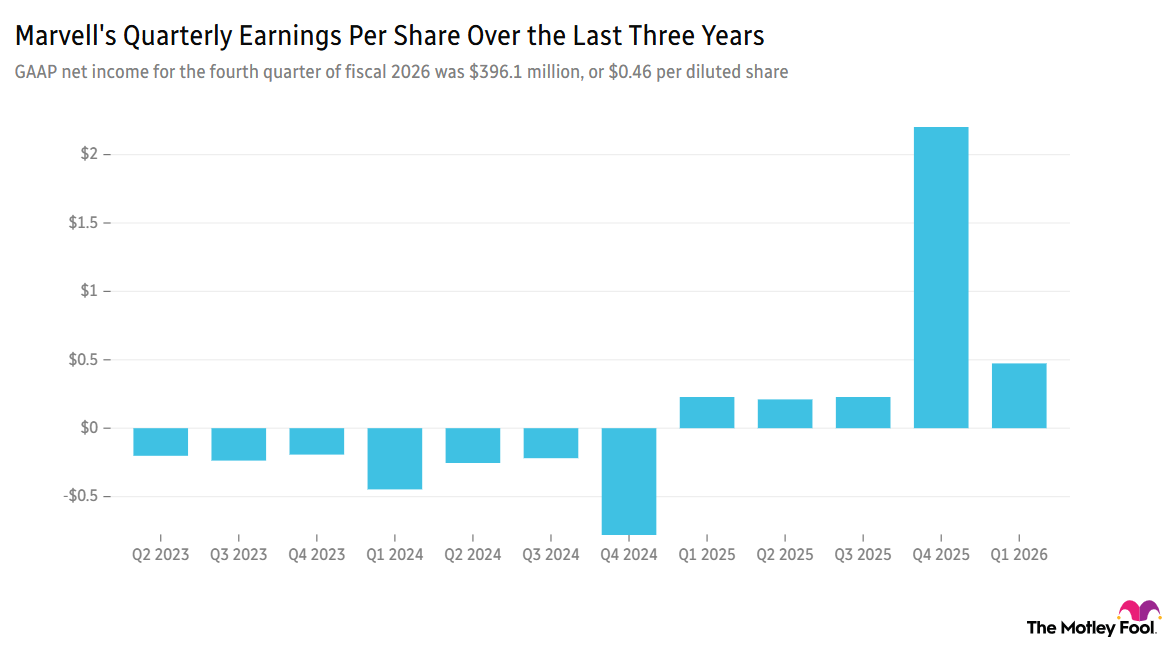

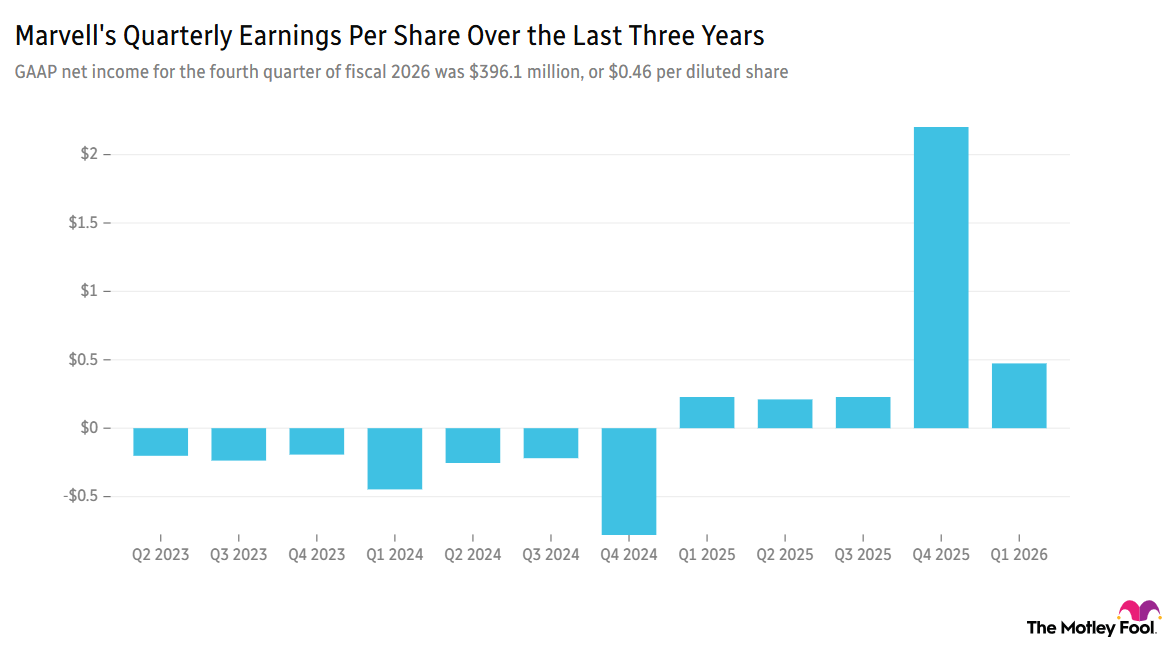

Marvell (NASDAQ:MRVL) popped 15% before the opening bell, on the back of new quarterly and annual revenue records reported in yesterday's post-close fourth-quarter results. The company -- which makes chips and data center products for cloud and networking providers -- saw revenue climb 22% year over year (YOY) in the final quarter, driven by artificial intelligence (AI) demand.

The Motley Fool surveyed 2,000 individual investors across the U.S. in January about their investing plans, stock market outlook, and predictions for 2026. The full (free) report includes insights from senior Motley Fool investment analysts Asit Sharma and David Meier.

The February jobs print is due this morning, with analysts expecting around 50,000 new jobs to have been added during the month, down from January's 130,000. The unemployment rate is tipped to fall slightly to 4.3% from 4.4%. With weak jobs and the latest oil shocks, the chance of a rate cut at the Fed's next meeting on March 18 is just 2.7%, according to the CME FedWatch tool.

What role do foreign stocks play in your portfolio? Do currency considerations keep you from investing in compelling international opportunities, or do you see them as portfolio diversification?

Debate with friends and family, or become a member to hear what your fellow Fools are saying!