Follow a buy-and-hold strategy

Buy stocks because you believe their underlying businesses will be worth more in a few years. Don't buy a stock just because you think it will perform well over the next few weeks or months. It's worth specifically stating that day trading -- buying and selling a stock on the same day or even within a few weeks -- is best left to the professionals.

Diversify your holdings

Don't put all your money into just one or two stocks. Even if you're investing only a relatively small amount of money to start, diversify your portfolio by buying a few shares of several different stocks. With fractional share investing available through many brokers, you can create a diversified stock portfolio even with a small amount of money.

Learn more about how to choose which stocks to buy by checking out our comprehensive guide to investing in the stock market. Or check out some of the top stocks to buy right now if you need some inspiration.

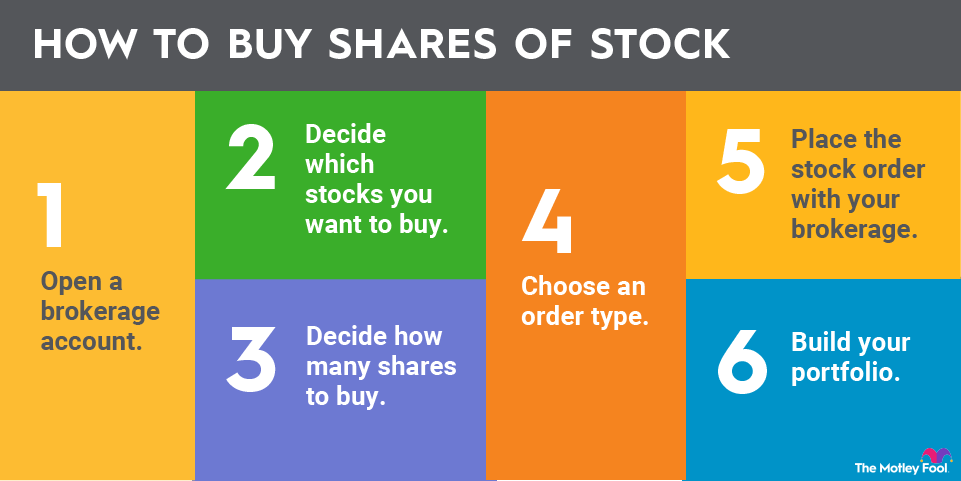

3. Decide how many shares to buy

To determine how many shares you should buy, first decide how much money you want to invest in each stock that interests you and then divide this amount by the stock's current share price. You can find stock prices on your brokerage's platform by searching for either the stock's ticker symbol or the company's name.

Some brokerages allow you to buy or sell fractional shares. This is especially common with app-focused brokers.

For example, let's say you want to invest $800 in Microsoft (MSFT +0.56%). You use Microsoft's stock ticker symbol (MSFT) to check its share price and find that it is about $525 (as of October 2025). Dividing $800 by this share price indicates you can buy as many as 1.52 shares.

If your broker doesn't trade fractional shares, you would purchase one share of Microsoft stock and have $275 left over. With fractional shares, you can invest your entire $800.

4. Choose an order type

Different order types exist for stock purchases. For our purposes, there are two types of orders you should know about.

- A market order, which instructs your broker to buy the stock immediately and at the best available price, is typically the best order type for buy-and-hold investors.

- On the other hand, you may want to place a limit order, which indicates to your broker the maximum price you're willing to pay for a stock.

For example, let's say a stock is currently trading for $20.50 per share. You want to buy it only when the price is less than $20, so you place a limit order. Your broker then buys shares on your behalf only if the stock's price dips below $20.