Infrastructure real estate investment trusts (REITs) own and manage infrastructure-related real estate. These property types are essential to the economy because they help support the movement and storage of data and energy.

Here's a closer look at infrastructure REITs, their advantages and risks, and some companies that investors should consider.

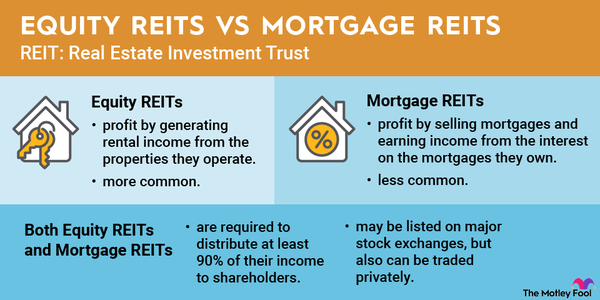

Understanding REITs

Understanding infrastructure REITs

Infrastructure is one of the unique real estate investments. It typically doesn't include traditional commercial real estate such as buildings or land. However, it's still physical property leased to tenants. The most common infrastructure owned by REITs includes telecommunications assets such as cell towers, fiber optic cable, and small cell nodes. REITs can also own various types of midstream energy assets, including oil and gas pipelines and processing facilities.

Infrastructure REITs make money by leasing their infrastructure to tenants, typically under long-term contracts. The long-term contracts supply the REITs with steady cash flows to support dividend payments.

Advantages

Advantages of investing in infrastructure REITs

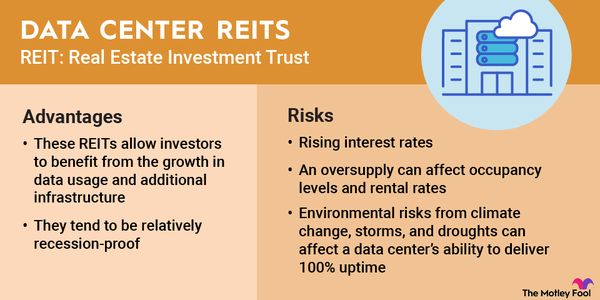

Infrastructure REITs benefit from relatively steady demand for their assets. Telecom companies need communications towers to support mobile networks, while energy companies require pipelines to transport oil and gas. Because of that, companies typically sign long-term leases with REITs to guarantee access to essential infrastructure.

Meanwhile, demand for infrastructure continues to grow. An increasingly digital economy needs more infrastructure to support faster networks like 5G. Likewise, rising energy demand can fuel the need for more energy infrastructure.

Risks

Risks of investing in infrastructure REITs

While infrastructure REITs typically benefit from stable and growing demand, they're not without risk.

Tenant risk has affected infrastructure REITs. For example, REITs focused on energy infrastructure have experienced the effects of tenant bankruptcies during commodity price crashes that have left tenants unable to meet their lease obligations. REITs focused on communications infrastructure have faced issues when tenants merge and no longer need as much infrastructure to support a combined network.

Interest rate risk also is an issue common to the REIT sector. Rising interest rates have two notable effects on REITs. First, rising rates can increase interest expenses if a REIT has a lot of floating-rate debt or significant near-term debt maturities.

In addition, rising interest rates tend to weigh on REIT stock prices because they're yield-focused investments. Rising interest rates increase the income yield on lower-risk investments such as bonds. To compensate for their higher-risk profiles, REITs need to offer higher dividend yields. That's why their stock prices tend to decline as interest rates rise.

Our list

4 infrastructure REITs to consider in 2025

According to the National Association of Real Estate Investment Trusts (NAREIT), there were four publicly traded telecom infrastructure REITs as of early 2025. Here's a closer look at this quartet of REITs focused on communications and data infrastructure:

| Infrastructure REIT | Ticker Symbol | Market Cap | Company Description |

|---|---|---|---|

| American Tower | (NYSE:AMT) | $86.8 billion | A global tower and data center REIT. |

| Crown Castle | (NYSE:CCI) | $38.6 billion | A U.S.-focused tower REIT. |

| SBA Communications | (NASDAQ:SBAC) | $21.5 billion | A global wireless infrastructure REIT. |

| Uniti Group | (NASDAQ:UNIT) | $1.3 billion | A REIT focused on fiber infrastructure. |

1. American Tower

American Tower has grown out of its name over the years. The leading REIT entered 2025 with roughly 148,000 communications sites spread across more than two dozen countries. In addition, it owns a growing portfolio of U.S. data centers. The company's international expansion and move into data centers have diversified its portfolio and transformed it into a global leader in data infrastructure.

American Tower has become one of the largest global REITs. It has steadily acquired tower portfolios from telecom companies, built new towers, and added tenants to its sites. This three-pronged growth strategy has enabled the company to increase its revenue and adjusted funds from operations (AFFO) at a 9% compound annual rate over the past decade. Meanwhile, the REIT has increased its dividend at more than 20% annually since 2014. With its recent move into data centers and a strong balance sheet, American Tower should be able to continue growing at a healthy rate for the next several years.

2. Crown Castle

Crown Castle entered 2025 with more than 40,000 communications towers in the U.S. In addition, the company had 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S. market. These assets are crucial to supporting 5G networks.

Crown Castle has invested tens of billions of dollars in acquiring and building out fiber and tower assets over the past decade. The company sees another decade-long investment cycle ahead as its customers develop next-generation wireless networks such as 5G.

However, the company was looking to unload its fiber and small cell assets in early 2025 due to the lower returns generated by those investments. That would enable the company to repay debt and focus on growing its tower business.

3. SBA Communications

SBA Communications owns a global portfolio of wireless communications infrastructure, including towers, buildings, rooftops, distributed antenna systems, and small cell nodes. As of early 2025, its portfolio consisted of more than 39,000 communications sites throughout the Americas and Africa.

SBA Communications generates revenue from site leasing and site development. The company leases space on its towers and other structures to wireless service providers under long-term contracts to house their communications equipment. In addition, the REIT assists wireless service providers in developing their networks through site acquisition, construction, and equipment installation. These two businesses have enabled the company to steadily increase its revenue, earnings, and dividend over the years.

4. Uniti Group

Uniti Group focuses on acquiring and constructing mission-critical communications infrastructure. As of early 2025, it owned 144,000 route miles of fiber, 8.7 million strand miles of fiber, and other communications real estate such as small cells in the U.S. It's one of the 10 largest fiber providers in the country.

In early 2024, Uniti Group agreed to merge with Windstream Holdings to create a premier digital infrastructure company. It will combine Uniti's national wholesale-owned fiber network with Windstream's fiber-to-the-home business. The company expect the transaction to close in the second half of 2025, when it will convert from a REIT to a taxable C-corporation.

Related investing topics

Telecom infrastructure REITs see a lot of growth ahead

Infrastructure is crucial to the global economy. That's providing REITs with steady demand for their existing infrastructure and ample opportunities to expand. With infrastructure spending expected to increase in the coming years, these infrastructure REITs should be able to continue growing at above-average rates.