REIT dividends can be great for investors seeking to generate passive income. In mid-2024, the average REIT offered a dividend yield of around 4%, more than double the S&P 500's yield (less than 1.5%).

However, while most REITs are great options for those seeking to generate passive income from real estate, not all are safe bets. Some REITs are at higher risk of reducing their dividend payments due to various issues. A very high dividend yield is often a sign that danger lurks for that REIT's dividend.

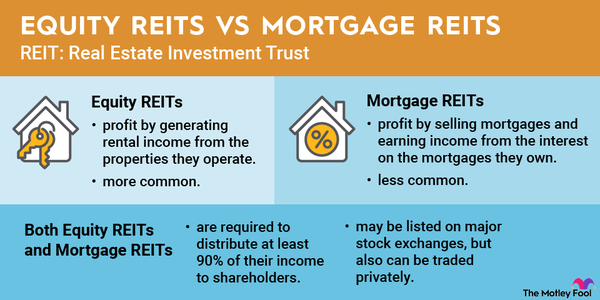

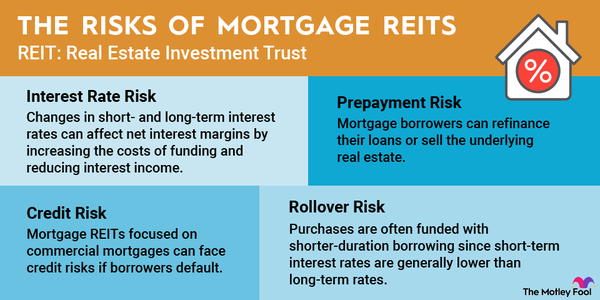

One subgroup of the REIT sector known for its high dividend yields is mortgage REITs or mREITs. These REITs use leverage (i.e., debt) to invest in real estate debt, like mortgage-backed securities (MBS) and other real estate loans. Much like banks, these REITs make money on the spread between their borrowing rates and the income yield on their debt investments. For example, if a mortgage REIT can borrow money at 5% and buy MBS at 7%, they can earn a 2% spread.

When the spread is wide, mREITs can make a lot of money, which they use to pay lucrative dividends. However, when spreads narrow due to changes in interest rates, they make less money. A decline in their income can cause an mREIT to cut its dividend.

Here's a look at three mREITs that might not be able to sustain their dividends for much longer.

Our list of mREITs

Annaly Capital Management

1. Annaly Capital Management

In mid-2024, Annaly Capital Management's (NLY 0.86%) dividend yield was around 13%, roughly 10 times higher than the S&P 500's.

The REIT focused on residential mortgages has cut its dividend several times in the past. It most recently delivered a more than 25% reduction in early 2023 when it cut its quarterly payment from $0.88 to $0.65 per share. The driving factor was the expectation that Annaly's earnings available for distribution (EAD) would decline, which is exactly what happened. EAD fell from $0.89 per share in the final quarter of 2022 to $0.68 per share in the last period of 2023.

Annaly's EAD dipped below its dividend in the first quarter of 2024 ($0.64 per share) before recovering in the second quarter ($0.68 per share). If its earnings fall below the dividend (and remain there), the REIT will need to cut its payout again. Given that risk, investors should beware of this REIT.

Arbor Realty Trust

2. Arbor Realty Trust

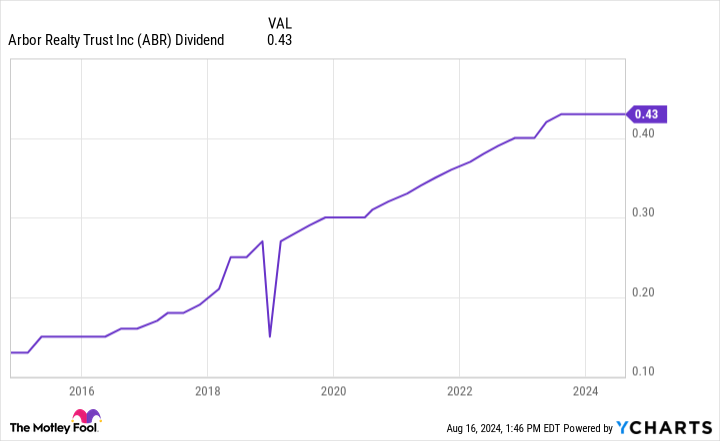

Arbor Realty Trust's (ABR 0.24%) dividend was almost 13% in mid-2024. The mortgage REIT focused on multifamily properties had been steadily increasing its dividend until the middle of 2023:

However, the REIT has stopped increasing its payout due to the impact higher interest rates are having on the multifamily sector and its earnings. When the REIT last raised its dividend in July 2023, its dividend payout ratio was 75% of its distributable earnings ($0.43 dividend on $0.57 of distributable earnings). Fast forward a year, and the REIT's distributable earnings were down to $0.45 per share in the second quarter of 2024, just slightly above its $0.43 per share dividend payout.

In addition to that rising dividend payout ratio, the REIT was facing questions about its financial practices. While the REIT put out a press release reiterating its confidence in its financial and business practices, that hasn't eased investor concerns. If the REIT's earnings continue to decline or its business practices prove to be a problem, it might need to cut its dividend.

Ready Capital

3. Ready Capital

Ready Capital's (RCC -0.44%) dividend was more than 14% in mid-2024. The multi-strategy real estate finance company was facing some headwinds from underperforming assets, so the REIT only produced $0.07 per share of distributable earnings in the second quarter. That was well below its dividend payment of $0.30 per share. And even after adjusting for the impact of realized losses, its distributable earnings would have only been $0.19 per share, which was still below its dividend level.

On a positive note, the REIT was working on cycling out of underperforming assets and into market-yielding investments. As part of the disposition of its residential mortgage banking segment, it sold $4.7 billion of residential mortgage servicing rights. The REIT also completed the sale of $462 million of underperforming loans. Meanwhile, Ready Capital acquired Madison One and Funding Circle USA as part of its strategy to improve its earnings.

If Realty Capital's earnings don't improve, the REIT will need to cut its big-time dividend.

Related real estate topics

Look for signs of danger before buying a REIT for its dividend

REITs can be great income-generating investments because they tend to offer higher dividend yields. However, some REIT dividends aren't worth the risk. Investors must make sure there is no lurking danger in a higher-yielding payout before buying a REIT for dividend income.