Real estate investment trusts (REITs) play a vital role in the retail sector. Retail REITs own and operate many of the regional malls, shopping centers, and other freestanding stores that retailers need to physically serve customers. While more and more consumers are doing their shopping online and reducing the need for some physical retail space, many retailers still need a brick-and-mortar location to best serve their customers.

Here's a closer look at the ins and outs of the retail REIT sector, along with some top retail REITs for investors to consider.

Understanding retail REITs

Understanding retail REITs

Retail REITs own, operate, manage, acquire, and develop retail-related real estate. These properties include regional shopping malls, outlet centers, shopping centers, strip malls, power centers, and freestanding retail properties. Most retail REITs focus on a specific property type and tenant base.

Retail REITs make money by renting space in their properties to retailers, service providers, and other types of tenants. Most retail REITs use gross leases where the tenant pays a fixed rental rate each month based on the amount of square feet they lease in the property and a pro-rated portion of the common area. Meanwhile, REITs focused on freestanding retail properties utilize triple net leases. In addition to paying a base rental rate, the tenant covers building insurance, real estate taxes, and building maintenance. Triple net lease structures enable retail REITs to generate very stable cash flows. Finally, some retail REITs also utilize ground leases, where they own the land (but not the buildings) that they lease to retailers. These leases also provide a very stable stream of rental income.

Advantages

Advantages of retail REITs

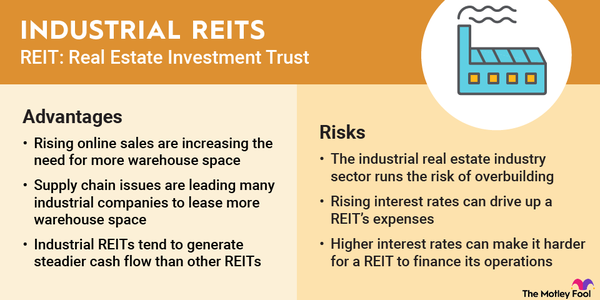

Despite the challenges facing the retail industry from rising e-commerce sales, companies continue to need physical real estate to directly sell products and provide services to customers. Some segments of the retail sector are relatively immune to disruption from e-commerce because of the types of products they sell or the services they provide. For example, while consumers can purchase groceries online, most still shop in physical grocery stores, which also serve as distribution hubs for online orders. Likewise, physical locations are best suited to sell and distribute daily necessity items and off-price goods. That's why pharmacies, convenience stores, home improvement centers, and dollar stores continue to thrive amid the rise in e-commerce. Such stores benefit REITs, which continue to see demand for space in their properties.

Retail REITs also benefit from specific tenant types and lease structures. Anchor tenants -- large retailers such as grocery stores, home improvement centers, and big box stores -- provide stability to a retail property through long-term leases. They also drive traffic to the retail center, which benefits other tenants at the property. Meanwhile, freestanding retail properties secured with triple net leases provide REITs with steady rental income.

Risks

Risks of investing in retail REITs

While retail REITs can generate a lot of rental income, the sector faces several risks that can affect dividend payments. These include:

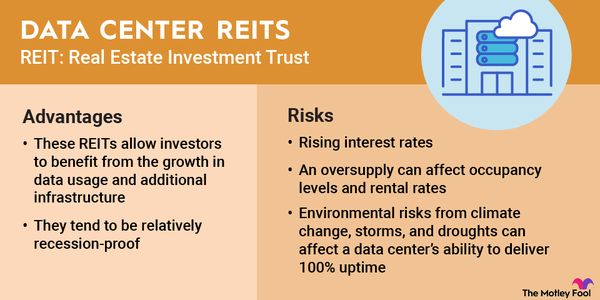

- Interest rate risk: Interest rates can have a significant impact on the entire REIT sector. REITs tend to borrow a lot of money to acquire and develop properties. As interest rates rise, interest expenses and borrowing costs can go up. Meanwhile, rising interest rates increase the income yield on lower-risk investments such as bonds. REIT stock prices often decline when interest rates go up, driving their dividend yields higher to compensate investors for a higher risk profile.

- Recession risk: Many retailers sell consumer discretionary products. Demand for discretionary products tends to fall during a recession, affecting retail sales and retailers' ability to meet financial obligations such as rental payments.

- The risk of disruption by e-commerce: Consumers are doing more shopping online, affecting sales of brick-and-mortar retailers. Many are closing locations, causing rising vacancy levels.

Top retail REITs

3 Retail REITs to Consider in 2025

Dozens of REITs own properties leased to retailers. According to the National Association of Real Estate Investment Trusts (NAREIT), 28 publicly traded REITs primarily focused on owning retail properties as of late 2024, giving investors lots of options.

Several retail REITs stand out as attractive options for investors to consider, led by:

| Top Retail REITs | Ticker | Market Cap | Description |

|---|---|---|---|

| Kimco Realty | (NYSE:KIM) | $16.1 billion | A retail REIT focused on grocery-anchored shopping centers. |

| Realty Income | (NYSE:O) | $51.2 billion | A retail REIT focused on freestanding net lease retail properties. |

| Simon Property Group | (NYSE:SPG) | $54.7 billion | A retail REIT focused on regional shopping malls. |

Here's a closer look at these top retail REITs.

1. Kimco Realty

1. Kimco Realty

Kimco Realty is the leading publicly traded REIT focused on owning and operating open-air, grocery-anchored shopping centers and mixed-use properties. As of late 2024, it held interests in 567 shopping centers and mixed-use assets with 101 million square feet of gross leasable space. The REIT is focused on owning shopping centers in major coastal gateway cities and fast-growing metro areas in the Sun Belt region.

Kimco's shopping centers focus on providing essential, necessity-based goods and services to their local communities. Most of its centers feature economically resilient and e-commerce-resistant anchor tenants such as grocery stores, home improvement centers, and pharmacies. It also focuses on densely populated areas and fast-growing metros because they benefit from steadily growing demand for retail space.

The retail REIT has made several moves in recent years to improve the long-term financial sustainability of its operations. It acquired fellow retail REIT RPT Realty in 2024 to increase its scale and deepen its presence in key Coastal and Sunbelt markets. Kimco also routinely invests money in retail and mixed-use redevelopment to enhance its existing shopping centers. The REIT also has a Special Situations Group that provides capital to third-party owners of retail real estate, giving it the option to buy these properties in the future. These investments diversify its revenue streams while increasing traffic at its retail centers. Kimco also has a strong investment-grade balance sheet to help finance its investments.

2. Realty Income

2. Realty Income

Realty Income is the largest REIT focused on net lease real estate. It had more than 15,450 freestanding properties across the U.S. and Europe as of late 2024. It acquired fellow REIT Spirit Realty for $9.3 billion in early 2024, further enhancing its scale and diversification. The combined company gets 79.4% of its rental income from retail properties (primarily recession- and e-commerce-resistant retailers), 14.5% from industrial real estate, 3.5% from gaming properties, and 2.4% from other property types, like data centers. About 36% of its rental income will come from financially strong tenants with investment-grade credit ratings.

Realty Income's focus on net lease properties has paid dividends over the years. The REIT pays a monthly dividend, which it has increased more than 125 times since its initial public offering in 1994. Overall, the REIT has consistently raised its dividend for 30 consecutive years.

The main factor driving Realty Income's steadily rising dividend has been a constant stream of acquisitions. The company has completed corporate mergers such as its combination with Spirit Realty and purchased billions of dollars in properties directly from owners via sales-leaseback transactions. Realty Income has one of the strongest balance sheets in the REIT sector with A-rated credit, giving it the financial flexibility to continue acquiring properties.

3. Simon Property Group

3. Simon Property Group

Simon Property Group focuses on premier shopping, dining, entertainment, and mixed-use destinations, with properties across North America, Europe, and Asia. The company holds interests in 231 properties with 184 million square feet of space, including malls and premium outlets. It also owns an 84% interest in The Taubman Realty Group, which owns 22 properties in the U.S. and Asia, and 22.4% of Klepierre, which owns shopping centers in 14 European countries.

Simon's mall-based tenants have faced significant headwinds in recent years due to the accelerating adoption of e-commerce and the pandemic's impact on the sector. That has weighed on occupancy levels, rental rates, and its rental collection rate.

However, Simon has been working to offset these headwinds. It's investing in transformative mixed-use redevelopment projects at many of its malls. The REIT is adding new shopping, dining, and entertainment spaces. In addition, it has built other property types at its malls such as office buildings and hotels. These investments are diversifying its revenue streams and turning its malls into destinations that draw more traffic. Simon has an excellent balance sheet to finance its investments, including A-rated credit.

Related investing topics

REITs offer a lower-risk way to invest in the retail sector

The retail industry is facing challenges these days, making it a riskier sector. While that has some impact on retail REITs, the top players in the industry are making moves to insulate their portfolios from these headwinds. They can be lower-risk ways to invest in the overall growth of retail sales.