Even if you don't invest in U.S. Treasury bonds or Treasury bills, understanding the inverted yield curve can help you better comprehend the economic environment in which you're investing. Although it's not a guaranteed harbinger of trouble, the inverted yield curve should not be ignored.

What is an inverted yield curve?

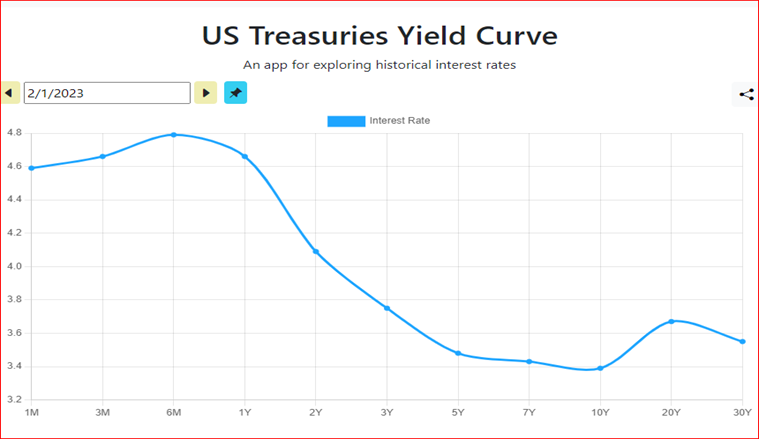

A yield curve refers to how short-term and long-term interest rates compare to one another and how they look when plotted on a chart. Generally, the investment instruments involved in an inverted yield curve are the 10-year U.S. Treasury bond and the two-year U.S. Treasury bond.

Academics may also measure the 10-year U.S. Treasury bond against the three-month Treasury bill. However, there are many ways to look at this curve as long as you're comparing short-term securities to similar long-term securities.

The yield curve is considered inverted when interest rates favor the short-term security because the curve flips and slopes downward instead of sloping upward. This is due to a shorter maturity rate delivering a higher yield. When comparing securities, the spread -- the difference between the longer security's yield and the shorter security's yield -- is a negative number instead of a positive one.

For example, if the long-term security yields 5% and the short-term security 3.5%, the spread is 1.5% because we view it from the long-term security perspective. We plot that point on the corresponding date. Because it and the surrounding figures are all positive, we consider it a great day. When the spread turns negative and stays there, we have an inversion.

How does an inverted yield curve form?

An inverted yield curve forms when a security's yield at maturity shows interest rates favoring the short-term instrument. Normally, a long-term instrument will have a better yield due to the greater risk being taken by the investor, but that isn't always the case.

This sometimes happens when investors are moving their money from short-term bonds into longer-term bonds. So, rather than an indication of something specific, it's more of an economic indicator of market sentiment. People are concerned that short-term bonds won't be safe enough, so they're moving their money into something they believe to be safer.

If enough people do this, the interest rate of a short-term bond will increase to attract more investors, and the long-term bond's interest rate will drop since there's no reason to pay more interest when demand is high.

What does an inverted yield curve mean?

Strictly speaking, an inverted yield curve simply means that the short-term asset in the measurement has a better return on investment. But that's just the surface-level interpretation. The 10-year to two-year Treasury spread is generally considered a reliable recession indicator, though it is not a perfect oracle.

It managed to predict recessions in 1980, 1981, 1990, 2001, 2007, and 2020 and has been inverted since April 2022. We are not currently in a recessionary period, but we are in a period of high inflation that continues to pose a risk of recession. Only time will tell whether the inverted yield curve was correct once again.

Inverted yield curves and investing

There's a lot to unpack about inverted yield curves if you're an investor.

First and foremost, of course, is the idea that the data provided by an inverted yield curve tells you where to put your money. Everyone is fleeing to long-term bonds for safety? The short-term bonds will pay considerably better, and you can always move that money back into lower-paying, long-term bonds when they mature if you're concerned.

It's more work, but you're still ahead as long as the fees don't eat up the gain over the long-term bonds. And it's a great way to build up your nest egg. Both bonds compared on an inverted yield curve are still extremely secure government bonds; you're just simply not promised a return for as long of a period. It's another case of buying when an opportunity presents itself.

Related investing topics

But as an investor, the other thing to weigh and to really consider is whether that inverted yield curve actually means something besides where cash flow is best. That is, do you believe it's a recession indicator? If so, you may want to put your money into a more liquid investment, like a mutual fund or high-yield savings account you can access quickly and without penalty.

As with many economic indicators, the inverted yield curve is hardly one thing to all people. It can tell you where investor sentiment is but can't predict the future. Investors may see the clouds rolling in, but only you can decide for yourself whether that's thunder in the distance.