Charlotte-based Bank of America (BAC -2.25%) is the second-largest financial institution in the U.S. and one of the world's largest banks. This article will provide an overview of Bank of America's business and the economics of its operations, as well as explain how to buy Bank of America stock.

How to buy

How to buy Bank of America stock

To buy a stock, such as Bank of America, investors must follow a few general steps.

Stock

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should I invest?

Should I invest in Bank of America?

Deciding which stocks to add to a diversified investment portfolio is a personal decision. There's no one-size-fits-all answer.

However, many investors want to outperform the stock market average with their stock picks. Bank of America stock has performed in line with the S&P 500 over the last five- and 10-year periods, but it's underperformed over the last 20 years, which might cause some investors to avoid this stock.

However, Bank of America stock's history doesn't mean that it can't outperform in the future -- it's possible that returns improve from here. Moreover, it's a strong and stable business. Some investors might be compelled to buy the bank stock simply because they appreciate the stability that one of the largest financial institutions in the world can bring to their portfolios.

Regarding stability, Bank of America is what's known as a universal bank, providing both commercial banking services and investment banking services. By contrast, some other banks focus on one of the two.

Bank of America's performance can be hurt by factors outside its control, including interest rates and consumer spending. However, the company is more stable than smaller, more niche financial institutions because it's so diversified.

Bank of America divides its business into four primary segments: consumer banking, global wealth and investment management, global banking, and global markets. Anything that doesn't fit into these categories gets lumped together into a fifth segment called "other."

The bank offers services such as savings accounts and loan products within its consumer banking and global banking divisions. It also offers investing services in its global wealth and investment management segment. For example, investors could use brokerage services from Bank of America's Merrill Edge instead of Fidelity to buy and sell stocks. And finally, its global markets segment exposes investors to the commodities market.

Bank of America is so big and diverse that much could potentially go wrong, but management appears up to the task.

As evidence, consider that regulators annually assess U.S. banks to determine their financial health in case of adverse economic conditions. This assessment, known as a stress test, is consistently passed by Bank of America, and it passed again in 2024, which could be another reason for investors to like its stock.

As one of the largest financial institutions in the world, Bank of America will likely continue to grow its banking deposits over the long term, which will also give the company an opportunity to originate more loans. This provides ongoing upside for the business, which would consequently be good for the stock as well.

Profitability

Is Bank of America profitable?

When investing in bank stocks, investors should consider the economics of each bank to see how profitable it is. In Bank of America's case, it's quite profitable.

As of June 2025, Bank of America had earned almost $28 billion in net income over the previous four quarters, which represents a profit margin of 27%. High net margins are somewhat expected in this space, but this is still a strong number.

When borrowers fail to repay their loans, bank profits hurt, which can be one of the most significant ways for Bank of America's profits to take a hit. It usually happens with increased frequency during a slowing or receding economy. This is one area to watch.

Interest rates have been elevated, and higher interest rates can help Bank of America's net interest income. But this assumes healthy loan originations at those higher rates. Sometimes, bank customers choose to wait until rates come down before taking out a new loan, which can also be detrimental to profits. With Bank of America's strong profits right now, this isn't an immediate concern, but it's important to continually watch this area.

Dividends

Does Bank of America pay a dividend?

Bank of America stock pays a quarterly dividend and has paid a dividend every year for decades. However, the Great Recession severely affected the dividend. And afterward, financial reforms limited some of its autonomy in this area.

Still, Bank of America's dividend has steadily increased over the past decade, with management frequently increasing the payout at a double-digit percentage rate. In 2024, it raised its dividend again, this time by 8%. Many investors expect the company to raise it again in July 2025.

ETF options

ETFs with exposure to Bank of America

Researching and picking individual stocks is a lot of work, and some investors simply don't have the time or the desire. That's OK. For these investors, a bank exchange-traded fund (ETF) may be the best option. ETFs offer investors a portfolio of stocks based on a theme -- in this case, banking.

Exchange-Traded Fund (ETF)

Choosing a bank ETF would still provide investors with outsized exposure to Bank of America stock. One option is the Invesco KBW Bank ETF (KBWB -2.42%), which holds many of the largest bank stocks on the market. Bank of America was worth about 8% of the portfolio's value in June 2025.

Another option for investors who don't need as much exposure to Bank of America stock is the iShares U.S. Financial Services ETF (IYG -1.63%), which holds a broader portfolio of financial stocks, extending beyond the big banks. But Bank of America stock was still a prominent component of the ETF, with an almost 5% weighting.

Although these ETFs provide solid exposure to the world of financial stocks and offer instant diversification, it's worth pointing out that the Invesco KBW Bank ETF has underperformed the S&P 500 over the last five years, as has Bank of America stock. By contrast, the iShares U.S. Financial Services ETF is slightly outperforming the index. That said, the returns for these two ETFs are fairly comparable to the S&P 500 and Bank of America stock itself.

Stock splits

Will Bank of America stock split?

In mid-2004, Bank of America stock announced a 2-for-1 stock split. This happens to be its most recent stock split and may provide clues as to whether Bank of America stock will split again.

To be clear, Bank of America's management hasn't communicated a plan to split its stock as of June 2025, so you won't find it on the calendar of upcoming stock splits. Investors need to use logic to determine whether Bank of America stock will split in the future.

In 2004, when Bank of America announced its 2-for-1 stock split, it was trading at more than $80 per share. We can assume management thought the price was too high and preferred to have its shares trade closer to $40.

As of this writing, Bank of America stock trades at about $45 per share, which might be management's ideal price. So, it's unlikely that Bank of America stock will split in the near future. It would probably have to increase substantially before splitting again.

Related investing topics

The bottom line

The bottom line on Bank of America

Bank of America is a massive financial institution that offers many ways to make money and grow. The bank's diversity allows it to earn a profit consistently throughout different macroeconomic conditions.

While it hasn't provided its shareholders with substantial market-beating gains in recent years, returns have been positive, and it's still well positioned to thrive over the long term. For this reason, it could make sense for some investors to buy and hold Bank of America stock in a well-diversified portfolio.

FAQ

Investing in Bank of America FAQ

Is Bank of America a good investment?

Bank of America stock has performed mostly in line with the market average in recent years, so many of its shareholders would likely say it's not been a good investment. Still, returns have generally been positive over the long haul, so it hasn't been a bad investment, either. The company is also in a strong financial position for the future, so the stock could perform better in the coming years.

How do you buy Bank of America stock?

Investors can buy Bank of America stock like shares of any publicly traded company. They must fund a brokerage account and then buy shares of Bank of America through the brokerage's stock-trading features.

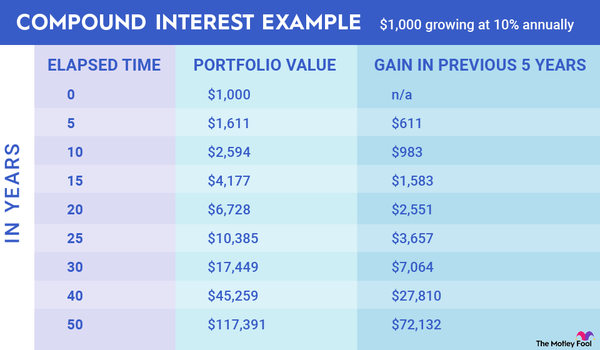

How do I invest money to make money?

There are many ways to invest money to make money. One of the best methods is to buy ownership stakes in appreciating assets. When investors buy a stock, they buy an ownership stake in the underlying business, which is an asset.

Generally speaking, if a business performs well and grows, that stock (the ownership stake) becomes more valuable. Therefore, the stock market is a way to invest money to make money.

That said, the stock market does have risks, and nothing is guaranteed. Many investors also lose money in the stock market because their ownership stakes become less valuable. A shrinking business opportunity, increased competition, and mismanagement are reasons a company might become less valuable over time.